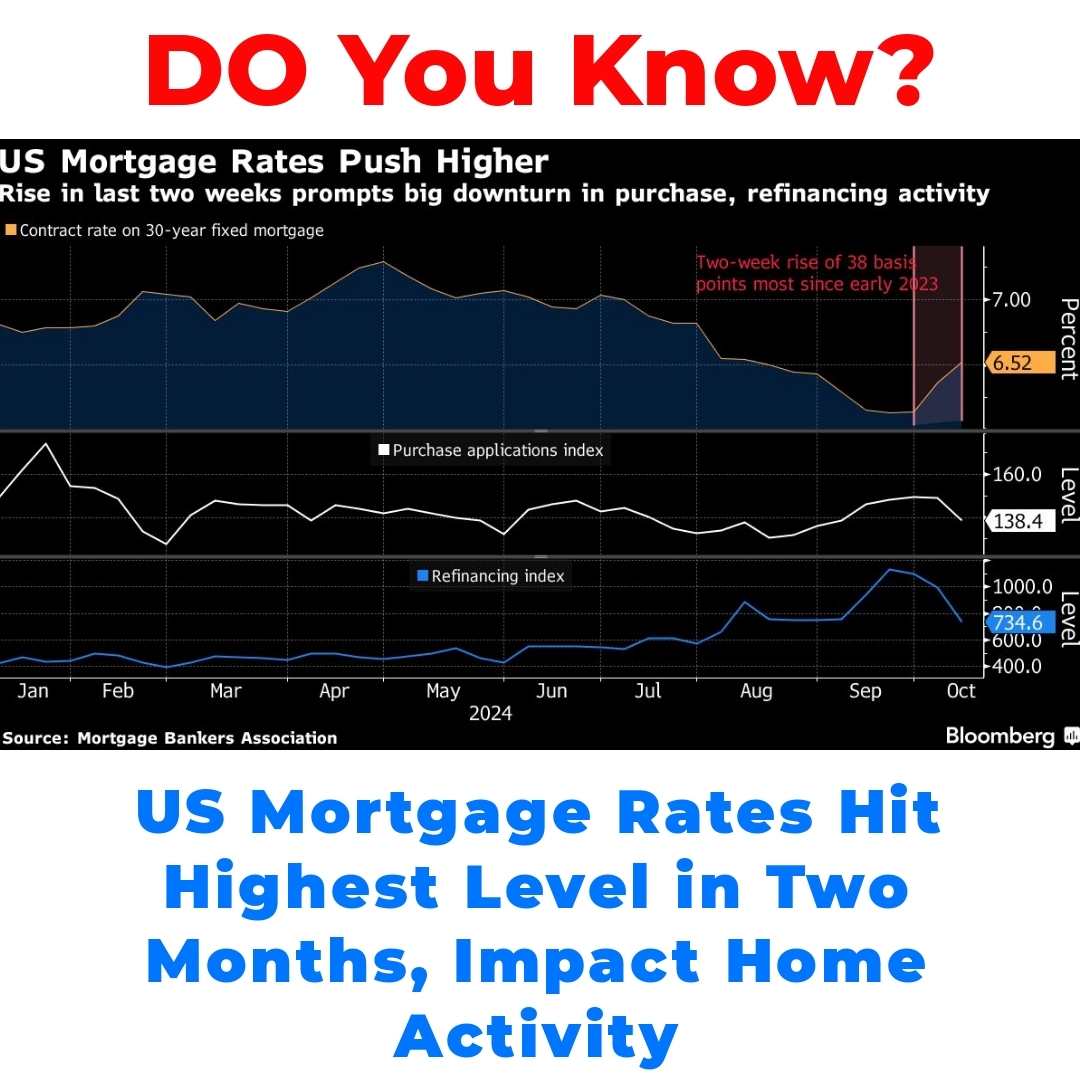

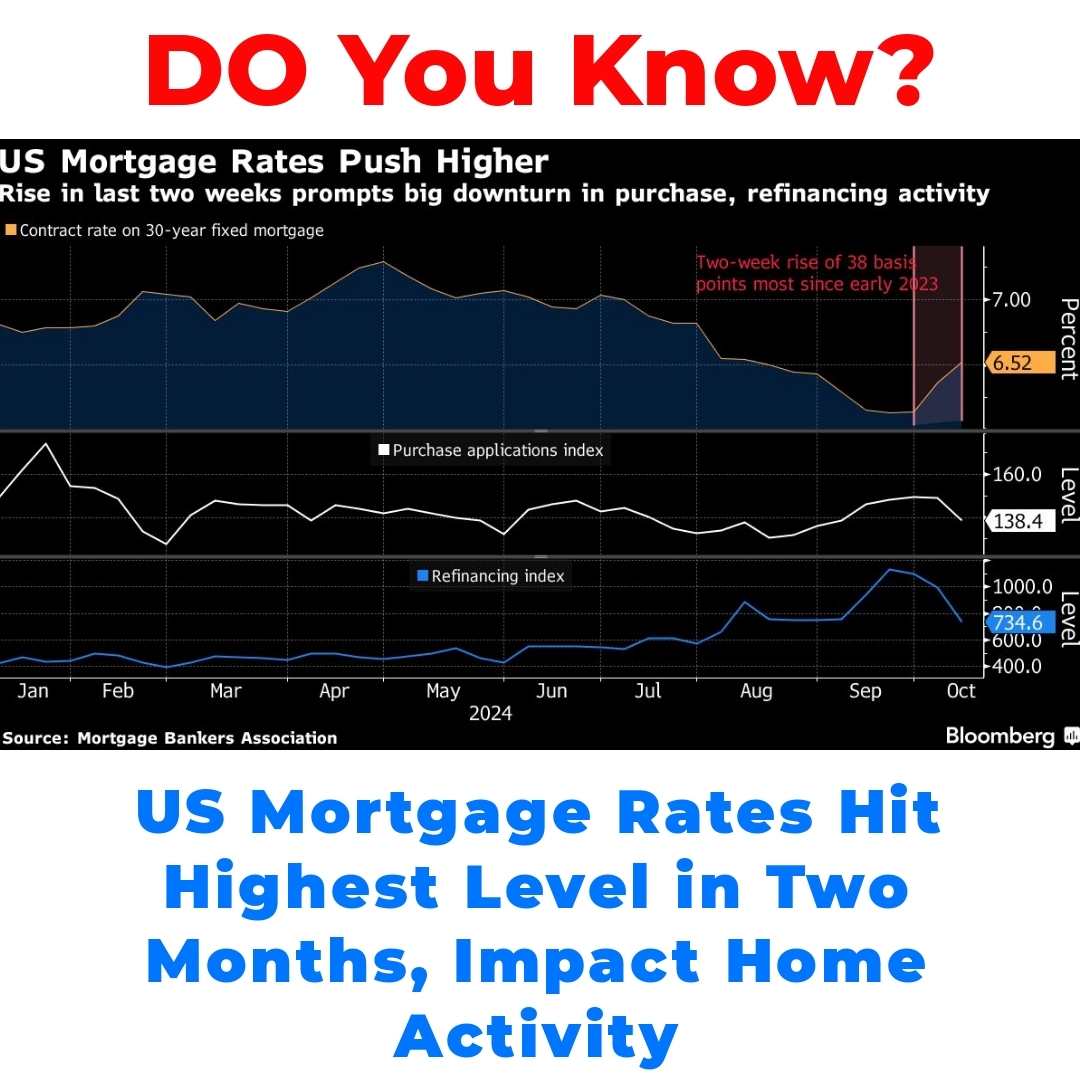

In recent weeks, the US mortgage rates have seen a significant increase, reaching heights not experienced since early August. This sharp upward trend in rates, now occurring for the second consecutive week, has substantial implications for both home-purchase and refinance activity. Understanding the impact of these rising US mortgage rates is crucial for buyers and homeowners alike.

Overview of Current Mortgage Rate Trends

The current state of US mortgage rates is shaping up to be quite significant. As of now, mortgage rates are hovering at levels that haven’t been seen in months. In fact, when we look at the historical context, we can see that the overall trend in interest rates has been rising. This uptick in lending rates is impacting not just the availability of loans but also the broader housing market.

