Bitcoin miners are currently facing selling pressure, leading to concerns about the impact on the price of BTC. As miners offload their holdings, it could potentially drive the price of Bitcoin down. Investors are keeping a close eye on this development as it could significantly affect the overall Market sentiment towards the leading cryptocurrency.

Win Up To 93% Of Your Trades With The World’s #1 Most Profitable Trading Indicators

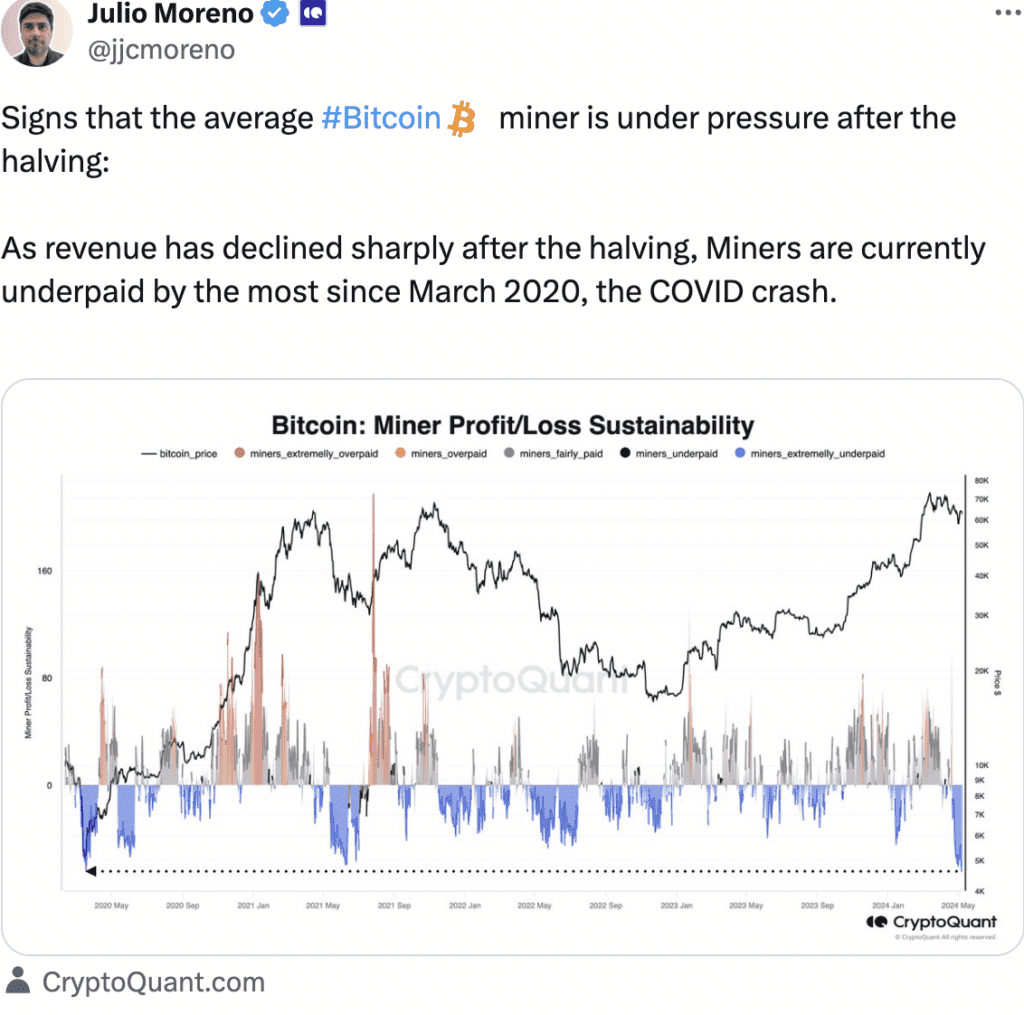

Bitcoin miners are feeling the pinch as their revenues decline post-halving, putting pressure on them to remain profitable. With the recent drop in revenue, miners are facing tough conditions reminiscent of the COVID-19 crash in March 2020. The declining hashrate has led to the network’s fourth negative difficulty adjustment of the year, the largest since 2022. This situation may force miners to sell their BTC holdings to stay afloat.

On the brighter side, inflows for Bitcoin ETFs are on the rise, particularly in the US and Asia. US Spot Bitcoin ETFs saw a significant net inflow of $11.78 billion, with Bitwise’s BITB leading the pack. Meanwhile, Grayscale’s GBTC witnessed zero net flow and a total net outflow of $17.5 billion. In Asia, HK Spot Bitcoin ETFs garnered a total net inflow of $273.6 million since their launch, while HK Spot Ether ETFs recorded a net outflow on the 8th of May.

At the moment, Bitcoin is trading at $62,945.16, up by 3.40% in the last 24 hours. The MVRV ratio has increased due to the price surge, making most BTC holders profitable. As addresses become more profitable, the incentive for holders to sell and take profits also rises. So, while miners face selling pressure, inflows for Bitcoin ETFs continue to grow, creating a dynamic landscape for the king coin.

Win Up To 93% Of Your Trades With The World’s #1 Most Profitable Trading Indicators

1. How will the selling pressure from Bitcoin miners impact the price of BTC?

– The increased selling pressure can potentially drive the price of BTC down.

2. Why are Bitcoin miners selling their coins?

– Miners may be selling their coins to cover operating expenses or to take advantage of price fluctuations.

3. Will the selling pressure from miners lead to a drop in Bitcoin’s value?

– It can contribute to downward pressure on Bitcoin’s price but other factors also play a role in determining the value of BTC.

4. How can investors prepare for the impact of selling pressure from miners?

– Investors can stay informed about Market trends and consider diversifying their portfolios to mitigate risks associated with price fluctuations.

5. Is selling pressure from miners a common occurrence in the cryptocurrency Market?

– Yes, selling pressure from miners is a normal part of the Market cycle as miners need to sell their coins to cover expenses and to realize profits.

Win Up To 93% Of Your Trades With The World’s #1 Most Profitable Trading Indicators

Win Up To 93% Of Your Trades With The World’s #1 Most Profitable Trading Indicators