With Bitcoin’s bull cycle in full swing, many investors are wondering how long they should HODL before BTC reaches its peak. As the cryptocurrency Market continues to be volatile, it’s important to understand the factors that could impact the price of Bitcoin and when the best time to sell might be. Experts suggest that a long-term investment strategy and patience could pay off in the end, but staying informed and monitoring Market trends is key. Stay tuned for more updates on Bitcoin’s bull run and maximize your profits.

Win Up To 93% Of Your Trades With The World’s #1 Most Profitable Trading Indicators

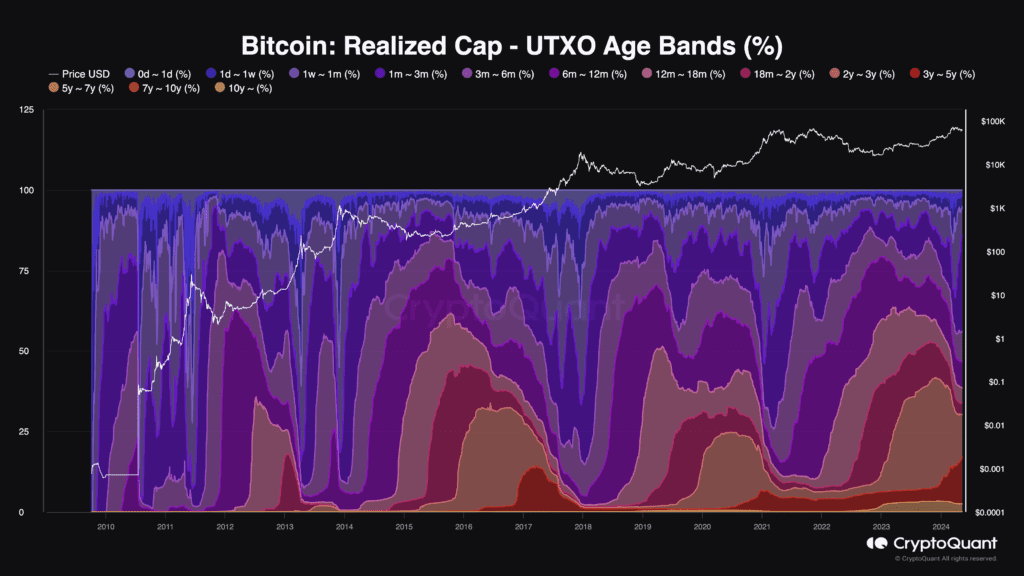

Bitcoin has not reached its peak in this cycle as indicated by the Realized Cap. The UTXO Age Bands show that there is still room for growth in the Market. Active individual purchases in the Market are not at their highest, implying that there is more potential for money to flow into Bitcoin.

Crypto analysts suggest that Bitcoin has only completed 20% of its bull cycle, leaving room for a significant price increase. Long liquidations in the derivatives Market show that the Market has not yet topped out, unlike the situation in the 2021 peak.

Despite some liquidations, most positions being wiped out are short, indicating a strong potential for Bitcoin to hit a new all-time high. Coin Days Destroyed (CDD) analysis shows that HODLers are accumulating more coins rather than spending them, suggesting that a monster rally could be on the horizon.

HODLing remains the preferred strategy for investors, leading to a potential surge in Bitcoin’s price before the cycle reaches its peak. The current Market conditions point towards a positive outlook for Bitcoin’s future performance.

Win Up To 93% Of Your Trades With The World’s #1 Most Profitable Trading Indicators

1. How long should I hold onto my Bitcoin before it reaches its highest price?

– There is no set answer as to how long you should HODL before Bitcoin hits its peak, as it can vary greatly with Market conditions and external factors.

2. Will I know for sure when Bitcoin has reached its peak price?

– It’s nearly impossible to predict the exact peak of Bitcoin’s price, so it’s important to keep an eye on Market trends and make informed decisions.

3. Should I sell all my Bitcoin when it reaches its peak price?

– Deciding whether to sell all your Bitcoin at its peak price is a personal choice that depends on your financial goals and risk tolerance.

4. What factors can influence Bitcoin’s bull cycle?

– Factors such as Market demand, investor sentiment, regulatory developments, and macroeconomic trends can all impact Bitcoin’s bull cycle.

5. Can holding onto Bitcoin for too long be risky?

– While holding onto Bitcoin can potentially lead to significant gains, it’s also important to be aware of the risks, including Market volatility and regulatory changes.

Win Up To 93% Of Your Trades With The World’s #1 Most Profitable Trading Indicators

Win Up To 93% Of Your Trades With The World’s #1 Most Profitable Trading Indicators