– Average mortgage rates are climbing, which places a heavier financial burden on buyers.

– Housing market trends are shifting as buyers adjust to these changes.

As we navigate through these trends, it’s crucial to keep an eye on how rising rates are guiding home-purchase activity across the nation.

Reasons Behind Rising Mortgage Rates in the US

There are several key reasons behind the increasing US mortgage rates. First and foremost, economic indicators such as inflation and employment rates play a major role. When inflation is high, lenders often raise their rates to manage risk.

Additionally, Federal Reserve policies are also a big factor. The Fed has been adjusting interest rates to combat inflation, which directly influences lending rates. Furthermore, global economic influences—such as geopolitical events or shifts in foreign markets—can also impact mortgage rates.

In summary, the reasons behind rising mortgage rates in the US are interconnected and multi-faceted, making it essential for potential buyers and homeowners to stay informed.

Impact of Mortgage Rates on Home Purchases

With the rise in US mortgage rates, home-purchase activity is feeling the squeeze. Higher rates typically lead to decreased buyer affordability, meaning that many potential homeowners could find it challenging to enter the market. When mortgage rates rise, monthly payments increase, which can lead to a significant change in buyer sentiment.

– Buyers may delay their home-buying plans, waiting for rates to stabilize.

– There’s also a noticeable shift in buyer demographics; first-time buyers may be especially affected.

As mortgage rates continue to climb, it’s vital for those interested in purchasing homes to understand how these changes affect their ability to buy.

Effects of High Mortgage Rates on Refinancing

High mortgage rates don’t just impact home purchases; they also play a crucial role in refinancing activity. With rates on the rise, we are seeing a marked decrease in refinancing applications. Homeowners who might have considered refinancing to secure a lower rate are now hesitant, opting to stay with their current loans.

– Current trends indicate that refinancing activity has slowed considerably compared to previous periods.

– For many, the cost of moving to a new loan is simply not worth it given the higher rates.

Looking at these effects of high mortgage rates on refinancing, it becomes clear that homeowners need to carefully evaluate their options.

Predictions for Future Mortgage Rate Trends

As we move forward, predictions for future US mortgage rates suggest a continued upward trend, at least in the near term. Experts believe that if inflation remains a concern, the Federal Reserve may tighten its policies further, leading to even higher rates.

Market analysts are anticipating that this environment will continue to shape home-purchase and refinance activity. It’s important for buyers and homeowners to keep their ears to the ground on this front, as those who are prepared will be better positioned to take advantage of potential opportunities.

Conclusion

In conclusion, understanding US mortgage rates is essential, especially in the context of the current housing market. With rising rates influencing both home-purchase and refinance activity, potential buyers and homeowners face unique challenges and opportunities.

By staying informed and consulting with mortgage lenders, individuals can navigate this complex landscape more effectively.

Call to Action

We encourage you to stay updated on the latest mortgage rates and market trends. Whether you’re looking to purchase your first home or considering refinancing, talking to a mortgage lender can provide you with personalized options and valuable insights.

Don’t wait—being proactive is key in this ever-changing market!

FAQ

What are the current trends in mortgage rates in the US?

Currently, mortgage rates are rising and are at levels not seen in months. This increase is significantly impacting both the availability of loans and the broader housing market.

How do rising mortgage rates affect home buyers?

As mortgage rates climb, buyers face a heavier financial burden. Higher rates lead to increased monthly payments, reducing affordability and potentially delaying home purchases.

What factors are contributing to the rise in mortgage rates?

- Economic indicators like inflation and employment rates.

- Federal Reserve policies aimed at combating inflation.

- Global economic influences, including geopolitical events.

How are high mortgage rates impacting refinancing?

High mortgage rates are causing a decrease in refinancing applications. Many homeowners are hesitant to refinance due to the costs associated with moving to a new loan at a higher rate.

What predictions are experts making about future mortgage rate trends?

Experts predict that mortgage rates will continue to rise in the near term, especially if inflation remains a concern and the Federal Reserve tightens its policies further.

What should potential buyers and homeowners do in light of rising mortgage rates?

It’s essential to stay informed and consult with mortgage lenders to understand personalized options and navigate the changing market effectively.