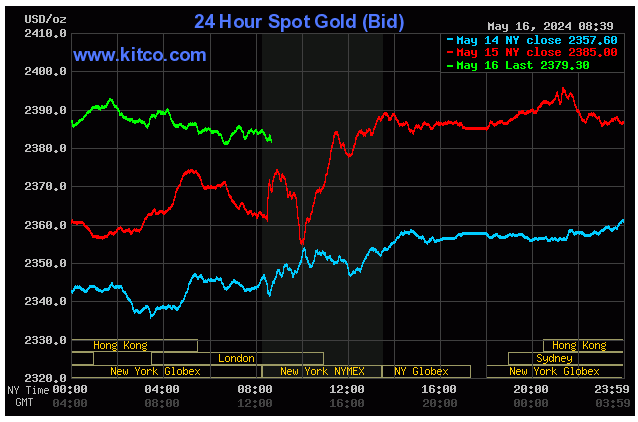

Gold and silver prices have experienced slight increases recently as Market charts show a bullish trend. Investors are keeping a close eye on these precious metals as they navigate economic uncertainties.

Win Up To 93% Of Your Trades With The World’s #1 Most Profitable Trading Indicators

Gold and silver prices are showing a slight increase in early U.S. trading on Friday. Silver is nearing its three-year high achieved in April, attracting speculators towards long positions in both precious metals. The June gold price is up $6.10 at $2,391.60, while July silver is up $0.089 at $29.965.

Stock indexes in Asia and Europe mostly saw gains overnight, with U.S. stock indexes expected to open slightly higher after hitting record highs on Thursday. The Euro zone’s April consumer price index rose by 2.4% year-on-year, meeting Market expectations.

China has taken steps to support its struggling property sector, including a 300 billion yuan relending facility for affordable housing. This news led to a rally in China property stocks. Additionally, China saw positive economic data with a 6.7% year-on-year increase in April industrial output.

Comex copper futures hit a record high above $5.00 a pound this week, fueling talk of a potential “short squeeze.” Market reports suggest that copper prices have outpaced demand, leading to supply disruptions and speculation in base metals trading.

In the Market today, the U.S. dollar index is up, while Nymex crude oil prices are slightly lower at around $79.00 a barrel. The 10-year U.S. Treasury note yield stands at 4.38%. Economic data to be released includes leading economic indicators.

Technically, gold futures show a strong near-term bullish trend, with the next upside target at $2,448.80. Silver futures also exhibit bullish momentum, targeting a close above $30.19. Traders can expect continued Market analysis and forecasting in the upcoming “Markets Front Burner” weekly email report.

Please note that the views expressed in this article are the author’s own and may not reflect those of Kitco Metals Inc. Accuracy of information is not guaranteed, and this article is for informational purposes only. Trading decisions should be made based on individual analysis and risk assessment.

Win Up To 93% Of Your Trades With The World’s #1 Most Profitable Trading Indicators

1. What is the current price trend for gold and silver?

Both gold and silver are experiencing modest price gains as charts show a bullish trend.

2. Should I consider investing in gold and silver right now?

The charts suggest that now could be a good time to consider investing in gold and silver.

3. Will the price of gold and silver continue to rise?

While nothing is certain, the bullish charts indicate that the price of gold and silver may continue to increase.

4. How can I buy gold and silver?

You can buy gold and silver from reputable dealers, online platforms, or through exchange-traded funds (ETFs).

5. Are there any risks associated with investing in gold and silver?

Like any investment, there are risks involved in investing in gold and silver, so it’s important to do your research and consider speaking with a financial advisor before making any decisions.

Win Up To 93% Of Your Trades With The World’s #1 Most Profitable Trading Indicators

Win Up To 93% Of Your Trades With The World’s #1 Most Profitable Trading Indicators