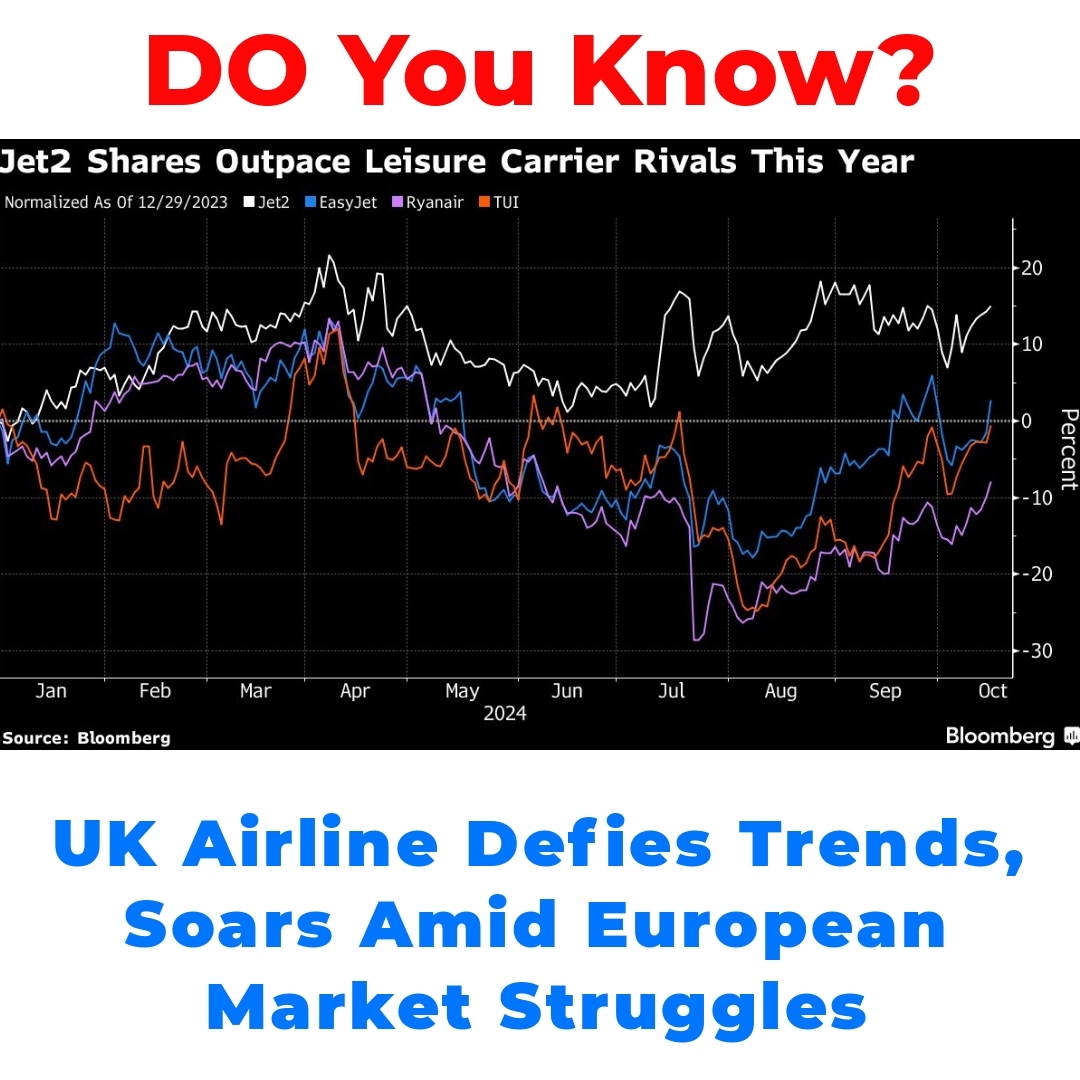

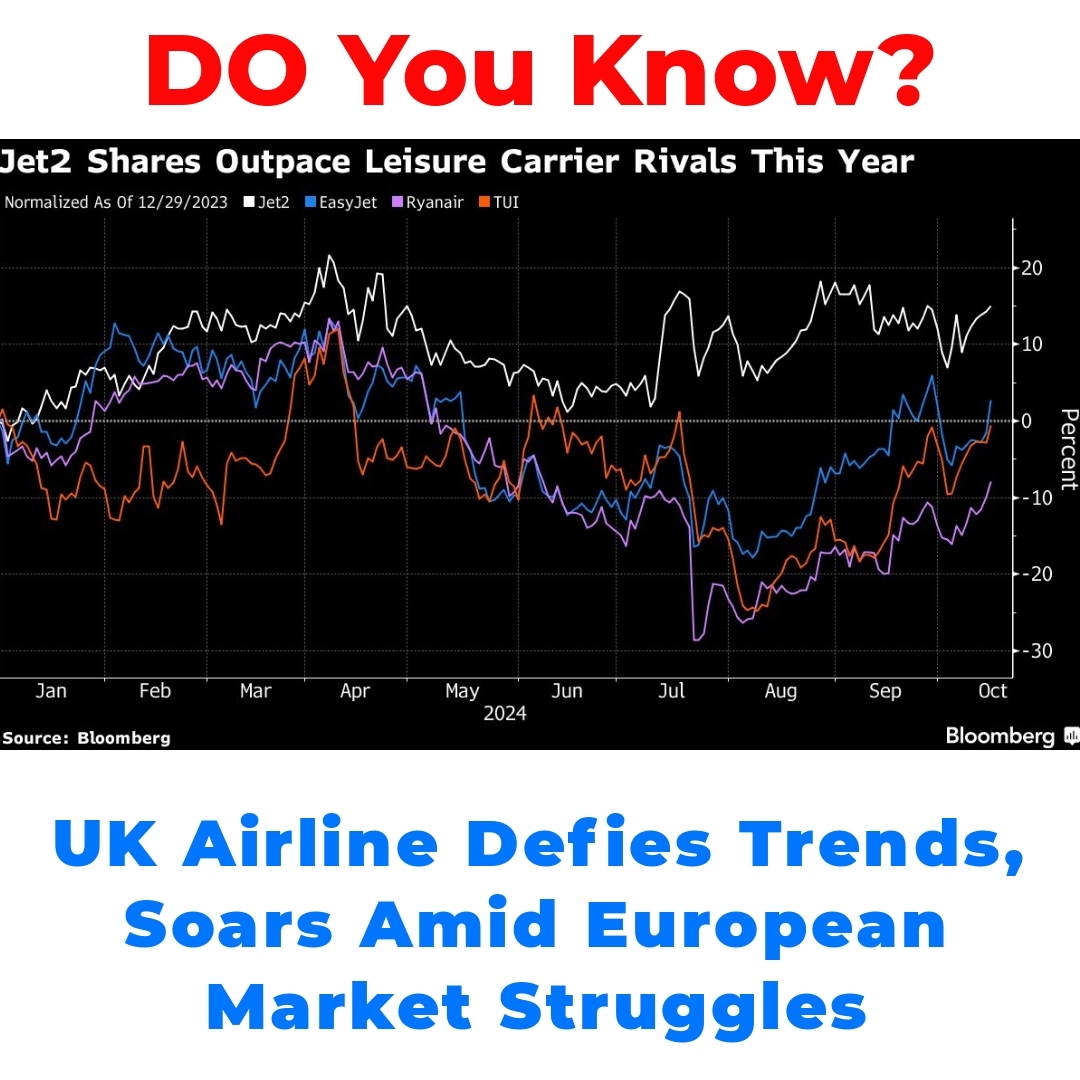

The current landscape of European airline stocks reveals significant volatility, with many carriers struggling amidst global economic pressures. However, one UK carrier has emerged as a resilient player, significantly outperforming its rivals. This analysis aims to explore airline market trends and the stock performance of this standout UK airline.

Overview of European Airline Stocks

The current performance of European airline stocks reflects a turbulent landscape. Many carriers are grappling with significant challenges, which has resulted in a noticeable decline in stock values. Factors such as ongoing global economic turmoil, fluctuating fuel prices, and shifting consumer behavior are all affecting the airline industry. In 2023, the overall airline industry performance has been less than stellar, proving that airlines are still facing hurdles as they work towards recovery.

