Bitcoin (BTC) is facing strong selling pressure amid global trade war fears and economic uncertainty. Currently trading above $80,000 but below $85,000, BTC lacks a clear direction as investors remain cautious. Despite this, the options Market shows some bullish signs, with more traders betting on a price rebound. The coming weeks are critical; BTC needs to reclaim key resistance levels for a potential recovery, especially the $90,000 mark. If not, it risks further declines. Long-term factors, such as growing institutional adoption and potential U.S. policy changes, may support future price movements. Traders are closely watching the Market for signs of stability amid current volatility.

Bitcoin Sees Market Shifts Amid Uncertainty

Bitcoin (BTC) is facing significant selling pressure as fears over a global trade war and macroeconomic instability loom large. Currently, the price is holding above the crucial $80,000 mark but struggles to break past $85,000. With investors being cautious, Bitcoin is in a delicate phase where both buyers and sellers are waiting for some clear direction.

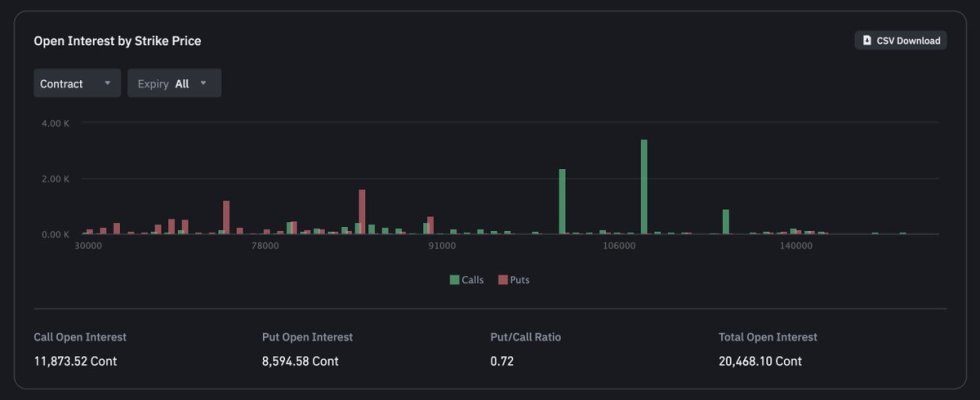

Interestingly, despite the current atmosphere of uncertainty, there are signs of cautious optimism in the Bitcoin options Market. Recent data shows a higher number of call options being traded, suggesting some traders are betting on potential price increases in the near future.

The upcoming trading sessions could be vital for Bitcoin. It must either reclaim critical resistance levels to signal a recovery or face the risk of continued downward pressure from sellers. The behavior of the options Market hints at some possible upside, but traders are carefully watching both support and resistance thresholds.

Market Sentiment Highlights Potential for Recovery

Bitcoin has dropped nearly 20% since the beginning of the month, and bears appear to be in control. However, analysts believe that if Bitcoin can stabilize above $80,000 and target the $90,000 level, a significant recovery could be on the horizon.

Long-term fundamentals for Bitcoin remain strong. Institutional adoption is growing, and plans related to a Strategic Bitcoin Reserve could further drive demand. If confidence returns, it might lead to upward price movements.

Notable Market analyst Axel Adler shared insights indicating a moderately bullish sentiment in the Bitcoin options Market. Many are betting on a rebound, but there’s also concern over large hedging positions for puts in the $75,000 to $85,000 range, reflecting uncertainty in the Market and a readiness for volatility.

As Bitcoin makes its move, the next few weeks are crucial. Reclaiming higher levels could suggest a recovery, while failure to maintain support could lead to more significant declines and further Market turmoil.

Bulls Strive to Reclaim Key Levels

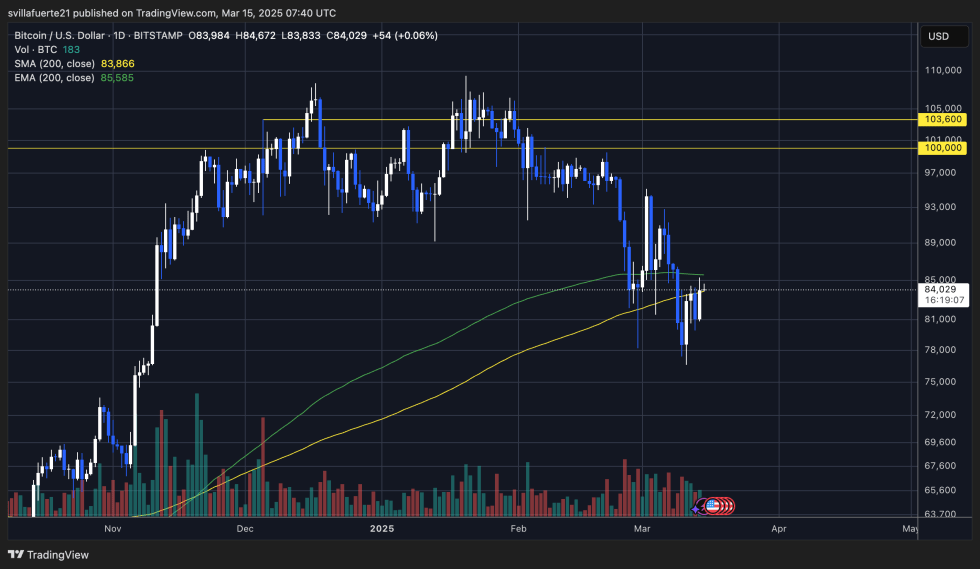

Bitcoin is currently trading at around $84,000, trying to maintain its position above the 200-day moving average. Bulls need to act quickly to push BTC past the 200-day exponential moving average at $85,500 to set a foundation for recovery.

Market sentiment remains shaky, and if bulls cannot reclaim the $85,000 level, Bitcoin may face more selling pressure and possibly drop below the critical $80,000 threshold. A failure to hold this support could increase the risk of deeper corrections.

For Bitcoin to confirm a genuine recovery, it must surpass the $90,000 mark, a significant psychological and technical resistance level. Achieving this would signal renewed confidence among buyers and set the stage for a more robust rally.

As Bitcoin hovers at these crucial levels, the coming days could determine whether it stabilizes and regains its footing or if it continues its downward trend towards lower support zones.

Editorial Process for bitcoinist is focused on providing thoroughly researched, accurate, and unbiased content. We adhere to strict sourcing standards, and each article is meticulously reviewed by our team of experts and seasoned editors. This process ensures the integrity and relevance of our content for our audience.

What is the Bitcoin options Market?

The Bitcoin options Market allows traders to buy or sell the right to trade Bitcoin at a specific price by a certain date. It helps them make decisions based on price predictions and risk management.

What does a bullish bias mean in this context?

A bullish bias means that traders generally think the price of Bitcoin will go up. They are buying more call options, which give them the right to buy Bitcoin at a set price.

Why are heavy put positions a sign of caution?

Heavy put positions indicate many traders believe Bitcoin’s price might drop. This can create uncertainty and suggests that while some expect growth, many others are hedging against potential losses.

What does volatility mean for Bitcoin prices?

Volatility refers to how much and how quickly the price of Bitcoin can change. When traders see signs of volatility, they prepare for big price swings, whether up or down.

Should I invest in Bitcoin options now?

Investing in Bitcoin options can be risky, especially during times of uncertainty. It’s essential to do thorough research and consider your risk tolerance before diving in.