Ethereum saw an increase in supply by 100,000, raising questions about its ‘deflationary status’. Cryptocurrency enthusiasts are closely monitoring the impact of this development on Ethereum’s Market dynamics and long-term value. Stay tuned for more updates on this evolving story.

Win Up To 93% Of Your Trades With The World’s #1 Most Profitable Trading Indicators

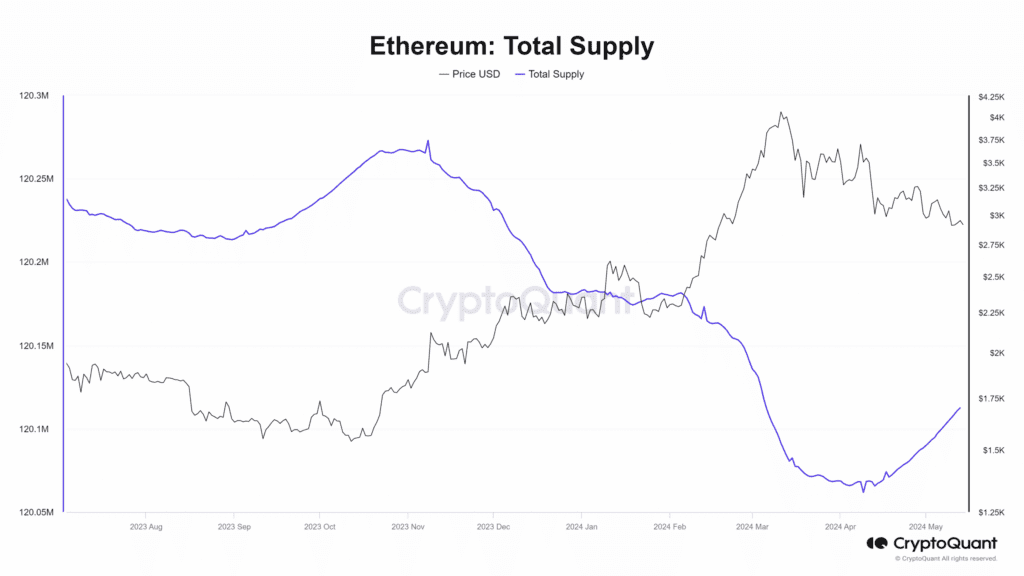

Ethereum has lost its “ultrasound money” status due to the recent EIP-1559 upgrade, leading to changes in its deflationary nature. The total supply of ETH has increased by over 100,000, with recent fluctuations in supply dynamics being observed.

From November 2023 to April 2024, there was a decrease in ETH’s total supply, but it has started to ascend again in recent weeks. This increase is attributed to a decline in fees burnt, resulting in a shift in Ethereum’s deflationary dynamics.

Furthermore, Ethereum transaction fees have decreased significantly, with the overall fees generated on the network showing a noticeable decline. Despite this, Ethereum’s exchange supply has been on the rise, but it remains relatively low compared to the total supply, indicating manageable oversupply risks.

In terms of price, Ethereum has been struggling to regain ground after dropping below $3,000. The indicators like the Stochastic and RSI suggest a bearish trend, but there is potential for a price reversal in the near future.

Overall, the recent developments in Ethereum’s supply dynamics, transaction fees, and price trends indicate a period of adjustment and potential opportunities for investors. Keep an eye out for potential price upticks in the coming days.

Win Up To 93% Of Your Trades With The World’s #1 Most Profitable Trading Indicators

1. What is the current situation with Ethereum’s supply increasing by 100,000?

– The supply of Ethereum has gone up by 100,000 tokens recently.

2. How does this impact Ethereum’s ‘deflationary status’?

– This increase in supply may affect Ethereum’s deflationary status by potentially lowering the value of each token.

3. Will this change the overall value of Ethereum?

– The increase in supply could potentially lead to a decrease in the value of Ethereum.

4. Is this increase in supply permanent?

– It depends on the specific circumstances of the increase, but generally, an increase in supply can impact Ethereum’s Market dynamics in the long term.

5. What should Ethereum investors be aware of regarding this supply increase?

– Investors should closely monitor the Market reaction to the increase in supply and consider how it may impact their investment decisions.

Win Up To 93% Of Your Trades With The World’s #1 Most Profitable Trading Indicators

Win Up To 93% Of Your Trades With The World’s #1 Most Profitable Trading Indicators