Bitcoin network fundamentals are showing strong signs that could potentially lead to a price of $265,000, according to the CEO of CryptoQuant. In a recent interview with TradingView News, the CEO explained how these fundamentals could sustain such a high valuation for the popular cryptocurrency. Stay tuned for more updates on how Bitcoin’s network performance could impact its price in the coming months.

Win Up To 93% Of Your Trades With The World’s #1 Most Profitable Trading Indicators

The CEO of analytics firm CryptoQuant recently highlighted how the Bitcoin network fundamentals could potentially support a Market cap three times larger than its current size.

In a recent post, CryptoQuant founder Ki Young Ju discussed how network fundamentals could give insight into the sustainability of Bitcoin’s Market cap. Bitcoin operates on a proof-of-work mechanism, where miners compete to add blocks to the blockchain by using computing power. These miners incur electricity costs, which they cover by selling their block rewards.

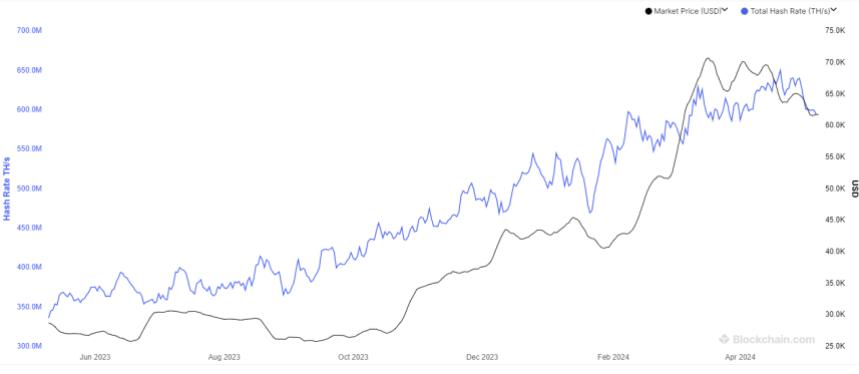

One crucial metric for miners is the Hashrate, which measures the computing power connected to the Bitcoin blockchain. Ju introduced the concept of the Hashrate/Market Cap Ratio, which compares the cryptocurrency’s total valuation against its Hashrate. The CEO shared a chart illustrating the trend of this metric over the years.

Despite Bitcoin’s current price levels similar to those of the 2021 bull run, the Hashrate/Market Cap Ratio remains relatively low. This discrepancy is due to the network’s Hashrate being more than three times higher than before. If the ratio from the previous cycle’s peak indicates where the current cycle will top out, the asset’s Market cap could increase over threefold.

Based on these insights, Ju suggests that the current network fundamentals could potentially support a price of $265,000 for Bitcoin. Currently, Bitcoin is trading at approximately $62,300, showing over a 9% increase in the past week.

Win Up To 93% Of Your Trades With The World’s #1 Most Profitable Trading Indicators

1. What is the Bitcoin network fundamentals?

Bitcoin network fundamentals refer to the underlying metrics and data that reflect the health and strength of the Bitcoin network, such as mining difficulty, hash rate, and network activity.

2. How could Bitcoin network fundamentals sustain a $265,000 price?

According to CryptoQuant CEO, strong network fundamentals like increasing hash rate and active addresses suggest sustained demand and adoption, which could support a higher Bitcoin price like $265,000.

3. What role does the CryptoQuant CEO play in this analysis?

The CryptoQuant CEO provides insights and analysis based on data from the CryptoQuant platform, which tracks various metrics related to the Bitcoin network and Market trends.

4. Why is network activity important for the price of Bitcoin?

Network activity, such as the number of active addresses and transactions, can indicate the level of demand and interest in Bitcoin. Higher network activity often correlates with a higher price.

5. How can investors use knowledge of Bitcoin network fundamentals to make informed decisions?

By staying informed about network fundamentals, investors can better understand the underlying strength of Bitcoin and make more educated decisions about when to buy, sell, or hold their investments.

Win Up To 93% Of Your Trades With The World’s #1 Most Profitable Trading Indicators

Win Up To 93% Of Your Trades With The World’s #1 Most Profitable Trading Indicators