The landscape of cryptocurrency regulations is rapidly evolving, raising significant questions about the future of digital assets. Tether Holdings Ltd. stands out in this complex environment, becoming a focal point for regulatory scrutiny. Understanding the legal actions against cryptocurrency companies, particularly Tether, is essential for navigating this challenging terrain.

Overview of Cryptocurrency Regulations

Cryptocurrency regulations serve an important purpose in the ever-evolving digital landscape. They are essentially the rules and guidelines set forth by governments and regulatory bodies to govern the use of digital currencies. These regulations aim to enhance consumer protection, prevent fraud, and mitigate the risks associated with digital assets. As the blockchain technology advances, these rules are constantly adapting to emerging trends and challenges.

The landscape of regulations is shifting quickly, and for businesses operating in the digital-asset industry, compliance has become not just a requirement, but a necessity. Understanding and adhering to these regulations is crucial for blockchain companies to operate legally and remain competitive in the market.

The Legal Actions Against Cryptocurrency Companies

Over the past year, US regulators have taken several notable legal actions against various cryptocurrency companies. This includes significant enforcement by the Securities and Exchange Commission (SEC), which has focused on many facets of the cryptocurrency market. These legal battles are not just about individual companies; they have broader implications for the market perception of cryptocurrencies as a whole.

Cases related to SEC enforcement and other regulatory bodies have revealed the serious risks that can come with non-compliance. For many in the crypto space, these legal challenges have intensified scrutiny and prompted businesses to rethink their strategies and operations.

Focus on Tether Holdings Ltd.

