Bitcoin could be poised for more gains according to Standard Chartered, thanks to relaxed regulations and the prospect of US spot ETFs. The banking giant predicts further upside potential for the popular cryptocurrency.

Win Up To 93% Of Your Trades With The World’s #1 Most Profitable Trading Indicators

Bitcoin has the potential for significant growth, especially with a Republican administration in the US, according to Standard Chartered. The bank believes that looser regulations and the approval of spot Bitcoin exchange-traded funds (ETFs) could benefit the cryptocurrency under a second-term Republican president like Donald Trump.

In recent news, Hong Kong issuers revealed that the government has banned the sale of virtual asset-related products to mainland Chinese investors. This move has dashed hopes of mainland Chinese investors accessing spot Bitcoin and Ethereum ETFs in Hong Kong.

Meanwhile, South Korea’s Democratic Party, set to take power in June, has announced plans to allow spot Bitcoin ETFs within the country. This follows similar developments in Japan and Singapore, as Asia catches up with the US Market in embracing Bitcoin ETFs.

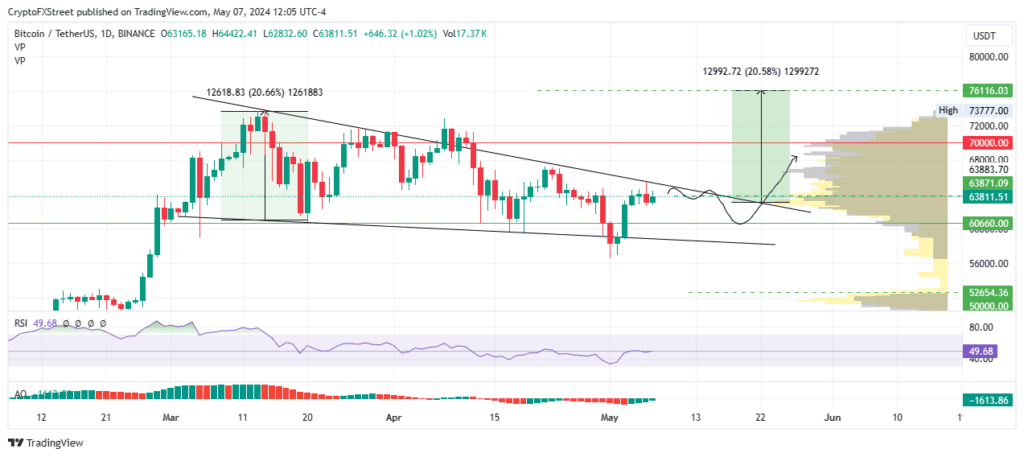

From a technical analysis perspective, Bitcoin’s price has been consolidating within a falling wedge pattern, indicating a potential 20% rally towards $76,116 upon breakout. Traders are advised to look for a stable break above $68,000 and a higher low on the Relative Strength Index (RSI) before entering long positions. The current bullish sentiment is reflected in indicators like the Awesome Oscillator (AO) and the volume profile.

However, if bears take control, Bitcoin could drop below key support levels at $60,600 and $56,000, invalidating the bullish thesis. In such a scenario, the $52,654 level presents an attractive buying opportunity as indicated by the volume profile.

Overall, with the prospects of US fiscal dominance and favorable regulatory environment, Bitcoin could see significant gains in the near future. Stay tuned for more updates on the cryptocurrency Market as developments unfold.

Win Up To 93% Of Your Trades With The World’s #1 Most Profitable Trading Indicators

1. What is causing Bitcoin’s potential for further upside, according to Standard Chartered?

Standard Chartered cited looser regulation and the introduction of US spot ETFs as factors driving Bitcoin’s potential for further upside.

2. How can looser regulation impact Bitcoin’s price?

Looser regulation can lead to increased adoption and investment in Bitcoin, potentially driving up its price.

3. What are US spot ETFs and how do they relate to Bitcoin’s potential growth?

US spot ETFs are exchange-traded funds that track the price of a specific asset, such as Bitcoin. The introduction of US spot ETFs can attract more investors to Bitcoin, potentially driving its price higher.

4. Why is Standard Chartered optimistic about Bitcoin’s future prospects?

Standard Chartered is optimistic about Bitcoin’s future prospects due to the combination of looser regulation and the introduction of US spot ETFs, which can create a favorable environment for Bitcoin’s growth.

5. Should investors consider buying Bitcoin based on Standard Chartered’s analysis?

Investors should carefully consider their own risk tolerance and investment goals before making any decisions. While Standard Chartered’s analysis may provide valuable insights, it is important to conduct thorough research and seek professional advice before investing in Bitcoin or any other asset.

Win Up To 93% Of Your Trades With The World’s #1 Most Profitable Trading Indicators

Win Up To 93% Of Your Trades With The World’s #1 Most Profitable Trading Indicators