Many of the European airlines have reported disappointing financial results and lowered expectations for future growth. Investors are understandably cautious, especially as the aviation sector grapples with rising costs and unpredictable travel demand. Despite these challenges, it’s essential to look beyond the general trend and focus on specific players in the market, specifically the UK carrier that seems to be defying the odds.

Spotlight on the UK Carrier

Among the many European airlines, one UK carrier stands out for its robust performance. This airline has managed to outperform its rivals in terms of financial results and stock performance. Recent reports highlight impressive earnings and a steady rise in stock prices, which is a stark contrast to the struggles faced by other carriers in the region.

When compared to its European counterparts, this UK carrier has adopted a more resilient approach, allowing it to thrive even as others falter. That said, it’s crucial to examine what strategies have contributed to this success, especially in a climate where many airlines are still trying to regain their footing.

Analysis of European Airline Stock Trends

In 2023, we’ve observed various trends within the airline sector. For instance, there’s been a visible push for recovery following the massive disruptions caused by the pandemic. Airlines are implementing cost-cutting measures, redefining routes, and enhancing customer experiences in an effort to attract travelers back to the skies.

The investor sentiment towards European airline stocks has shifted, particularly as focus turns towards sustainability and profitability. Many are keenly watching the evolution of airline market trends, hoping that these adaptations will lead to a more stable future for the sector.

The Performance of a UK Airline Amidst Market Downturn

Let’s dive deeper into how the UK carrier is navigating the challenges presented by the tumultuous market environment. This airline has leveraged innovative strategies aimed at boosting resilience. For example, by expanding its route network and enhancing operational efficiency, the UK carrier has not only increased its market share but also fortified its brand reputation.

Analysts have also shared positive insights about this UK carrier. They believe that its strong performance amid market downturns demonstrates a well-managed operation that can effectively adapt to changing market conditions. Quotes from industry professionals emphasize the carrier’s forward-thinking strategies, setting a benchmark within the sector.

Future Outlook for UK Carrier and European Airline Stocks

Looking ahead, predictions for the aviation sector, particularly regarding European airline stocks, remain cautiously optimistic. Factors such as ongoing economic recovery, travel demand restoration, and advancements in technology will play significant roles in shaping the future landscape.

For the UK carrier, potential areas for growth include diversifying services and increasing digital engagement with customers. However, it’s also essential to be aware of external challenges such as regulatory changes and competitive pressures that could impact performance.

As for investors, this presents a unique opportunity. Keeping a close eye on the performance of the UK carrier amidst the broader European airline stocks could yield valuable insights for future investment decisions in the sector.

Conclusion

In summary, the standout performance of the UK carrier amid the current volatility of European airline stocks is noteworthy. While many airlines struggle, this UK carrier appears to be charting its own course, showcasing resilience and innovation in challenging times.

As market dynamics keep shifting, it will be crucial for both industry players and investors to stay informed about ongoing airline market trends and stock performance. The path ahead may hold challenges, but understanding the landscape and adapting accordingly is key to navigating the future of the aviation sector.

Frequently Asked Questions

What is the current state of European airline stocks?

The performance of European airline stocks is facing significant challenges, with many airlines experiencing a decline in stock values due to global economic issues, fluctuating fuel prices, and changing consumer behaviors.

Which UK carrier is performing well amid the downturn?

One UK carrier stands out for its robust performance, showcasing impressive earnings and a steady rise in stock prices compared to its European counterparts, despite the industry’s overall struggles.

What strategies has the UK carrier used to succeed?

The UK carrier has focused on innovative strategies, including:

- Expanding its route network

- Enhancing operational efficiency

- Boosting brand reputation through better customer experiences

What trends are emerging within the airline sector?

In 2023, notable trends include a push for recovery post-pandemic, implementation of cost-cutting measures, and a stronger focus on sustainability and profitability among airlines.

What are future predictions for the aviation sector?

Future expectations for the aviation sector are cautiously optimistic, influenced by economic recovery, restoration of travel demand, and advancements in technology.

How can investors benefit from monitoring the UK carrier?

Investors can gain valuable insights and potential investment opportunities by closely following the performance of the UK carrier, particularly as it navigates the broader challenges faced by European airline stocks.

What are the potential challenges for the UK carrier going forward?

Possible challenges include:

- Regulatory changes

- Competitive pressures within the airline industry