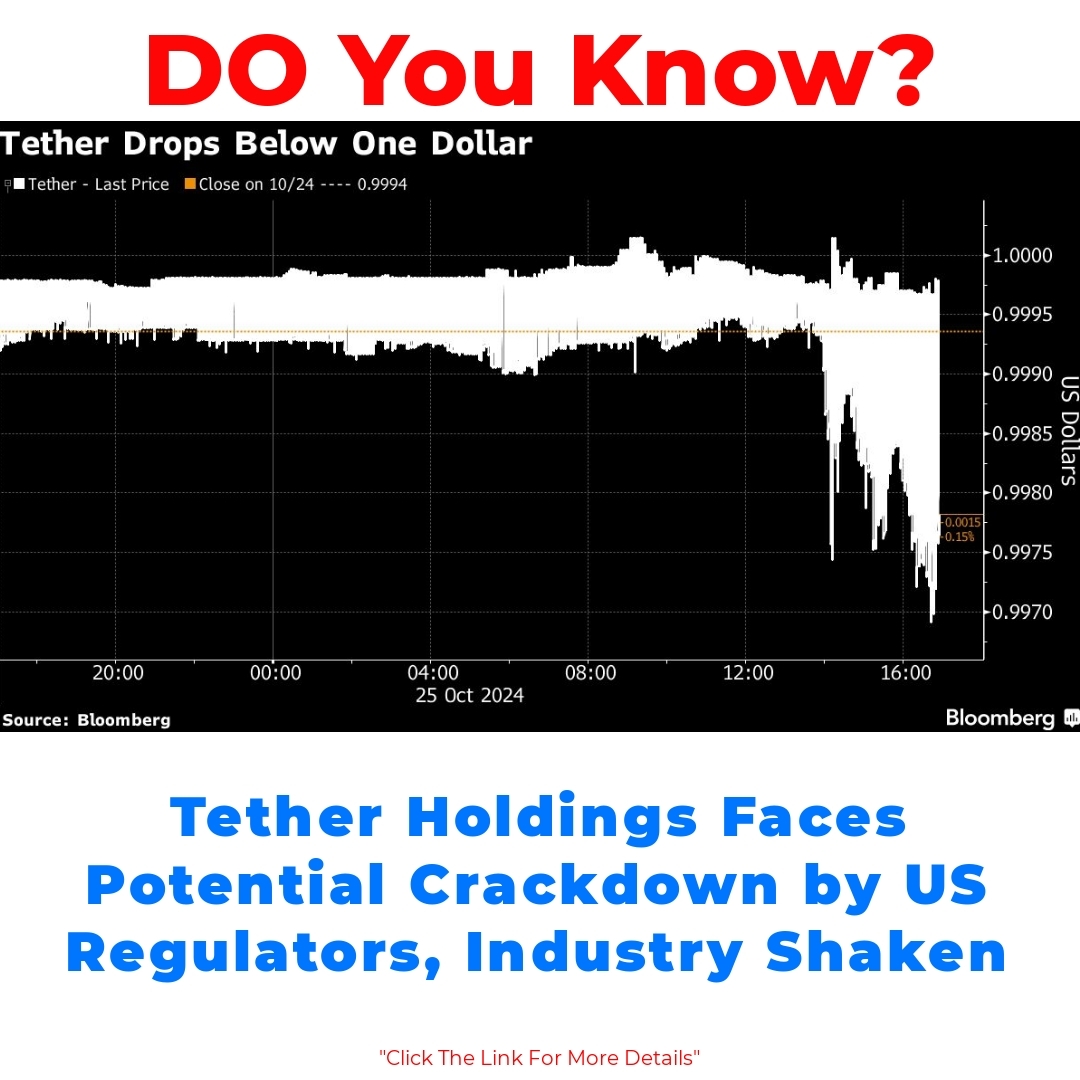

Tether Holdings Ltd. plays a pivotal role in the stablecoin market, with its stablecoin, USDT, being one of the most widely used. However, Tether has been under significant scrutiny from US regulators. Recent investigations into its operations and reserves have raised questions about its compliance and financial transparency.

If these legal actions against Tether proceed, the implications could be severe for the company. Tether’s ability to maintain its peg to the US dollar, which is critical for its market stability, may be jeopardized. This situation has managed to capture the attention not just of regulatory agencies but also of investors and stakeholders throughout the cryptocurrency ecosystem.

The Ripple Effect on the Digital-Asset Industry

A crackdown on Tether Holdings Ltd. could have a ripple effect throughout the digital-asset industry. It may lead to increased regulatory scrutiny for other stablecoins and cryptocurrency projects. For example, if regulators tighten the rules surrounding stablecoins, companies might need to adapt their business models to comply with new requirements.

In such a scenario, blockchain companies may start implementing more rigorous compliance measures and transparency practices to avoid being the next target of regulatory actions. The landscape is likely to shift, causing a major restructuring in how digital assets are developed and managed.

Future Predictions and Possible Scenarios

As regulatory actions continue to unfold, the impact on cryptocurrency companies remains uncertain. While some may view the increased regulations as a threat, others perceive it as an opportunity for market maturation. Experts argue that regulations may create a more stable environment for legitimate businesses while weeding out less compliant players.

In the context of US regulations, challenges for companies like Tether could pave the way for innovation within more compliant frameworks. The balance between regulation and innovation in the digital-asset space remains delicate, with voices on both sides advocating for either more stringent rules or more freedom for crypto businesses.

Conclusion

The ongoing changes in cryptocurrency regulations significantly impact the industry. With companies like Tether Holdings Ltd. facing intense scrutiny, it’s crucial to understand how these legal actions are shaping the future of digital assets. Continuous monitoring of these developments is essential for stakeholders looking to navigate this complex environment.

In the end, the challenge will be finding the right balance between regulatory compliance and the innovative spirit of the cryptocurrency world. The future could either see a flourishing of new technologies or a tightening of restrictions that could hinder growth.

Call to Action

To stay ahead in this dynamic landscape, it’s important to keep yourself informed about cryptocurrency regulations. Consider subscribing to relevant updates and resources that can help you better understand the ever-changing world of crypto. Knowledge is power, and staying informed will help you navigate these turbulent waters effectively.

What are cryptocurrency regulations?

Cryptocurrency regulations are the rules set by governments and regulatory bodies that govern how digital currencies can be used. They are designed to protect consumers, prevent fraud, and manage risks associated with digital assets.

Why are these regulations changing so quickly?

The digital landscape is constantly evolving, so regulations must adapt to keep pace with new technologies and emerging trends. This shift aims to ensure that consumers are protected and that the market remains competitive.

What happens if a cryptocurrency company does not comply with regulations?

Non-compliance can lead to legal actions from regulatory bodies, like the Securities and Exchange Commission (SEC) in the US. This can result in fines, legal battles, and damage to the company’s reputation, prompting them to reevaluate their business strategies.

What is the significance of Tether Holdings Ltd. in the cryptocurrency market?

Tether Holdings Ltd. is crucial for the stablecoin market, primarily due to its stablecoin, USDT. However, it has faced scrutiny from US regulators concerning its compliance and financial transparency, which has raised concerns about its stability and operations.

How could legal actions against Tether impact the overall cryptocurrency industry?

If Tether faces increased regulatory scrutiny, it may lead to the same for other stablecoins and cryptocurrency projects. This could force companies to adapt their business models and implement stricter compliance measures to avoid regulatory issues.

What are some future predictions for cryptocurrency regulations?

As regulations evolve, experts predict that while some companies may see them as a threat, others could view them as an opportunity for growth. Regulations may help create a more stable market for compliant businesses, potentially pushing out less compliant ones.

Why should stakeholders keep monitoring cryptocurrency regulations?

Ongoing changes in regulations can significantly influence the future of the cryptocurrency industry. By staying informed, stakeholders can better navigate the complex environment and adapt to new compliance requirements as they arise.

How can someone stay updated on cryptocurrency regulations?

It’s essential to subscribe to relevant updates and resources that provide insights into the changes in cryptocurrency regulations. This knowledge can empower individuals and businesses to navigate the evolving market effectively.