The Treasuries downturn signals a turbulent period ahead for the bond market, influenced by strong economic indicators, the upcoming US presidential election, and an increase in bond supply. Understanding this complex landscape is crucial for investors as they navigate the factors driving the recent decline in Treasury yields.

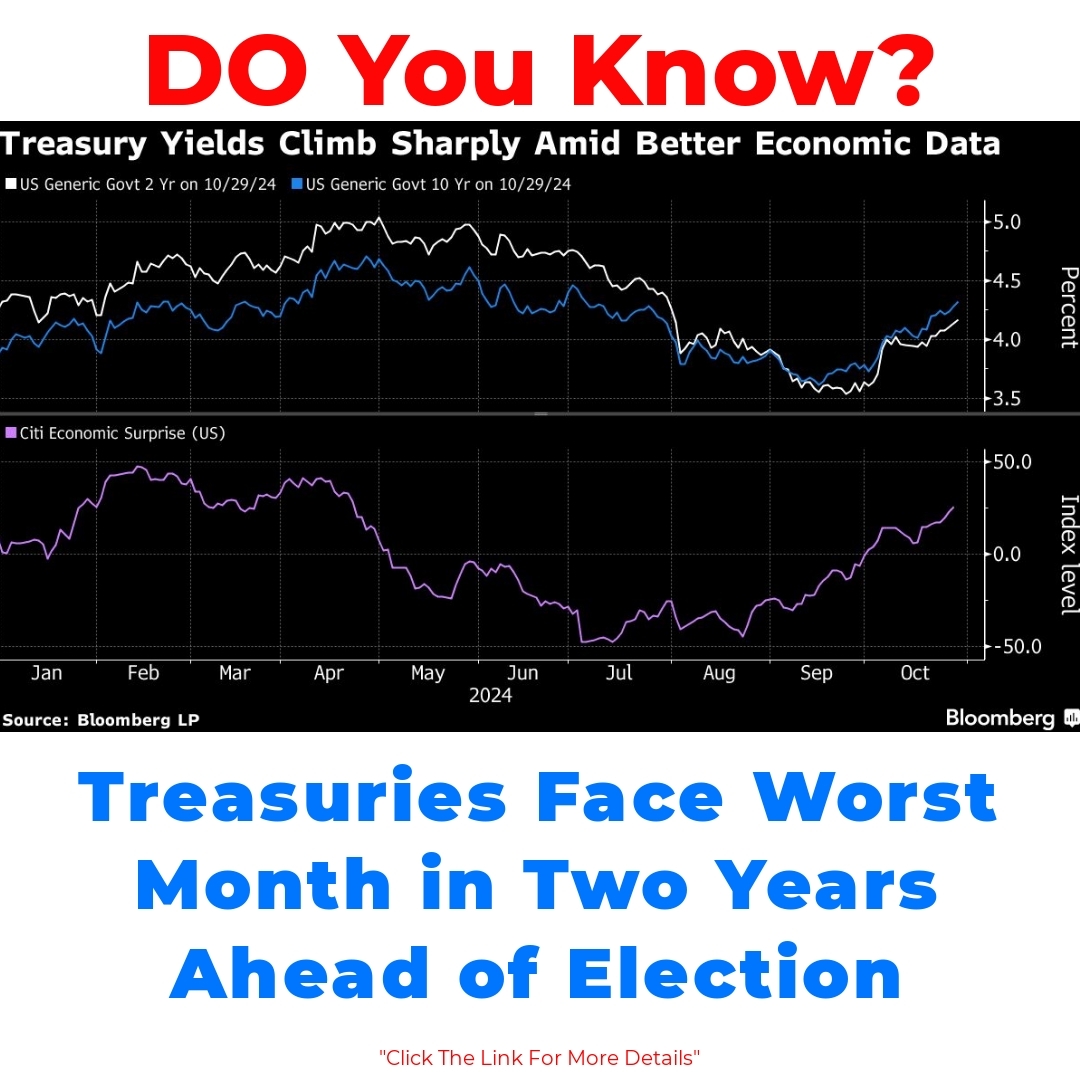

The current situation in the Treasuries market is certainly concerning as we witness a Treasuries downturn that marks the worst month in two years. Recent data shows a noticeable decline in Treasury yields, and this downturn is shaped by a combination of strong economic indicators, an upcoming US presidential election, and a significant increase in bond supply. Understanding these factors is crucial for investors looking to navigate this complex landscape.

