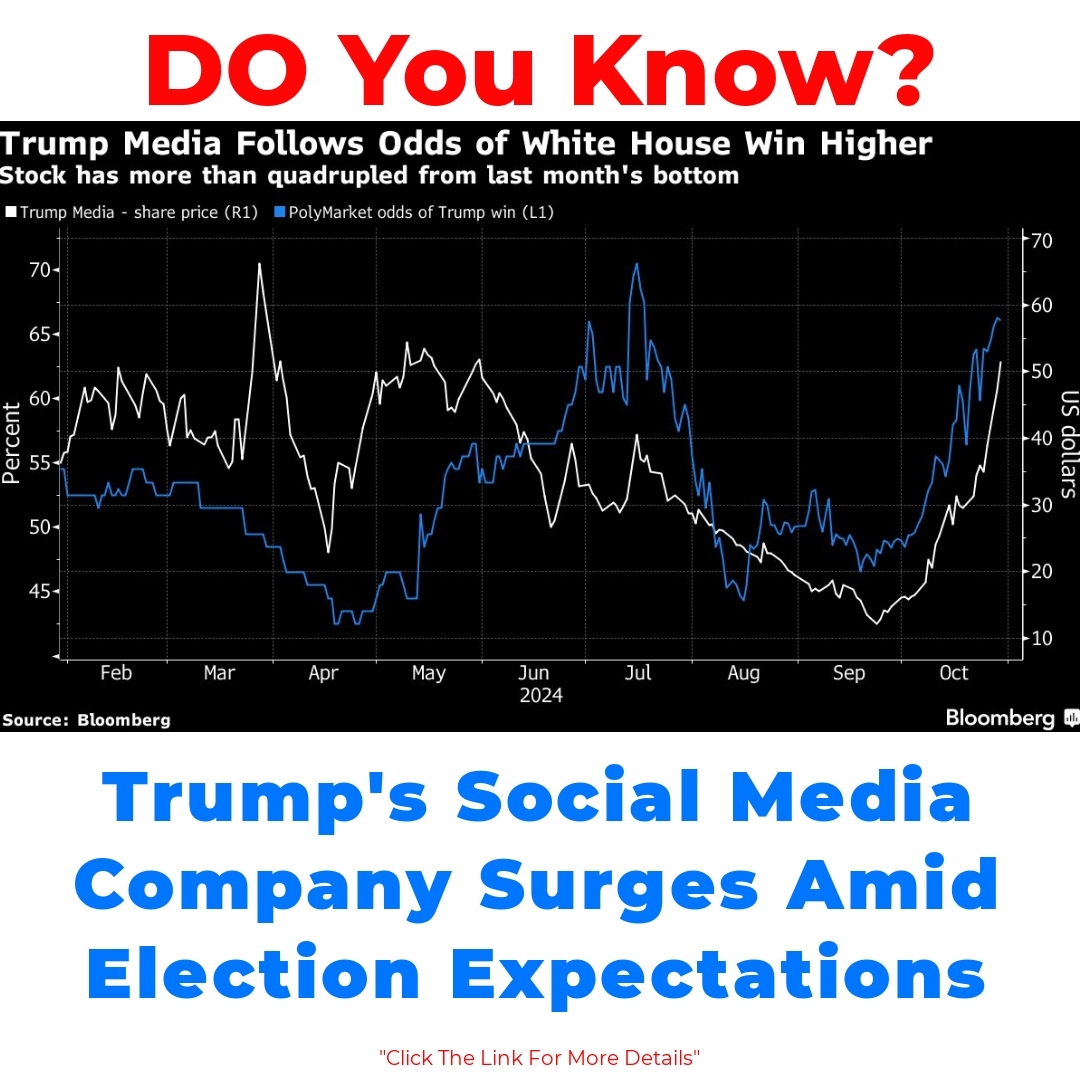

The Trump Media Company has seen a remarkable rise in social media shares, boasting a staggering $7.9 billion increase in value, largely fueled by speculation surrounding the upcoming election. This article will explore the factors behind this surge and the potential implications for digital media valuation and investor sentiment.

The Rise of Trump Media Company Shares

The Trump Media Company has witnessed a significant surge in social media shares recently, and this can be attributed to multiple factors. One major aspect is the rising interest and speculation surrounding the upcoming election. This enthusiasm has propelled the company’s value by an impressive $7.9 billion. Investors are keenly watching how political events unfold and their potential impact on the market, particularly regarding the Trump shares rally.

