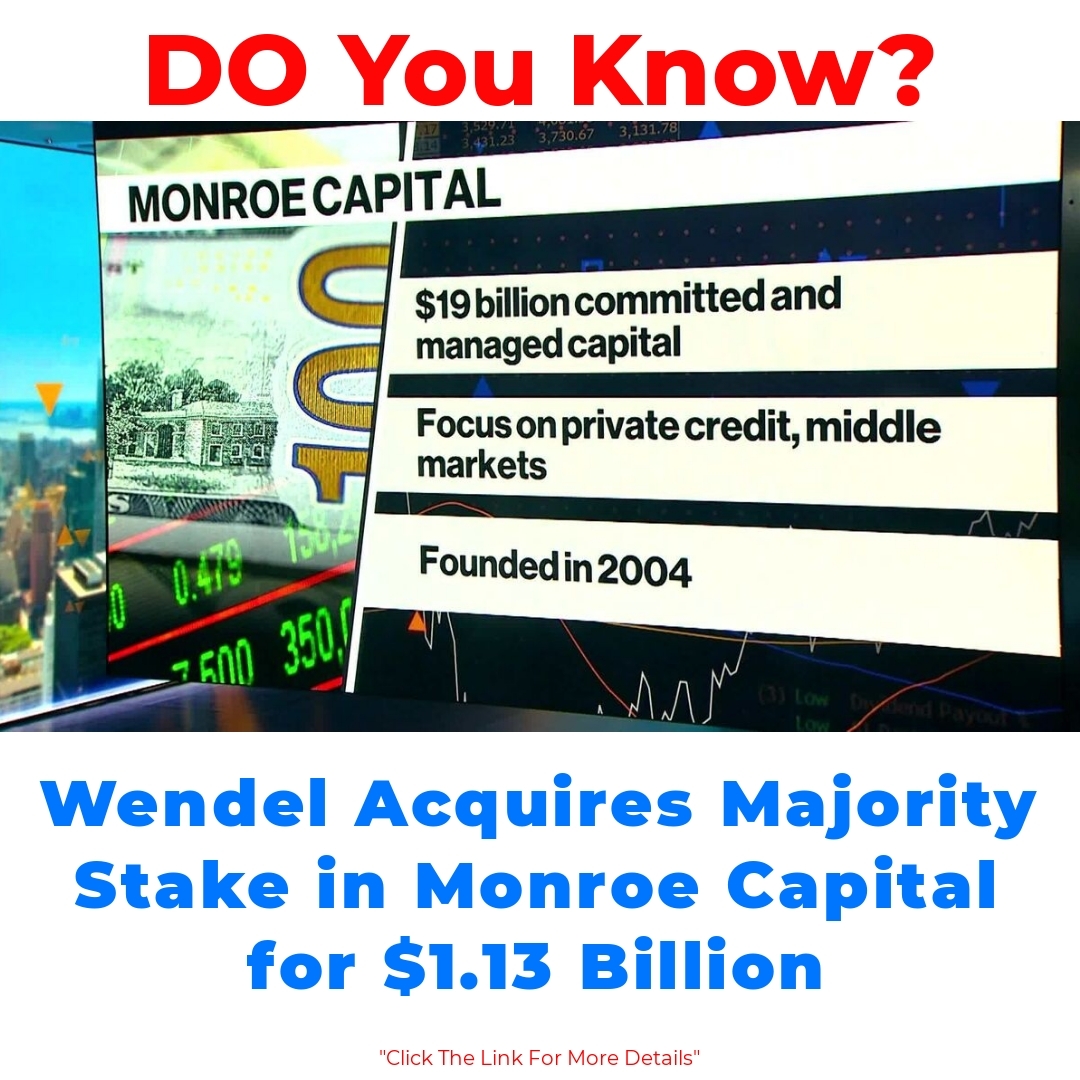

The recent Wendel investment acquisition of Monroe Capital for $1.13 billion marks a significant development in the financial landscape. This strategic move highlights Wendel’s commitment to expanding its reach into the private credit sector, underscoring the increasing importance of private lending in today’s investment strategies.

Understanding Wendel: An Investment Firm on the Move

Wendel is a well-established investment firm that has made significant strides over the years. Founded in France in the early 18th century, Wendel has grown from a timber business into a global investment powerhouse. The firm’s history is rich, and it has developed a reputation for targeting dynamic companies across various sectors.

