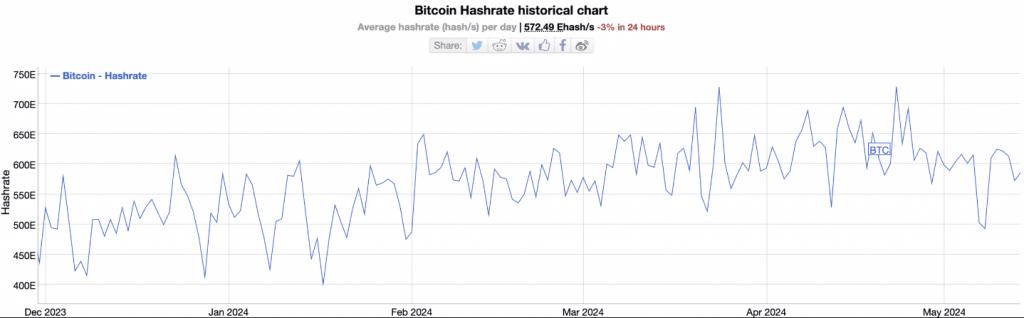

The network hashrate has experienced a significant drop of 20%, causing concern among traders and investors. This sudden decrease in computational power could have far-reaching implications for the cryptocurrency Market. Stay tuned for updates on how this development may impact Market trends.

Win Up To 93% Of Your Trades With The World’s #1 Most Profitable Trading Indicators

The world of Bitcoin after the halving event has been full of surprises. Recently, there has been a 20% drop in Bitcoin’s computational power, known as hashrate, sparking debates among experts.

Some analysts believe that this decline may indicate a “miner capitulation,” where less efficient miners are shutting down their operations due to reduced profits post-halving. This has led to a decrease in hashrate, impacting the overall mining activity.

One of the technical indicators supporting this theory is Hash Ribbons, which tracks the difference between short-term and long-term hashrate averages. The recent plunge in hashrate has raised concerns of miner capitulation, historically linked to price lows for Bitcoin.

Another concerning factor is the decrease in Bitcoin’s Miner Reserve, indicating that miners may be selling off their coins. However, some experts see this as a buying opportunity, citing the Market Value to Realized Value ratio, suggesting Bitcoin might be undervalued.

Despite these indicators, not all analysts are convinced of a mass miner exodus. Some attribute the hashrate decline to temporary factors like extreme weather disruptions. The post-halving period is typically a time of adjustment for miners, and short-term fluctuations may not necessarily signal a long-term trend.

In conclusion, the situation in the post-halving Bitcoin landscape is still evolving. While some see potential buying opportunities, particularly for long-term investors, others remain cautious. The future of Bitcoin’s hashrate and mining activity is uncertain, making it important for investors to stay informed and adapt to the changing Market conditions.

Win Up To 93% Of Your Trades With The World’s #1 Most Profitable Trading Indicators

1. What is network hashrate?

Network hashrate is the measuring unit of the processing power of a cryptocurrency network.

2. Why did the network hashrate take a 20% dive?

The network hashrate took a 20% dive due to a decrease in the number of miners participating in verifying transactions on the network.

3. What does a decrease in network hashrate mean for cryptocurrency traders?

A decrease in network hashrate can lead to slower transaction times and higher fees for cryptocurrency traders.

4. Will the network hashrate recover after a 20% dive?

It is possible for the network hashrate to recover after a 20% dive as miners may return to the network once the profitability of mining increases.

5. How can cryptocurrency miners help stabilize the network hashrate?

Cryptocurrency miners can help stabilize the network hashrate by increasing their mining efforts and investing in more efficient mining equipment.

Win Up To 93% Of Your Trades With The World’s #1 Most Profitable Trading Indicators

Win Up To 93% Of Your Trades With The World’s #1 Most Profitable Trading Indicators