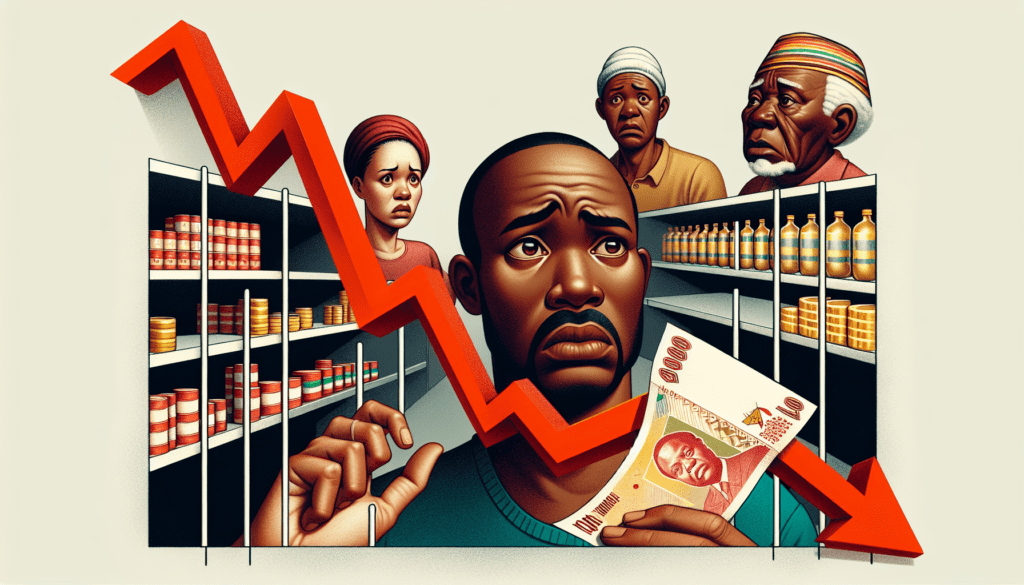

Zimbabwe is once again finding itself in a challenging spot with its ongoing currency struggles. The African nation’s journey towards economic stability seems to be taking another twist as it potentially spirals into deeper currency chaos. With the situation quickly unfolding, concerns are rising among citizens and investors alike about the future financial landscape of the country. This latest development sheds a light on the ongoing challenges facing Zimbabwe’s economy and raises questions about the path forward.

Win Up To 93% Of Your Trades With The World’s #1 Most Profitable Trading Indicators

Zimbabwe is facing a new chapter in its ongoing economic saga with the introduction of a new local currency known as the Zig, short for “Zimbabwe gold.” This new currency, which aims to tackle the country’s persistent issues with inflation and hyperinflation, has received mixed reactions from the public.

Traders, especially those working hard to ensure their livelihoods in Harare’s bustling markets like Mbare, are among those expressing frustration. The swift introduction of the Zig, replacing digital RTGS currency and cash “bond notes,” caught many off guard. Individuals like Sylvia Dhliwayo, who is determined to provide for her children through her street stall business, are finding it hard to accept this abrupt change. The fluctuation and instability of currency values are a daily battle for her and many others, complicating transactions and savings.

The government’s latest currency endeavor follows a troubled history of monetary changes, including the infamous Zimbabwe dollar, which saw denominations soaring to a hundred trillion at its peak. With this, the Zig marks the sixth attempt at introducing a new currency within two decades, raising skepticism about its potential success and stability.

Citizens are particularly concerned about the lack of physical cash available, as the Zig exists mostly in digital form. This poses a significant challenge in a country where power outages are common, making digital transactions unreliable. Despite the enthusiasm from official sectors, including a statement from the Reserve Bank Governor John Mushayavhanu that the introduction follows World Bank advice, many Zimbabweans remain unconvinced.

Market prices continue to be listed in US dollars, highlighting the ongoing reliance on foreign currency. This scenario underscores the difficulties faced by those in the informal sector and ordinary citizens, who struggle with accessing enough US dollars to meet their needs. The persistence of the US dollar as the primary medium of exchange for essential services illustrates the lack of confidence in the new Zig and its capacity to stabilize Zimbabwe’s economy.

Furthermore, the crackdown on black Market foreign exchange dealers, ironically required to pay bail in US dollars, and the demand for US dollars for nearly all major transactions, underscores the challenges in normalizing and stabilizing the Zig in the Market.

The introduction of the Zig into Zimbabwe’s economy represents yet another twist in the country’s complex financial landscape. Observers and citizens alike are keenly watching to see if this new currency will manage to break the cycle of inflation and restore confidence in the nation’s economy, or if it will join the ranks of previous failed currencies, leaving Zimbabweans to continue their search for economic stability.

Win Up To 93% Of Your Trades With The World’s #1 Most Profitable Trading Indicators

1. **What’s happening with Zimbabwe’s currency situation?**

Zimbabwe’s currency is having a tough time again. The value of their money is going down, which makes things expensive and hard for people to plan how to spend or save their money.

2. **Why is Zimbabwe’s currency in chaos?**

Several reasons. The government has made some decisions that didn’t work out well, there’s not much faith in the local currency because of past money problems, and the economy is struggling. All this together is causing the currency chaos.

3. **Are people in Zimbabwe using foreign currencies?**

Yes, many people and businesses in Zimbabwe prefer to use foreign currencies like the US dollar because it’s more stable. This helps them avoid losing money if the local currency’s value drops suddenly.

4. **What is the government doing to fix the currency problems?**

The Zimbabwe government has tried several things, like introducing new money and setting rules for using foreign currency, but it’s been tough to find a solution that works well. They’re still trying to figure out the best way to stabilize their currency.

5. **Will Zimbabwe’s currency stabilize anytime soon?**

It’s hard to say for sure. It depends on a lot of things like government policy, the global economy, and how much confidence people have in Zimbabwe’s economy. Everyone hopes it will get better, but it might take some time.

Win Up To 93% Of Your Trades With The World’s #1 Most Profitable Trading Indicators

Win Up To 93% Of Your Trades With The World’s #1 Most Profitable Trading Indicators