Today, Coinbase (NASDAQ:COIN) is facing tough competition as a new player enters the Market. With the rise of this new competitor, investors are keeping a close eye on how Coinbase will respond to the challenge. Stay tuned for updates on this developing story.

Win Up To 93% Of Your Trades With The World’s #1 Most Profitable Trading Indicators

Recently, Coinbase faced a setback as CME Group announced its entry into the cryptocurrency trading arena. This move caused Coinbase’s shares to plummet by over 8% in Thursday’s trading session. CME Group, known for being the largest futures exchange platform, will launch its own Bitcoin trading operations to cater to traders looking to add crypto exposure to managed funds.

The emergence of CME Group as a competitor poses a significant challenge for Coinbase. While Coinbase has been successful in the past, recent reports show that it had around $800 million in outstanding loans by the end of March, a substantial increase from the previous year. If CME Group manages to attract some of this traffic, Coinbase could face a tough time retaining its Market share. Additionally, recent service outages have further added to Coinbase’s woes.

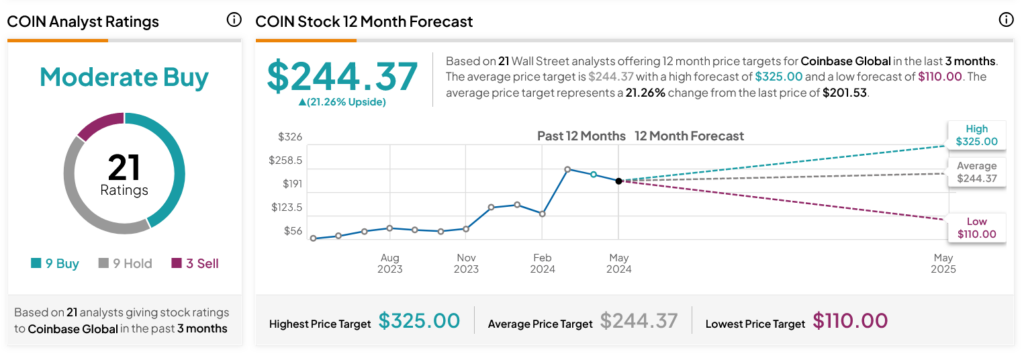

Despite these challenges, analysts on Wall Street have a Moderate Buy consensus rating on COIN stock. With the average price target of $244.37 per share, there is a potential upside of 21.26%. This suggests that despite the competition from CME Group, Coinbase still holds promise for investors.

In conclusion, Coinbase’s position in the cryptocurrency Market may face hurdles with the entry of CME Group. However, its strong track record and potential growth opportunities indicate that it could still be a viable option for investors looking to capitalize on the crypto Market.

Win Up To 93% Of Your Trades With The World’s #1 Most Profitable Trading Indicators

1. What is Coinbase and why is it being slammed by a new competitor?

Coinbase is a popular cryptocurrency exchange platform. It’s facing criticism as a new competitor enters the Market, potentially taking away customers.

2. Who is the new competitor stepping into the ring with Coinbase?

The new competitor is a company called X, which is making waves in the cryptocurrency exchange industry with its innovative features and lower fees.

3. Will Coinbase be able to compete with this new player?

It remains to be seen if Coinbase can retain its customer base and compete effectively with the new competitor. Only time will tell how the Market responds to this challenge.

4. How does this competition impact users of Coinbase?

Users of Coinbase may benefit from the increased competition, as it could lead to improved services, lower fees, and more options for trading cryptocurrency.

5. Should current Coinbase users be concerned about these developments?

Current users of Coinbase may want to keep an eye on how the competition plays out, but there’s no need to panic just yet. It’s always good to stay informed and evaluate your options in the rapidly changing cryptocurrency Market.

Win Up To 93% Of Your Trades With The World’s #1 Most Profitable Trading Indicators

Win Up To 93% Of Your Trades With The World’s #1 Most Profitable Trading Indicators