As Bitcoin on-chain activity reaches record low levels, questions arise about the impact on the cryptocurrency’s price. With fewer transactions happening on the blockchain, some experts believe this could signal a potential shift in Market dynamics. Find out more on TradingView News.

Win Up To 93% Of Your Trades With The World’s #1 Most Profitable Trading Indicators

The price of Bitcoin has been fluctuating within a narrow range after reaching a new all-time high in March. Many investors are concerned about this stagnant price movement, especially when the cryptocurrency lost support at the $60,000 level.

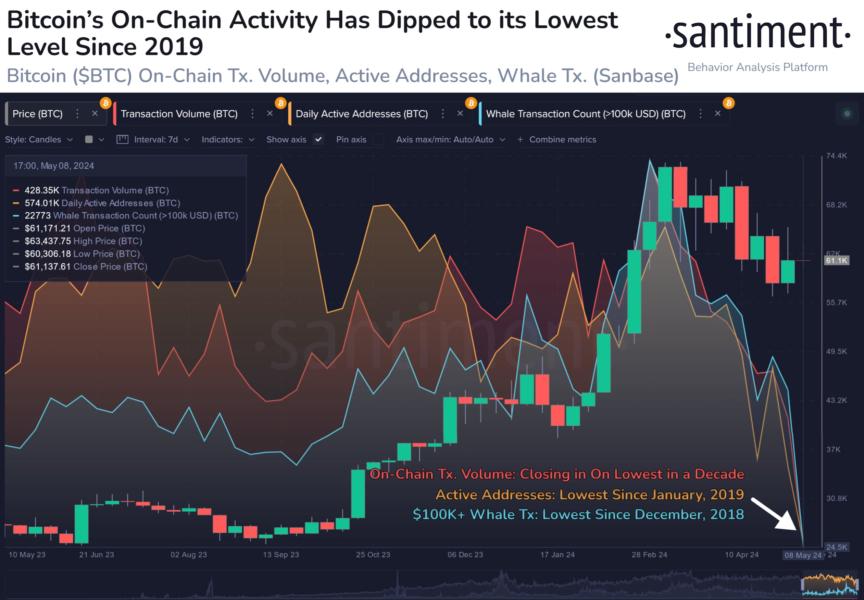

Interestingly, it’s not just the price that has cooled off. Data analytics firm Santiment revealed that on-chain activity on the Bitcoin network has also slowed down in recent months.

In a recent post, Santiment disclosed that on-chain activity on the Bitcoin network is approaching historic lows. This decline is evident in metrics such as transaction volume, daily active addresses, and whale transaction count.

Transaction volume on the blockchain is at its lowest in a decade, while the number of daily active addresses is the lowest since January 2019. Additionally, whale activity on the network has decreased, with fewer transactions exceeding $100,000.

Despite the decrease in on-chain activity, Santiment suggests that this may not necessarily lead to a drop in Bitcoin’s price. The decline is more likely a reflection of Market sentiment and uncertainty among traders.

As for the current Bitcoin price, it stands at around $60,770 with a slight 0.2% decrease in the past day, according to CoinGecko data. This cautious trading behavior may indicate a period of indecision in the Market, rather than impending price volatility.

Win Up To 93% Of Your Trades With The World’s #1 Most Profitable Trading Indicators

1. What does it mean that Bitcoin on-chain activity is approaching historic lows?

It means that there is a decrease in the number of transactions and overall activity happening on the Bitcoin network.

2. How does low on-chain activity impact the price of Bitcoin?

Low on-chain activity can signal a lack of interest or participation in the Market, potentially leading to a decrease in the price of Bitcoin.

3. Are there any potential reasons for this decrease in on-chain activity?

Possible reasons for low on-chain activity could include Market consolidation, reduced interest from investors, or regulatory concerns.

4. Is low on-chain activity always a negative sign for Bitcoin?

Not necessarily. Low on-chain activity could also indicate a period of stability or consolidation in the Market, which may be positive for long-term price growth.

5. What should investors do in response to the news of historic lows in Bitcoin on-chain activity?

Investors should carefully monitor Market trends, stay informed about any developments that could impact the price of Bitcoin, and consider diversifying their investment portfolios to manage risk.

Win Up To 93% Of Your Trades With The World’s #1 Most Profitable Trading Indicators

Win Up To 93% Of Your Trades With The World’s #1 Most Profitable Trading Indicators