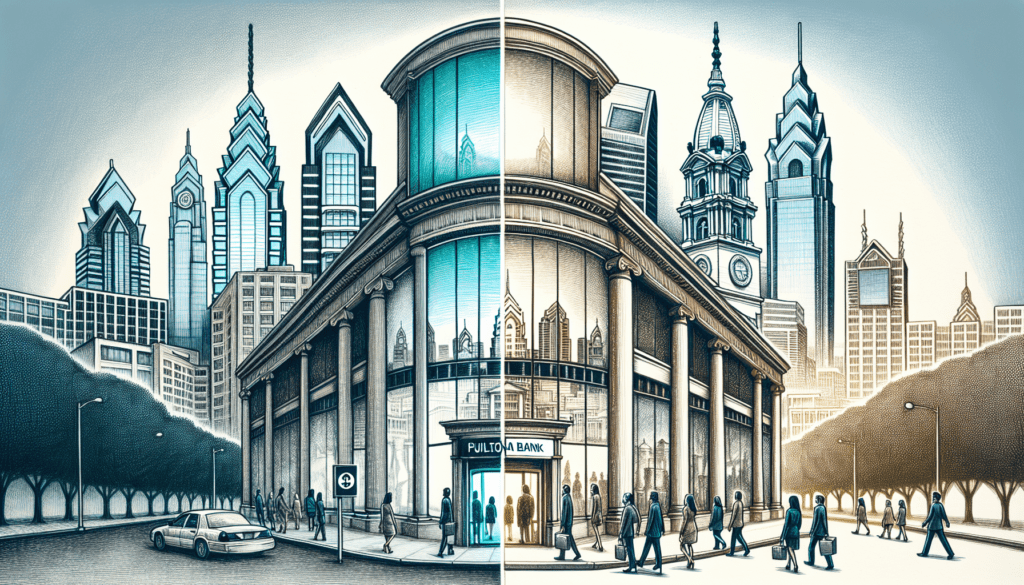

In a significant move, Philadelphia’s Republic First Bank has been officially shut down by regulators. This unexpected closure marks the end of the road for the local bank. However, there’s a silver lining for its customers as the bank is set to make a comeback, but this time as part of Fulton Bank. The transition promises a fresh start for both the bank’s clientele and employees, aiming to offer a seamless banking experience. Stay tuned for more details on how this change will affect your banking services.

In a significant move that caught the attention of the banking industry, Philadelphia-based Republic First Bank, also known as Republic Bank, faced closure by regulators. This action by the Federal Deposit Insurance Corp. (FDIC) has put the spotlight on the bank, which had been a notable entity serving areas in Pennsylvania, New Jersey, and New York. Before its closure, Republic Bank boasted assets of around $6 billion and had managed deposits worth approximately $4 billion as of the end of January.

The banking landscape saw a swift change with Lancaster, Pennsylvania’s Fulton Bank stepping in to take over. Fulton Bank has agreed to assume almost all of Republic Bank’s deposits and purchase the majority of its assets. This strategic move ensures minimal disruption for customers, with Republic Bank’s 32 branches set to reopen under the Fulton Bank name. Customers were assured access to their funds, through checks or ATMs, indicating a seamless transition managed by the FDIC.

This closure is not just a singular event but part of a nuanced narrative affecting regional and community banks in the current financial climate. The backdrop of rising interest rates and the dip in commercial real estate values, particularly post-pandemic, have introduced significant challenges. Many regional lenders are navigating these turbulent waters, trying to manage loans against depreciated property values, making refinancing a complex task.

Republic Bank’s situation is a manifestation of broader industry trends, with the bank becoming the first FDIC-insured institution to fail this year. The incident echoes the challenges faced by smaller banks, highlighting the precarious balance between growth, risk management, and economic fluctuations.

The closure of Republic First Bank underscores a critical moment for the banking sector, reflecting on the health of regional banking institutions and the importance of financial stability in uncertain times. As the industry watches how Fulton Bank integrates this new acquisition, the event marks a significant turning point, raising discussions on the future of banking, regulatory measures, and the resilience of financial institutions in adapting to evolving economic landscapes.

1. Why did Republic First Bank close?

Republic First Bank was closed by regulators because of issues with its financial stability. This is a process banks undergo when they aren’t able to keep up with their financial obligations.

2. What happens to my account at Republic First Bank now?

Don’t worry, your account will automatically move over to Fulton Bank. You’ll still be able to access your money, and it’ll be business as usual just under a new bank name.

3. Can I still use my Republic First Bank checks and cards?

Yes, for a while, you can still use your checks and ATM/debit cards like you normally would. Fulton Bank will let you know when it’s time to switch to their checks and cards.

4. Is my money safe?

Absolutely. Your deposits are still insured by the FDIC up to the legal limit. This means your money is protected just like before, now under the roof of Fulton Bank.

5. How do I access online banking now?

You should be able to use your existing online login details to access your account through Fulton Bank’s website. If there are any changes or updates needed, Fulton Bank will guide you through the process to make sure you have uninterrupted access to online banking.