Apple Stock (NASDAQ:AAPL) has become an attractive investment opportunity with over 110 billion reasons to buy after Warren Buffett decided to sell his shares. The tech giant’s impressive financial performance and innovative product lineup continue to make it a top choice for investors looking for long-term growth potential.

Win Up To 93% Of Your Trades With The World’s #1 Most Profitable Trading Indicators

Apple made headlines recently with its announcement of a massive $110 billion buyback plan, the largest of its kind in history. This news, along with a generous dividend increase and better-than-expected quarterly results, caused shares to jump 6%, although they dipped slightly after Warren Buffett’s Berkshire Hathaway sold off a portion of its stake.

Following the iPad event featuring the new M4 chip, it has been an eventful week for Apple. But for investors eyeing the company’s future in generative artificial intelligence (AI), the landscape may have shifted slightly.

Despite Berkshire’s share sale, the iPad event, the substantial buyback, and positive quarter results, I remain bullish on AAPL stock. Even if Buffett continues to reduce his stake, I see potential for growth and innovation in the AI sector.

Apple’s historic buyback is a significant development that could boost investor confidence. While some may be concerned about Berkshire’s actions, I view it as a neutral event. CEO Tim Cook’s support at Berkshire’s shareholder meeting and hints at tax considerations suggest this was a strategic move rather than a negative reflection on Apple.

The company’s focus on AI innovation, with rumors of an AI-powered iPhone and potential AI features in upcoming products, indicates a commitment to technological advancement. The gradual integration of AI into new features suggests long-term growth potential for Apple.

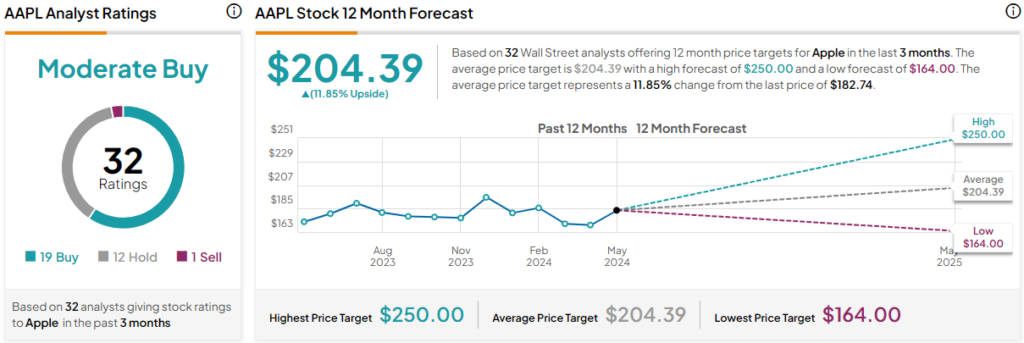

Analysts have a Moderate Buy rating on AAPL stock, with a price target of $204.39, signaling an 11.85% upside potential. The outlook for Apple’s AI initiatives and upcoming product launches could drive multiple expansion and investor confidence in the stock.

In conclusion, Apple’s emphasis on AI development and ongoing innovation, coupled with the massive buyback plan, paints a positive picture for the company’s future. Despite Berkshire’s recent share sale, Apple’s strategic direction and commitment to AI technology make it a compelling investment opportunity for those looking to capitalize on the tech giant’s future growth.

Win Up To 93% Of Your Trades With The World’s #1 Most Profitable Trading Indicators

1. Why did Warren Buffett sell Apple stock?

– Warren Buffett sold Apple stock due to a combination of reasons, including changes in his investment strategy and profit-taking.

2. Should I buy Apple stock after Buffett sold?

– Many investors see Buffett’s sale as an opportunity and view Apple as a strong long-term investment, with growth potential and a solid track record.

3. Is Apple stock a good buy right now?

– Apple stock remains a popular choice among investors, as the company continues to innovate, expand its product offerings, and show strong financial performance.

4. How has Apple stock performed compared to the overall Market?

– Apple stock has outperformed the Market in recent years, with strong gains driven by successful product launches and strong consumer demand.

5. What are some risks associated with investing in Apple stock?

– Some risks associated with investing in Apple stock include competition in the technology industry, changes in consumer preferences, and potential regulatory challenges.

Win Up To 93% Of Your Trades With The World’s #1 Most Profitable Trading Indicators

Win Up To 93% Of Your Trades With The World’s #1 Most Profitable Trading Indicators