Welcome to the latest insights from On-Chain Data on TradingView News. Stay ahead of the game with up-to-date analysis and trends based on real-time data from blockchain transactions. Discover key indicators and signals to inform your trading decisions and enhance your overall Market strategy. Don’t miss out on this essential resource for staying informed in the fast-paced world of cryptocurrency trading.

Win Up To 93% Of Your Trades With The World’s #1 Most Profitable Trading Indicators

Leading on-chain analyst James Check, also known as Checkmatey, has recently provided a detailed analysis of Bitcoin’s Market dynamics. In his latest report, he describes the current period as “Quiet and Trending,” indicating a strong underlying foundation amidst significant selling pressure and shifts in volatility.

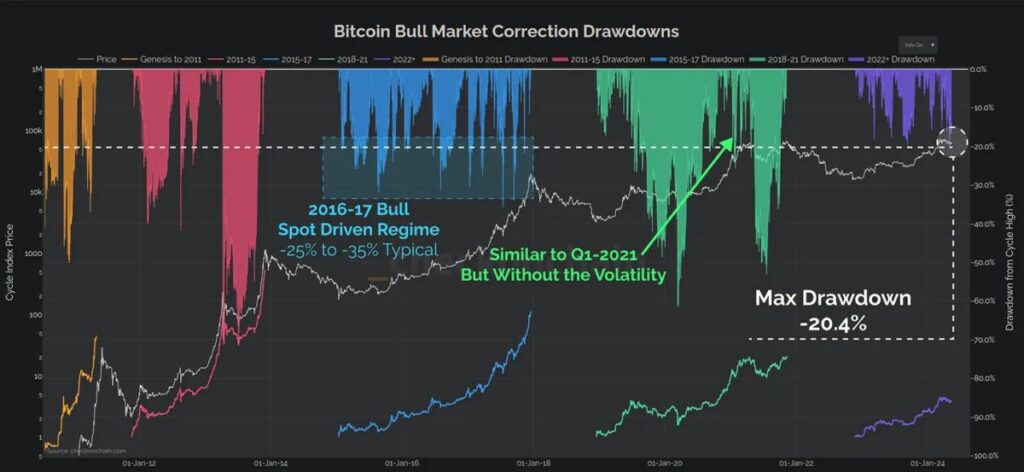

Since December, Bitcoin has faced considerable sell-side pressure, with over 1.5 million BTC being sold. Check attributes around 30% of this to the Grayscale Bitcoin Trust (GBTC), while the rest is attributed to profit-taking. Despite this substantial selling activity, Bitcoin has only experienced a modest price correction of -20%, pointing to robust support levels that may be stronger than perceived.

One noteworthy aspect of Check’s analysis is the evolving volatility profile of Bitcoin. He notes that Bitcoin’s realized volatility is now half of what it was in 2021 and three times smaller than in 2017. This trend indicates a growing maturity in the Bitcoin Market, transforming it into a more stable asset over time.

Contrary to common beliefs about Bitcoin’s volatility, Check emphasizes that upward volatility is actually positive. He suggests that the current uptick in volatility is moderate and signifies that the Market is still in the early stages of a bull run, rather than approaching its end.

Check relies on the Short-Term Holder MVRV (STH-MVRV) Ratio to assess Market sentiment and trends. He explains that this ratio typically finds support at 1.0 and resistance at 1.4 during stable upward trends. Any breach of these levels could signal instability and a potential shift to bearish conditions.

Despite a recent sell-off that brought Bitcoin down to $57k, Check notes that short-term holders have not been significantly impacted in terms of profitability. He also highlights that panic-selling by some top buyers may have actually stabilized the Market by eliminating weak hands.

In addition, Check disputes criticism regarding Bitcoin’s volatility, showcasing a comparison of Bitcoin’s volatility against top-performing US stocks. He also discusses the lower realized volatility of the SPY index, attributing it to specific factors affecting certain components.

By elucidating the structural elements of the current Market phase, Check offers a nuanced perspective on Bitcoin’s path to maturity as a financial asset. He concludes that the uptrend in 2023-24 appears structured, following a pattern of rally-consolidation-rally. However, increased volatility during consolidation phases could introduce instability.

As of the latest update, Bitcoin is trading at $66,288, illustrating the ongoing Market dynamics analyzed by Check.

Win Up To 93% Of Your Trades With The World’s #1 Most Profitable Trading Indicators

1. What is On-Chain data?

On-Chain data refers to information that is recorded on a blockchain, such as transactions, network activity, and token holdings.

2. How can On-Chain data help with trading?

On-Chain data can provide insights into Market trends, investor behavior, and the overall health of a cryptocurrency project, which can help traders make more informed decisions.

3. Where can I find the latest insights from On-Chain data?

You can find the latest insights from On-Chain data on platforms like TradingView News, which aggregates data from various sources to provide traders with up-to-date information.

4. Is On-Chain data reliable for making trading decisions?

While On-Chain data can be a valuable tool for traders, it is important to consider other factors and conduct thorough analysis before making any trading decisions.

5. How can I stay informed about On-Chain data trends?

You can stay informed about On-Chain data trends by regularly checking TradingView News, following experts in the cryptocurrency space, and staying up-to-date on industry news and developments.

Win Up To 93% Of Your Trades With The World’s #1 Most Profitable Trading Indicators

Win Up To 93% Of Your Trades With The World’s #1 Most Profitable Trading Indicators