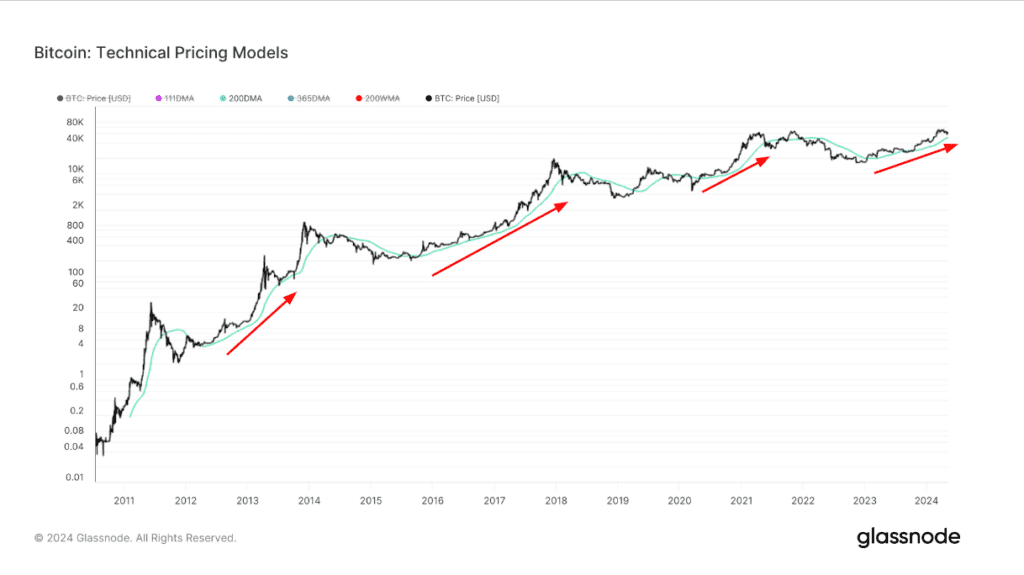

Bitcoin has reached a significant milestone as its 200-day moving average has surpassed $50,000 for the first time. This marks a significant breakthrough for the popular cryptocurrency, signaling a potential uptrend in its value. Investors and traders are closely monitoring this development as Bitcoin continues to make headlines in the financial world.

Win Up To 93% Of Your Trades With The World’s #1 Most Profitable Trading Indicators

Bitcoin has been moving between $60,000 and $70,000 since late February, reaching an all-time high of $73,600. However, it briefly fell below $60,000 at the start of May. The 200-day moving average recently crossed the $50,000 mark for the first time on May 6, with Bitcoin now around $61,000. This milestone is crucial as the 200DMA is a key indicator of Market cycles.

In May 2021, Bitcoin dropped below the 200DMA, starting a bear Market. However, by January 2023, it reclaimed this level, kicking off the current bull run. While there was a brief dip below the 200DMA in October 2023, it has since acted as strong support. Historically, holding above the 200DMA has been bullish, while breaking below it signaled bearish momentum.

The short-term holder’s realized price is close to breaking $60,000, indicating potential price movement. It’s important for Bitcoin to stay above $50,443 to continue the upward trend. Stay tuned for more updates on Bitcoin’s price movements and Market trends.

Win Up To 93% Of Your Trades With The World’s #1 Most Profitable Trading Indicators

1. What does it mean when Bitcoin’s 200-day moving average breaks $50,000?

– It means the average price of Bitcoin over the past 200 days has surpassed $50,000 for the first time.

2. Why is it significant that the 200-day moving average of Bitcoin has crossed $50,000?

– Crossing the $50,000 mark shows a strong upward trend in Bitcoin’s price over the long term.

3. Does this milestone indicate a positive outlook for Bitcoin’s future price?

– It suggests that there is growing confidence in Bitcoin’s value and potential for even higher prices in the future.

4. How does the 200-day moving average affect Bitcoin trading strategies?

– Traders often use the 200-day moving average as a key indicator for making decisions on when to buy or sell Bitcoin.

5. What factors could cause the 200-day moving average to drop below $50,000 again?

– Market volatility, regulatory changes, or shifts in investor sentiment could all potentially cause the 200-day moving average to dip below $50,000.

Win Up To 93% Of Your Trades With The World’s #1 Most Profitable Trading Indicators

Win Up To 93% Of Your Trades With The World’s #1 Most Profitable Trading Indicators