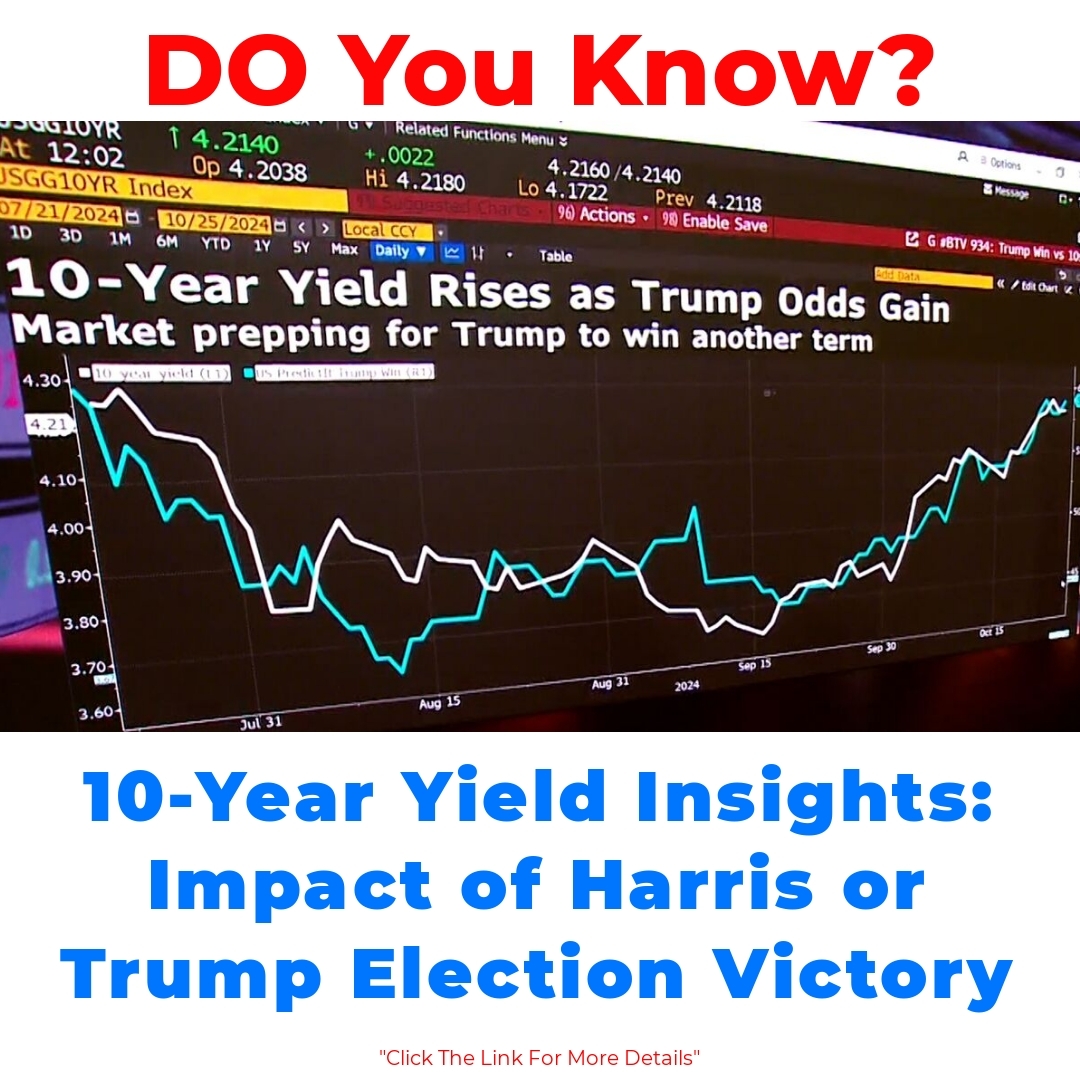

Credit Experts Say Red Sweep Could Boost Credit Spreads Outlook

UBS Head of Credit Strategy Matthew Mish believes a red sweep in the upcoming elections would be beneficial for credit spreads, indicating a positive outlook overall. Meanwhile, CreditSights Global Head of Strategy Winnie Cisar advises investors to look beyond the election noise. They shared these insights during an interview with Sonali Basak on "Bloomberg Real Yield."