Several elements have contributed to this exceptional rally in stock value. First, the public’s fascination with Trump as a political figure keeps engagement levels high on social media platforms. Furthermore, discussions around censorship and free speech have placed a spotlight on alternative media outlets, including Trump Media. These factors collectively create a buzz, leading to increased investments in the company and influencing the overall social media company value.

The Election Impact on Digital Media Valuation

Elections have a well-documented impact on digital media valuations and stock prices. Historically, companies in this sector experience fluctuations in stock value correlated with electoral cycles. For instance, during pivotal election seasons, we often see volatility as investors speculate about outcomes and their implications for various companies. The election impact on businesses ranging from traditional media to tech firms illustrates a clear pattern of increased stock activity intertwined with political movements.

Taking historical data into account, political events often lead to swings in investor sentiment. As citizens engage more in discussions online, platforms linked to political figures tend to rise in value. This pattern can be observed when we analyze the performances of other media entities during election years, reaffirming how critical a role the election plays in the digital media valuation landscape.

Projected Growth for Trump Media Company Post-Election

Looking ahead, analysts are eager to gauge the potential growth of Trump Media Company based on various election scenarios. Should Trump secure a favorable outcome, we could see a considerable boost in social media shares, which may attract a wave of new investors. Conversely, if he does not win, the company might still maintain a loyal user base, but the stock could face challenges. Understanding these potential outcomes is crucial as market analysts weigh the projected growth for Trump Media Company post-election.

Several scenarios are at play, and the future appears relatively unpredictable. However, markets generally react strongly to Trump’s influence, as seen in previous instances. This uncertainty creates both opportunities and risks, and investors need to be prepared for how the political landscape could shift in response to the election results. The projected growth and market sentiment will be closely tied to Trump’s standing, irrespective of the election’s outcome.

The Former President’s Influence on Media Company Shares

Trump’s unique position in the political arena undoubtedly impacts stock market responses to his activities. The former president’s election influence extends beyond politics; it also significantly affects the valuation of media companies. This can be observed in various case studies where political figures, notably Trump, have historically swayed market dynamics. For instance, during his presidency, companies like Fox News saw substantial growth, showcasing how political affiliations can drive stock prices.

The relationship between political events and media stocks is not random. The stock market tends to react quickly to any developments involving Trump. Investors who closely monitor the news often make moves that reflect their predictions on how Trump’s actions will influence the media landscape. Therefore, understanding this connection can provide critical insights for potential investors in Trump Media Company.

The Future of Trump Media and Technology Group

Regardless of what happens in the election, the future of the Trump Media and Technology Group holds significant potential. The company may embark on various business strategies to solidify its place in the market. Innovations in product offerings, enhanced user engagement, and potential partnerships can all play a role in shaping the company’s trajectory moving forward.

For investors, keeping an eye on the developments happening within the Trump Media Company will be essential. Even if the election yields unfavorable results for Trump, the company can adapt and innovate to maintain its relevance. In a rapidly evolving digital landscape, adaptability may just be the key to sustained success in social media shares and beyond.

Conclusion

In summary, the Trump Media Company has experienced remarkable growth amid electoral excitement, showcasing a current valuation that reflects its rise. Understanding the dynamics related to social media shares, election impact, and digital media valuation is vital for investors looking at this space. As the political landscape continues to evolve, so too will the influences on Trump Media Company, making it a critical watchpoint for future market movements.

- What caused the recent rise in Trump Media Company shares?

- The rise can be attributed to heightened interest and speculation surrounding the upcoming election, leading to a notable increase in the company’s value by $7.9 billion. Investors are closely watching political events and their potential market impacts.

- How do elections affect digital media valuations?

- Elections typically lead to fluctuations in stock values for digital media companies. Historical data shows that stock prices often experience volatility during election seasons as investors speculate on outcomes and their implications for the market.

- What might happen to Trump Media Company shares if Trump wins the election?

- If Trump secures a favorable outcome, analysts predict a significant rise in social media shares, which could attract new investors.

- What about if Trump does not win the election?

- While the company may retain a loyal user base, the stock could face challenges. The market’s reaction can depend heavily on Trump’s influence and the political landscape.

- How does Trump’s influence affect media company shares?

- Trump’s position as a political figure has a noticeable impact on stock market responses. His actions and election influences can rapidly shift market dynamics, affecting the valuation of media companies.

- What should investors watch for regarding Trump Media Company?

- Investors should monitor developments within the company, as well as any political events that could influence its market position. Innovations, user engagement, and potential partnerships may shape its future trajectory.

- Is the future of Trump Media Company secure?

- Regardless of election outcomes, the company has significant potential for future growth through new strategies, adapting to market changes, and maintaining relevance in a fast-evolving digital landscape.