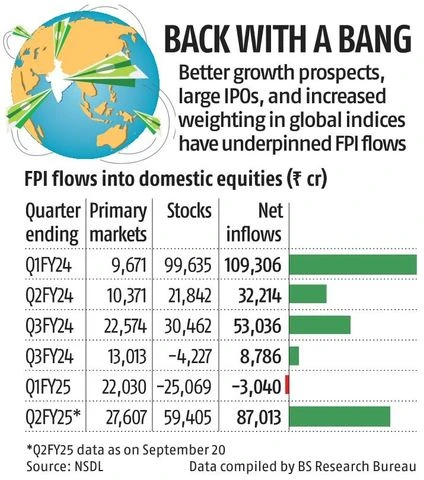

Foreign investors surge back into India’s stock market, driven by robust IPOs and optimism amid political shifts and global rate cuts.

Foreign portfolio investors (FPIs) injected over Rs 87,000 crore (over $10 billion) into Indian equities this quarter, marking the highest inflow since June 2023. Key factors driving this investment include improved growth prospects, increased global index weight, and a robust IPO Market, with 50 companies raising Rs 53,453 crore by August 2024. Despite a sluggish ...

)

)