Treasuries Experiencing Worst Month in Two Years

The recent statistics reveal just how significant the downturn has been. For instance, yields on the 10-year Treasury note have seen a steep rise, indicating a shift in investor sentiment. This phenomenon can be attributed to several factors that are contributing to the decline in Treasury prices, resulting in higher yields. Many experts in finance suggest that the interplay of economic strength and rising interest rates triggers a reaction in the bond market, adversely affecting Treasuries.

Economic Strength and Its Impact on Treasuries

When we talk about economic strength, it’s essential to connect that with the impact on Treasuries. Strong economic indicators often lead to increased confidence among investors, which in turn can cause interest rates to rise. For instance, robust growth in sectors such as employment rates and consumer spending indicates a healthy economy. Investors might then opt for riskier assets instead of Treasuries, pushing yields higher and prices down. The bond market often reacts swiftly to such indicators, leading to fluctuations that can significantly influence Treasury yields.

The Upcoming US Presidential Election and Its Influence on the Bond Market

As we look ahead to the upcoming US presidential election, we must consider its potential effects on the bond market. Political events frequently sway investor sentiment, and with uncertainty surrounding the election, we may see more volatility in Treasury yields. Traditionally, periods of election uncertainty lead investors to reassess their strategies, often shifting away from less risky Treasuries. Historical trends have shown that elections can drive significant shifts in bond markets, and this cycle appears to be no different.

Heavy Supply of New Notes and Bonds Affecting Treasuries

Another critical element influencing the Treasuries downturn is the heavy supply of new notes and bonds hitting the market. In recent months, we’ve seen an increase in debt issuance as the government funds various initiatives. This influx of supply can overwhelm demand, leading to higher interest rates to attract buyers. As new bonds are introduced, they often compete with existing Treasuries, further pressuring yields. Fiscal policy plays a crucial role here, and the implications of increased bond issuance amid a changing economic landscape can’t be overlooked.

The Future Outlook: Can Treasuries Recover?

Looking to the future, many are left wondering if Treasuries can recover from this downturn. The aftermath of the presidential election might bring some clarity to the markets, as we could see changes in monetary policy that might help stabilize interest rates. If bond supply levels off, Treasury yields may have a chance to decline, attracting more investors back to safer assets. Long-term trends suggest that while fluctuations are part of the bond market, there may be paths toward recovery for Treasuries in the coming months.

In conclusion, the ongoing Treasuries downturn represents a complex interplay of factors including economic strength, the US presidential election, and heavy bond supply. By understanding how these elements affect Treasury performance, investors can better navigate the unpredictable nature of the bond market. Keeping an eye on these developments will be crucial for those looking to make informed decisions in the future.

Frequently Asked Questions

1. What is causing the downturn in the Treasuries market?

The downturn is primarily driven by:

- Strong economic indicators leading to higher interest rates.

- The upcoming US presidential election creating uncertainty.

- A significant increase in the supply of new bonds and notes.

2. How do strong economic indicators affect Treasury yields?

When the economy shows strength, such as rising employment and consumer spending, investors often gain confidence. This can lead them to seek riskier investments, which pushes Treasury prices down and yields up.

3. Why does the presidential election impact the bond market?

Political uncertainty surrounding elections tends to make investors nervous, often causing them to move away from safer assets like Treasuries. This shift can lead to increased volatility in Treasury yields.

4. What is the effect of new bond supply on Treasury yields?

When there’s a heavy supply of new notes and bonds, it can overwhelm demand in the market. As a result, interest rates may rise to attract buyers, further pushing down Treasury prices and increasing yields.

5. Can Treasuries recover from this downturn?

Yes, there is potential for recovery. The aftermath of the presidential election may bring clarity to the markets, and if the supply of new bonds stabilizes, Treasury yields could decline, attracting more investors back to them.

6. What should investors pay attention to in this situation?

Investors should monitor the following:

- Economic indicators that could signal changes in interest rates.

- Developments surrounding the presidential election.

- Trends in bond supply and fiscal policy changes.