The Ethereum network has experienced a significant dip to a 6-month low, causing a ripple effect on the value of ETH. This drop has left investors and cryptocurrency enthusiasts questioning the stability of the popular digital currency. Stay tuned as we explore the impact of this downturn and how it has affected the Ethereum community.

Win Up To 93% Of Your Trades With The World’s #1 Most Profitable Trading Indicators

Ethereum’s fees hit a six-month low in the past seven days. ETH was down by 6%, and metrics looked bearish.

As L2s gain popularity, Ethereum’s network usage plummets, reaching a six-month low. This aligns with Vitalik Butarin’s 2020 roadmap, which aimed to enhance scalability by offloading transactions from the mainnet. However, ETH bears entered the Market and pushed the token’s price down.

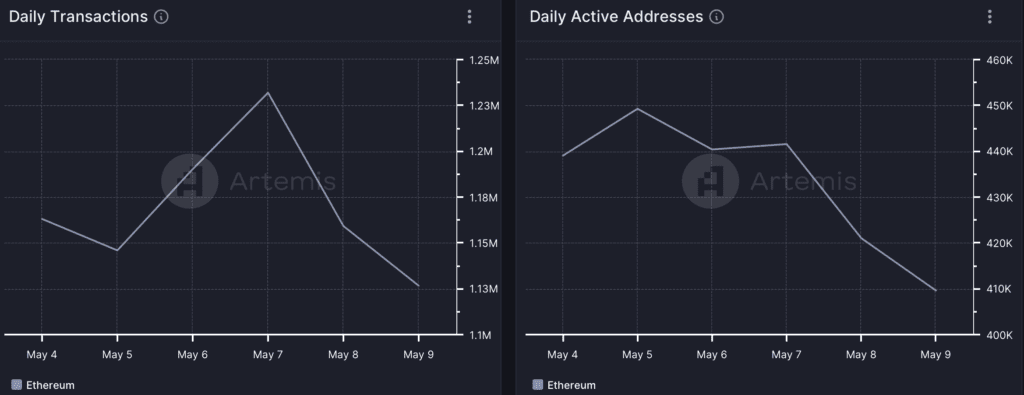

IntoTheBlock recently highlighted the fact that ETH’s fees plummeted to a 6-month low this week as it dropped by over 29%. The drop in ETH’s fees reflected a shift in activity to over 50 live Layer 2 networks. Overall activity on the network had dropped, alongside the blockchain’s Daily Active Addresses declined last week.

ETH’s Daily Transactions also followed a similar trend with a decline in fees causing the blockchain’s revenue to drop last week. Surprisingly, the blockchain’s usage dropped when its gas price declined significantly.

While the blockchain’s network activity dwindled, its price action also turned bearish. ETH’s price has dropped by more than 6% in the last seven days, trading at $2,920.99 with a Market capitalization of over $350 billion. Whales were seen selling their holdings, contributing to the negative price action in the Market.

Market sentiment turned bearish as Ethereum’s Weighted sentiment dropped in the last few days. Analysis of ETH’s daily chart revealed indicators suggesting a further price decline. Its Relative Strength Index (RSI) was under the neutral mark, and the Money Flow Index (MFI) registered a downtick. The price had touched the lower limit of the Bollinger Bands, indicating a possible trend reversal.

Overall, the negative price action had a negative impact on Market sentiment with selling sentiment being dominant. Ethereum’s Exchange Inflow spiked twice last week, indicating a sell-off that triggered the price correction.

Win Up To 93% Of Your Trades With The World’s #1 Most Profitable Trading Indicators

1. What caused the Ethereum network to dip to a 6-month low?

Answer: The dip in the Ethereum network was caused by various factors such as Market volatility, decreasing demand, and increased selling pressure.

2. How did the dip in the Ethereum network affect ETH prices?

Answer: The dip in the Ethereum network led to a decrease in ETH prices as investors panicked and sold off their holdings.

3. Is it a good time to buy Ethereum at the 6-month low?

Answer: It can be a good opportunity to buy Ethereum at a 6-month low, as prices may bounce back in the future.

4. Will the Ethereum network recover from this dip?

Answer: It is possible for the Ethereum network to recover from this dip, especially if Market conditions improve and demand for ETH increases.

5. How can investors protect themselves from losses during such dips in the Ethereum network?

Answer: Investors can protect themselves from losses during dips in the Ethereum network by diversifying their portfolio, setting stop-loss orders, and staying informed about Market trends.

Win Up To 93% Of Your Trades With The World’s #1 Most Profitable Trading Indicators

Win Up To 93% Of Your Trades With The World’s #1 Most Profitable Trading Indicators