Bitcoin whales, or large-scale investors, are holding onto their BTC, indicating strong confidence in the cryptocurrency. Recent analysis from TradingView shows robust support for Bitcoin above the $60,000 mark. This trend suggests that Bitcoin’s price may remain stable, reflecting positive sentiment among major investors. Stay updated to see how this could impact the broader crypto Market.

Win Up To 93% Of Your Trades With The World’s #1 Most Profitable Trading Indicators

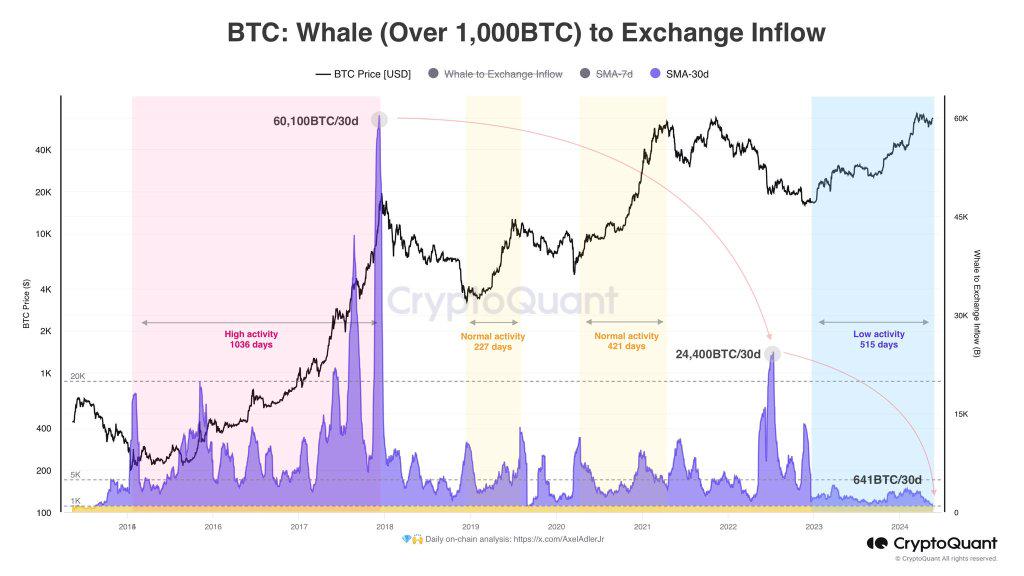

Bitcoin recently surged past the significant benchmark of $67,000 and is steadily approaching the crucial $70,000 psychological threshold. According to an analyst on X, this uptick is notable because whales holding over 1,000 BTC are not moving their coins to exchanges. This indicates that they likely expect Bitcoin prices to spike even higher in the coming days and weeks.

Whales Are Not Selling, More Gains Expected?

Despite a quiet weekend, the substantial price extension earlier today has bullish traders feeling optimistic. Historically, coin holders, including whales, tend to take profits when gains are perceived as shaky. However, this current cycle shows that whales are holding onto their coins, expecting a strong price recovery. The analyst highlighted that the 30-day average of BTC held by whales is 641 BTC, which has sharply decreased from mid-2023.

This observation suggests that whales are bullish and not swayed by short-term price movements. While this doesn’t guarantee a rapid increase, it supports the outlook that Bitcoin prices may rise further in the coming sessions. Accompanying the recent breakout above $66,000, on-chain data shows that the Market Value to Realized Value (MVRV) ratio is also climbing. The MVRV ratio for those who’ve held BTC for 1 to 3 months has risen above the $66,500 mark.

Bitcoin Finds Strong Support Above $60,000

Another analyst highlighted that over 530,000 BTC were traded at a price of $66,250. This point is turning into a reliable support level. If bulls can absorb the selling pressure, the $66,250 line may act as a solid platform for further gains towards an all-time high. The zone above $60,000 is seen as a strong support level, with analysts noting that the Bitcoin Short-Term Holder Cost Basis (STHCB) is rising and now stands at $60,700.

In on-chain analysis, the STHCB is a metric that tracks the average purchase price of BTC by short-term holders, those who bought their coins within the last 180 days. Historically, the STHCB has served as a support level during bull runs and a resistance level during bear markets. Currently, the STHCB sits at $60,700 and is increasing, suggesting a potential floor for Bitcoin prices.

Win Up To 93% Of Your Trades With The World’s #1 Most Profitable Trading Indicators

What does it mean that Bitcoin whales are not selling?

Bitcoin whales are big investors who own a lot of Bitcoin. When they don’t sell, it usually means they believe the price will go higher or stay strong.

Why is Bitcoin’s strong support above $60,000 important?

If Bitcoin stays above $60,000, it means there’s solid backing from buyers. This can make the price more stable and less likely to drop suddenly.

How does TradingView News know Bitcoin whales are not selling?

TradingView News uses data from the blockchain and trading platforms to see if large amounts of Bitcoin are being moved or sold by big investors.

Can Bitcoin’s support level change quickly?

Yes, support levels can change due to Market news, trends, and big trades. However, strong support levels are harder to break through.

What should I do if I want to invest in Bitcoin?

Research well, understand the risks, and consider talking to a financial advisor. It’s important to know that Bitcoin prices can go up and down a lot.

Win Up To 93% Of Your Trades With The World’s #1 Most Profitable Trading Indicators

Win Up To 93% Of Your Trades With The World’s #1 Most Profitable Trading Indicators