Over the years, Wendel has engaged in several successful acquisitions. Their unique investment strategy typically focuses on long-term value creation and partnering with management teams of the companies they invest in. This approach has helped them secure a solid position within the investment community, and now their recent acquisition of Monroe Capital further solidifies that position.

Inside the Deal: Wendel’s Majority Stake in Monroe Capital

The recent acquisition of Monroe Capital marks a pivotal moment for Wendel, as they secured a majority stake for a whopping $1.13 billion. This deal is significant not just for its size, but for its implications in the private credit space. By taking a controlling interest, Wendel is poised to leverage Monroe Capital’s expertise in private lending.

According to Ted Koenig, the Chairman and CEO of Monroe Capital, this acquisition brings together two companies with complementary strengths. In a discussion on Bloomberg Markets, Koenig emphasized how this partnership is strategically aligned, aiming to enhance service offerings and expand their portfolio. He noted, “This collaboration will allow us to deliver even greater value to our clients and investors.”

The Rise of Private Credit: What Does It Mean for Investors?

Private credit has been gaining traction over the past few years, and for a good reason. As traditional lending avenues became more restrictive post-financial crisis, investors started to look for alternative sources of capital. The private credit market, which enables companies to borrow directly from non-bank lenders, has seen significant growth and offers exciting opportunities for investors.

Wendel’s strategy to dive into the private lending sector by acquiring Monroe Capital is significant. It positions the firm to not only benefit from current trends but also adapt to the evolving landscape of investment. With experts predicting a continued rise in private credit demand, Wendel is well-placed to capitalize on this growing market.

Implications of the Wendel Acquisition: Broader Impact on Investment Strategies

The implications of the Wendel investment acquisition extend well beyond just their balance sheet. The acquisition enhances Wendel’s investment approach, integrating private credit into their broader strategy. This shift signifies a move towards diversifying their assets and enhancing potential returns for investors.

As private credit continues to reshape dynamics in the lending industry, Wendel’s entry into this space could signal a shift in how investment strategies are formulated. Experts anticipate that private lending will attract more institutional attention. Hence, other firms may follow Wendel’s lead, rethinking how they approach capital allocation and risk management.

Conclusion

In summary, the Wendel investment acquisition of Monroe Capital for $1.13 billion is not just another financial deal; it represents a major leap into the private credit sector. This move positions Wendel to take advantage of the growing demand for private lending and diversify their investment portfolio.

As we look to the future, it’s clear that the landscape of private credit is changing, and with this acquisition, Wendel is set to play a significant role in shaping those changes. For investors and financial analysts alike, this acquisition serves as a key indicator of trends moving forward in the private lending and investment strategies space.

Call to Action

Stay informed about financial deals like the Wendel investment acquisition and keep an eye on emerging investment trends. For ongoing insights, resources such as Bloomberg Markets provide valuable updates on the private credit landscape and expert opinions to help you navigate this evolving sector. Don’t miss out—connect with reliable financial news outlets and deepen your understanding of how these developments may affect your investment strategies.

FAQ Section

What is Wendel?

Wendel is an established investment firm originally founded in France in the early 18th century. The company has evolved from a timber business to a global investment powerhouse, focusing on dynamic companies across various sectors.

What recent acquisition did Wendel make?

Wendel recently acquired a majority stake in Monroe Capital for $1.13 billion. This move marks a significant step for Wendel in the private credit space.

Why is the acquisition of Monroe Capital important?

The acquisition is important because it allows Wendel to strengthen its position in private lending. Monroe Capital has expertise in this field, and the partnership aims to enhance service offerings while expanding their portfolio.

What is private credit?

Private credit refers to loans or loans-like investments made by non-bank entities, providing companies with alternative sources of capital outside traditional lending avenues.

How does Wendel’s acquisition impact investment strategies?

The acquisition signifies a shift in Wendel’s investment approach, integrating private credit into their overall strategy. It could change how other investment firms think about capital allocation and risk management as private lending gains institutional attention.

What should investors watch for following this acquisition?

- The growth of private credit demand and its implications for investment portfolios.

- Changes in investment strategies among firms influenced by Wendel’s approach.

- Emerging trends in the private lending landscape.

Where can I find more information on investment trends?

For ongoing updates and insights, reliable financial news outlets like Bloomberg Markets provide valuable resources on the evolving private credit landscape and expert opinions that can help inform your investment strategies.