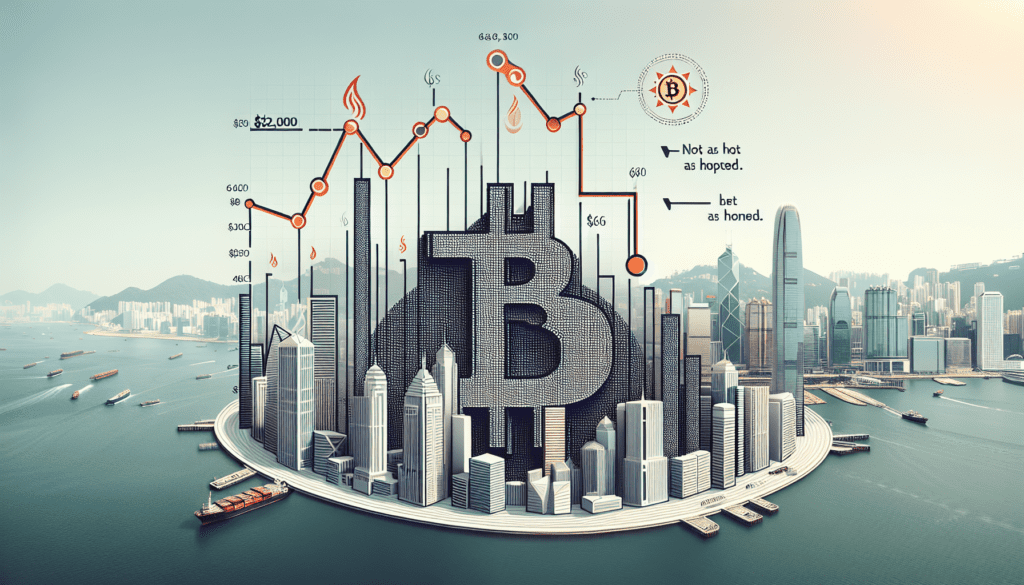

In a surprising turn of events, Bitcoin’s value took a notable dive, plummeting to $62,000. This unexpected fall comes in the wake of Hong Kong’s recently launched ETFs (Exchange-Traded Funds) not living up to the high expectations set by investors and cryptocurrency enthusiasts. The Market‘s reaction underscores the volatile nature of digital currencies and raises questions about the future stability of Bitcoin’s valuation. As the crypto community grapples with these developments, all eyes are now on how this will shape the landscape of cryptocurrency investment in the coming days.

Win Up To 93% Of Your Trades With The World’s #1 Most Profitable Trading Indicators

In a significant development within the cryptocurrency industry, CoinDesk, a leading media outlet known for its thorough coverage and detailed analysis of the crypto world, has recently announced a major update. With a reputation for adhering to strict editorial policies, CoinDesk has always been at the forefront of providing the latest news and insights in the cryptocurrency sector. This update comes amid news that CoinDesk was acquired by the Bullish group, a move that is set to bring about exciting changes.

Bullish, a regulated digital assets exchange, is now the proud owner of CoinDesk. This acquisition by the Bullish group, which is majority-owned by Block.one, signifies a new chapter for CoinDesk. Block.one, alongside Bullish, holds a significant presence in the blockchain and digital asset arena, with substantial investments and contributions to the industry, including considerable holdings in Bitcoin.

The transition of CoinDesk into the arms of the Bullish group marks an interesting development for both entities. CoinDesk, renowned for its award-winning journalism, including its explosive coverage which has won it top journalism prizes, maintains its commitment to high-quality, unbiased reporting on the cryptocurrency industry. It’s vital to note that even with this acquisition, CoinDesk will continue to operate as an independent subsidiary. This strategic move ensures that its editorial independence is safeguarded, allowing it to continue its legacy of trustworthy reporting. Furthermore, CoinDesk employees, including its journalists, stand to benefit from this acquisition as they may receive options in the Bullish group as part of their compensation package.

Privacy and policy updates have also been made in light of these changes. CoinDesk and the Bullish group are dedicated to maintaining transparency and user trust, updating their privacy policy, terms of use, cookies policy, and reinforcing their commitment to not selling personal information.

This acquisition is not just a testament to CoinDesk’s value and influence in the cryptocurrency news space but also highlights the growing importance of credible information sources in an often volatile and rapidly evolving industry. As the crypto world continues to expand, the role of dedicated media outlets like CoinDesk, backed by strong, knowledgeable players like the Bullish group and Block.one, becomes increasingly vital.

For crypto enthusiasts, investors, and technology followers, this development promises enhanced coverage and insightful analysis in the digital assets and blockchain sectors. As these technologies forge the path towards the future of finance, being well-informed through reliable sources like CoinDesk will be key to navigating the crypto landscape successfully.

Win Up To 93% Of Your Trades With The World’s #1 Most Profitable Trading Indicators

1. **Why did Bitcoin fall to $62,000?**

Bitcoin’s price dropped to $62,000 because the new ETFs (Exchange-Traded Funds) introduced in Hong Kong didn’t do as well as people hoped they would. This made some investors lose confidence and sell their Bitcoin.

2. **What are ETFs, and why are they important for Bitcoin?**

ETFs are investment funds that are traded on stock exchanges, just like stocks. They are important for Bitcoin because they provide a way for more people to invest in Bitcoin through a traditional financial system. When ETFs do well, they can attract more investors to Bitcoin, potentially raising its price.

3. **Did the Hong Kong ETFs directly cause the price of Bitcoin to drop?**

Not directly. The underperformance of the Hong Kong ETFs likely led to decreased investor enthusiasm for Bitcoin, contributing to the price drop. It’s more about investor sentiment than a direct financial link between the ETFs and Bitcoin’s price.

4. **Can the price of Bitcoin bounce back after such a drop?**

Yes, Bitcoin’s price has a history of volatility, which means it can experience significant drops and then recover. Price changes can happen because of various factors, including changes in investor sentiment, Market trends, or global economic events.

5. **What should investors do in such situations?**

Each investor’s situation is unique, so it’s hard to give a one-size-fits-all answer. Generally, it’s important to stay informed, consider long-term investment strategies, and not make hasty decisions based on temporary Market movements. Consulting with a financial advisor is also a good idea if you’re unsure.

Win Up To 93% Of Your Trades With The World’s #1 Most Profitable Trading Indicators

Win Up To 93% Of Your Trades With The World’s #1 Most Profitable Trading Indicators