Bitcoin (BTC) appears to be nearing a bottom as it continues to show signs of stabilizing after recent volatility. Investors are hopeful that this could signal a turning point for the cryptocurrency, which has been struggling in recent months. Experts are closely monitoring the Market to see if BTC can maintain its current levels and potentially begin a reversal in its downward trend.

Win Up To 93% Of Your Trades With The World’s #1 Most Profitable Trading Indicators

Bitcoin price has been fluctuating significantly during US stock Market open hours, mainly due to the impact of ETFs and institutional investors. Traders have shown a lack of enthusiasm for buying the dip, leading to multiple retests of the $60,600 mark. This lack of faith from the crowd could indicate that prices are nearing a bottom.

The trading behavior of Bitcoin during US stock Market hours contrasts with that of Asian traders, who have been more positive about the recent launch of BTC and ETH exchange-traded funds. However, in the US, outflows from ETFs have been on the rise, with Grayscale experiencing a significant outflow of $43.4 million on Thursday.

While the overall net flows have been negative, it is worth noting that Thursday marked a day where most ETF providers had either positive or neutral flows, with Grayscale being the exception. This trend suggests that demand for BTC is weakening, putting downward pressure on prices.

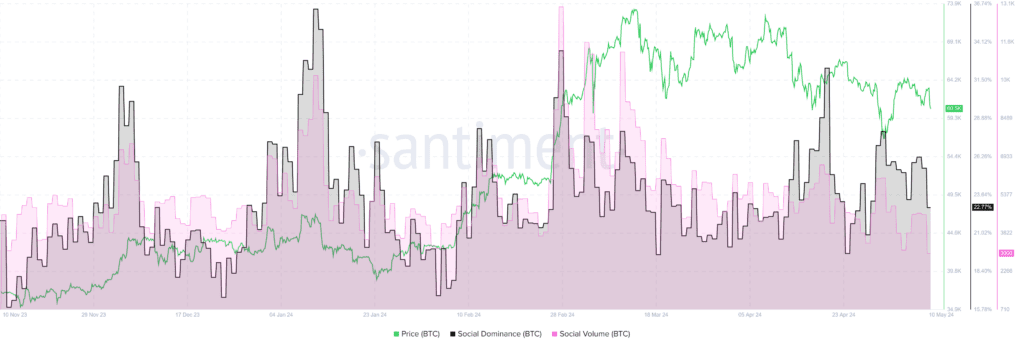

Social metrics for Bitcoin have also been on the decline, with a decrease in social dominance and social volume. This could indicate a lack of mainstream interest in the cryptocurrency, leading to lower volatility. As more traders discuss selling rather than buying, the likelihood of a Market recovery increases.

In terms of price outlook, Bitcoin continues to consolidate within a falling wedge pattern on the one-day time frame, suggesting a temporary pause in the downtrend. A breakout above the upper trendline of the falling wedge could signal a bullish reversal, with a potential profit target near $71,116. However, if the $55,473 support is breached, the bullish thesis may be invalidated.

Overall, the Market sentiment suggests that Bitcoin prices may be nearing a bottom, with a potential relief rally on the horizon. Factors such as whale behavior and the circulation of dormant BTC addresses will play a crucial role in determining the future price movements of Bitcoin. Investors should keep a close eye on key support levels and Market trends to make informed decisions.

Win Up To 93% Of Your Trades With The World’s #1 Most Profitable Trading Indicators

1. Why is BTC close to a bottom?

– Many experts believe that BTC is close to a bottom due to oversold conditions and the potential for a rebound in the Market.

2. What factors are contributing to BTC being close to a bottom?

– Factors such as increased institutional interest, regulatory clarity, and overall Market sentiment are contributing to BTC’s potential bottoming out.

3. Is now a good time to buy BTC?

– It may be a good time to consider buying BTC as it is close to a bottom, but it’s important to do your own research and consider Market conditions before making any investment decisions.

4. How can I determine if BTC has reached its bottom?

– Monitoring key technical indicators, Market trends, and expert analysis can help you determine if BTC has reached its bottom or if further price drops are expected.

5. Is it safe to invest in BTC when it’s close to a bottom?

– Investing in BTC when it’s close to a bottom can be profitable, but it also comes with risks. It’s important to diversify your investment portfolio and only invest what you can afford to lose.

Win Up To 93% Of Your Trades With The World’s #1 Most Profitable Trading Indicators

Win Up To 93% Of Your Trades With The World’s #1 Most Profitable Trading Indicators