FTX, a leading cryptocurrency exchange, has revealed its massive payout plan that could have a significant impact on Bitcoin’s price. This new initiative has the potential to shake up the Market and drive Bitcoin’s value in a particular direction. Stay tuned for updates on how this move could shape the future of the digital currency landscape.

Win Up To 93% Of Your Trades With The World’s #1 Most Profitable Trading Indicators

FTX, the crypto exchange that recently announced a plan to repay creditors up to $16.3 billion, is making waves in the Market. This move is expected to create a bullish trend in the second half of 2024, according to analysts.

The repayment plan by FTX has garnered positive reactions from the Market, with CEO Ray stating that they aim to return 100% of bankruptcy claim amounts plus interest to non-governmental creditors. This development is set to have significant ripple effects across the crypto Market, as highlighted in a recent report by K33 Research.

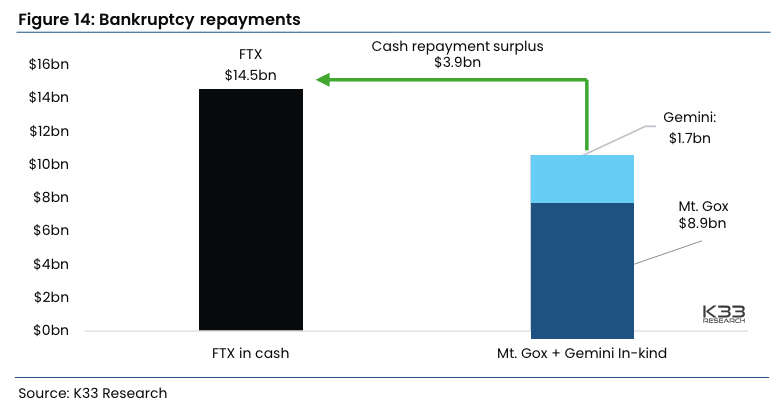

The analysts at K33 Research suggest that the cash-based repayments by FTX could create a “bullish overhang” in the Market, potentially leading to increased buying pressure. They also point out that these repayments could help balance out Market dynamics, especially when compared to other entities like Mt. Gox and Gemini, who are planning crypto-based repayments totaling $10.6 billion.

The timing of these repayments will be crucial in fully assessing their impact on the Market. While Gemini’s $1.7 billion repayment is expected in June and Mt. Gox’s $8.9 billion by October 2024, FTX’s repayment schedule is still under court review. Most creditors are anticipating disbursements later this year, indicating a potential slow summer in the Market but a strong end to the year.

Meanwhile, the global crypto Market has shown bullish signs, with Bitcoin and Ethereum breaking major resistance levels. The Market has surged by 5.8% in the last 24 hours alone, adding over $100 billion to the global Market cap. This surge has led to a wave of liquidations among traders, indicating heightened Market activity.

Additionally, the increase in Bitcoin’s open interest by nearly 10% signals growing confidence among investors in the Market‘s direction. Overall, the FTX repayment plan and recent Market trends point towards a potentially positive outlook for the future of the cryptocurrency Market.

Win Up To 93% Of Your Trades With The World’s #1 Most Profitable Trading Indicators

1. How can FTX’s massive payout plan impact Bitcoin’s price?

FTX’s massive payout plan can impact Bitcoin’s price by increasing demand for the cryptocurrency as users cash out their winnings, leading to a potential price increase.

2. Will FTX’s payout plan cause Bitcoin’s price to go up or down?

The impact of FTX’s payout plan on Bitcoin’s price may vary, but generally an increase in demand for Bitcoin could drive prices up in the short term.

3. Is FTX’s payout plan good for Bitcoin investors?

FTX’s payout plan could be beneficial for Bitcoin investors as it could drive up the price of the cryptocurrency, resulting in potential gains for those holding Bitcoin.

4. How can I take advantage of FTX’s massive payout plan?

To take advantage of FTX’s massive payout plan, users can participate in FTX’s trading competitions or other events that offer opportunities to win rewards in Bitcoin.

5. Are there any risks associated with FTX’s massive payout plan?

As with any investment or trading activity, there are always risks involved. It’s important for users to carefully consider the potential risks and rewards of participating in FTX’s payout plan before getting involved.

Win Up To 93% Of Your Trades With The World’s #1 Most Profitable Trading Indicators

Win Up To 93% Of Your Trades With The World’s #1 Most Profitable Trading Indicators