Since the approval of Bitcoin ETF in January, both Bitcoin and Ethereum have seen fluctuating performances in the crypto Market. Let’s delve into how these two major cryptocurrencies have fared post the ETF approval and what the future holds for them.

Win Up To 93% Of Your Trades With The World’s #1 Most Profitable Trading Indicators

Ethereum has been lagging behind Bitcoin in terms of capital inflows since January, according to a recent report by Glassnode. The long-term holders of Ethereum are patiently waiting for a new all-time high, while Bitcoin continues to attract significant investment.

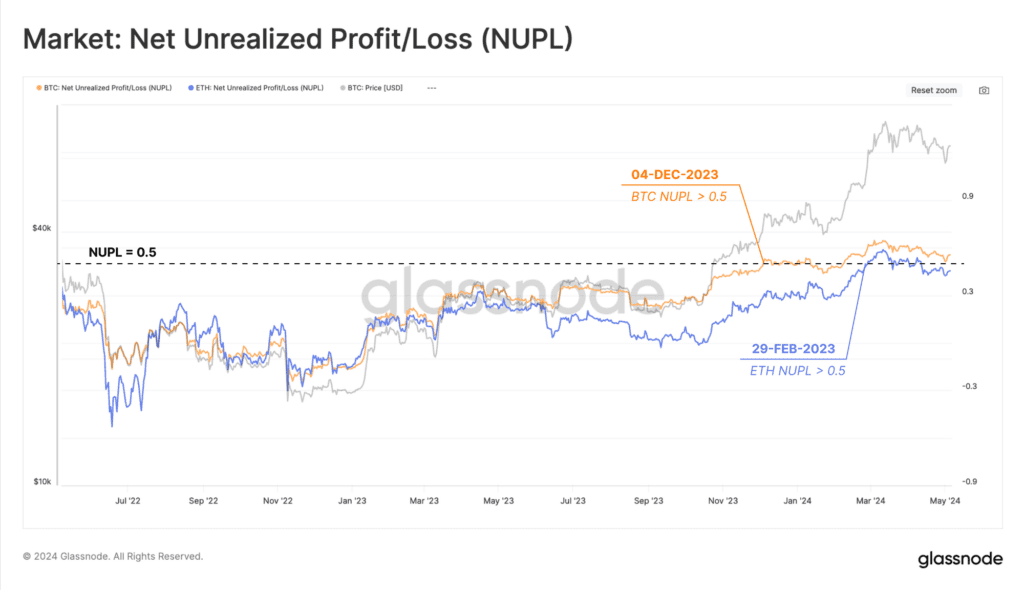

The approval of spot Bitcoin ETFs in January led to a noticeable difference in Net Unrealized Profit/Loss (NUPL) between Bitcoin and Ethereum, as highlighted by Glassnode. This indicates that Bitcoin investors have been reaping more profits compared to Ethereum investors in recent months.

The NUPL metric measures whether holders of an asset are experiencing unrealized gains or losses based on the average purchase price and current Market price. Glassnode noted that Bitcoin’s NUPL crossed the threshold of 0.5, signaling a greater unrealized profit than Ethereum.

Despite the hype surrounding Bitcoin ETFs, Ethereum has not seen a substantial increase in capital inflows. Glassnode’s assessment of Short-Term Holders’ Realized Cap reveals low activity among Ethereum’s short-term investors, impacting the coin’s price performance.

The underperformance of Ethereum relative to Bitcoin can be attributed to the lack of attention and access brought about by Bitcoin ETFs. The Market is eagerly awaiting the SEC’s decision on approving a suite of Ethereum ETFs, expected later in May.

As a result of the contrasting performance of Bitcoin and Ethereum, long-term holders have adopted different strategies. Bitcoin holders have been selling off some of their holdings to lock in profits, while Ethereum holders are still waiting for more lucrative opportunities to cash out.

In conclusion, the disparity between Bitcoin and Ethereum’s performance is evident in the behavior of investors and the level of capital inflows. While Bitcoin continues to attract significant attention, Ethereum’s long-term holders remain hopeful for better profit-taking opportunities in the future.

Win Up To 93% Of Your Trades With The World’s #1 Most Profitable Trading Indicators

1. What is Bitcoin and Ethereum?

Bitcoin and Ethereum are two popular cryptocurrencies that can be used for digital transactions and decentralized applications.

2. How have Bitcoin and Ethereum fared since January’s ETF approval?

Both Bitcoin and Ethereum have experienced growth in value since the approval of the first Bitcoin ETF in January.

3. Can I invest in Bitcoin and Ethereum?

Yes, you can invest in Bitcoin and Ethereum by purchasing them through a cryptocurrency exchange or trading platform.

4. What factors influence the value of Bitcoin and Ethereum?

The value of Bitcoin and Ethereum can be influenced by factors such as Market demand, regulation, technological developments, and overall Market trends.

5. Which is a better investment, Bitcoin or Ethereum?

The decision to invest in either Bitcoin or Ethereum depends on your personal investment goals and risk tolerance. It’s always recommended to do thorough research before making any investment decisions.

Win Up To 93% Of Your Trades With The World’s #1 Most Profitable Trading Indicators

Win Up To 93% Of Your Trades With The World’s #1 Most Profitable Trading Indicators