Is the Bitcoin bottom in? Find out what analysts are saying about key price levels to watch in this exclusive report from TradingView News. Stay informed on the latest developments in the cryptocurrency Market and make informed decisions on your investments.

Win Up To 93% Of Your Trades With The World’s #1 Most Profitable Trading Indicators

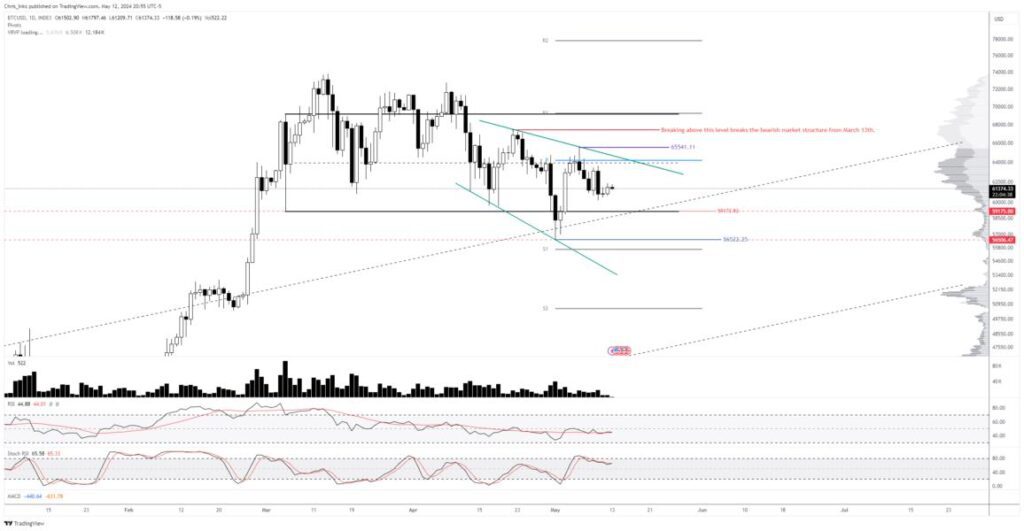

In his latest analysis, experienced crypto analyst Christopher Inks delves deep into the current Bitcoin Market structure, using a detailed chart analysis. The chart, showcased on X, displays Bitcoin’s price movements alongside key technical indicators and levels that could hint at a potential reversal from its current bearish trend.

The analysis showcases Bitcoin’s price action through daily candlesticks over the past few months, highlighting significant support (S1, S2) and resistance (R1, R2) levels. At present, Bitcoin is trading around the $63,000 mark, enclosed by two descending trend lines, reflecting a bearish Market structure.

Inks emphasizes the importance of a breakout above a crucial level to signal a shift in the bearish Market structure that initiated at the all-time high. This level serves as a convergence of various technical elements, including the daily pivot point, the upper descending green resistance line, and the two-month range equilibrium.

If Bitcoin can overcome this resistance, the next major resistance lies at $65,541, followed by a potential target of $68,000. Breaking above these levels could signify the end of the bearish trend since March 13th, with further resistance points at $69,000 (R1) and around $78,000 (R2).

For support, Bitcoin must maintain above $56,522 to avert a new low that might exacerbate the bearish sentiment. Inks stresses the importance of holding above this support, as breaching it could lead to a downward movement below $56,000 (S1) and $50,900 (S2).

Technical indicators like the Relative Strength Index (RSI), Moving Average Convergence Divergence (MACD), and Stochastic RSI are also discussed in the analysis. The RSI hovering around the neutral 50 mark suggests a balance between bullish and bearish forces, while the MACD shows a possible bullish crossover in the offing. The Stochastic RSI helps identify potential overbought or oversold territories, crucial for predicting short-term price movements.

Inks notes that the decreasing supply throughout the bearish Market structure could aid in stabilizing and potentially increasing Bitcoin’s price. At the time of writing, BTC was trading at $62,902.

Win Up To 93% Of Your Trades With The World’s #1 Most Profitable Trading Indicators

1. Question: Has the Bitcoin price reached its lowest point?

Answer: The analyst believes that Bitcoin may have hit its bottom, but it’s important to keep an eye on key price levels.

2. Question: What are the key price levels to watch for Bitcoin?

Answer: The analyst suggests keeping an eye on support levels around $48,000 and $44,000, as well as resistance levels around $58,000 and $62,000.

3. Question: Should I buy Bitcoin now or wait?

Answer: It’s always important to do your own research and consider your own risk tolerance before making any investment decisions.

4. Question: How can I stay informed about Bitcoin price movements?

Answer: You can stay informed by following reputable news sources, joining online forums and communities, and regularly checking price charts.

5. Question: What factors could impact the future price of Bitcoin?

Answer: Various factors can influence Bitcoin’s price, including Market sentiment, regulatory developments, macroeconomic trends, and technological advancements.

Win Up To 93% Of Your Trades With The World’s #1 Most Profitable Trading Indicators

Win Up To 93% Of Your Trades With The World’s #1 Most Profitable Trading Indicators