The recent nearly 10% drop in Toronto-Dominion Bank shares has raised concerns among investors. This decline follows TD Bank’s agreement to financial penalties related to compliance issues in its US branches. Understanding the implications of these penalties is crucial for assessing the bank’s future performance and investor sentiment.

Understanding the Latest Developments

The situation surrounding Toronto-Dominion Bank has taken a significant turn with the recent agreement to pay financial penalties. These penalties stem from compliance issues within their US branches, which has certainly caught the attention of the financial community. Investors are now trying to grasp the implications of these developments, especially how they connect to the recent decline in Toronto-Dominion Bank shares.

Overview of the Situation

In the past few weeks, several Toronto-Dominion Bank news reports have indicated a growing concern regarding regulatory challenges. The bank’s decision to agree to financial crimes penalties has sent shockwaves through the market. The penalties have impacted investor confidence, leading to a nearly 10% drop in TD Bank stock prices. Understanding these underlying issues is crucial in assessing the bank’s future performance.

Details on Compliance Issues

The compliance issues that led to these financial crimes penalties are significant. The penalties specifically relate to the bank’s practices in its US branches, highlighting areas where it fell short of regulatory expectations. This development has not only financial implications but also raises questions about the effectiveness of TD Bank’s governance and compliance programs.

The Impact of Financial Crimes on TD Bank Stock

Market reactions to regulatory violations are often swift and impactful. In this case, the compliance failures at TD Bank have played a crucial role in shaping investor sentiment. The connection between regulatory issues and stock performance is undeniable, leading many investors to reconsider their positions.

Market Reaction to Regulatory Violations

The recent decline in TD Bank share prices reflects investor unease regarding the bank’s ability to navigate regulatory challenges. When a major financial institution faces compliance issues, it raises red flags. The impact of financial crimes on TD Bank stock has been evident as shareholders react to news of these penalties, reflecting broader concerns regarding the bank’s operational integrity.

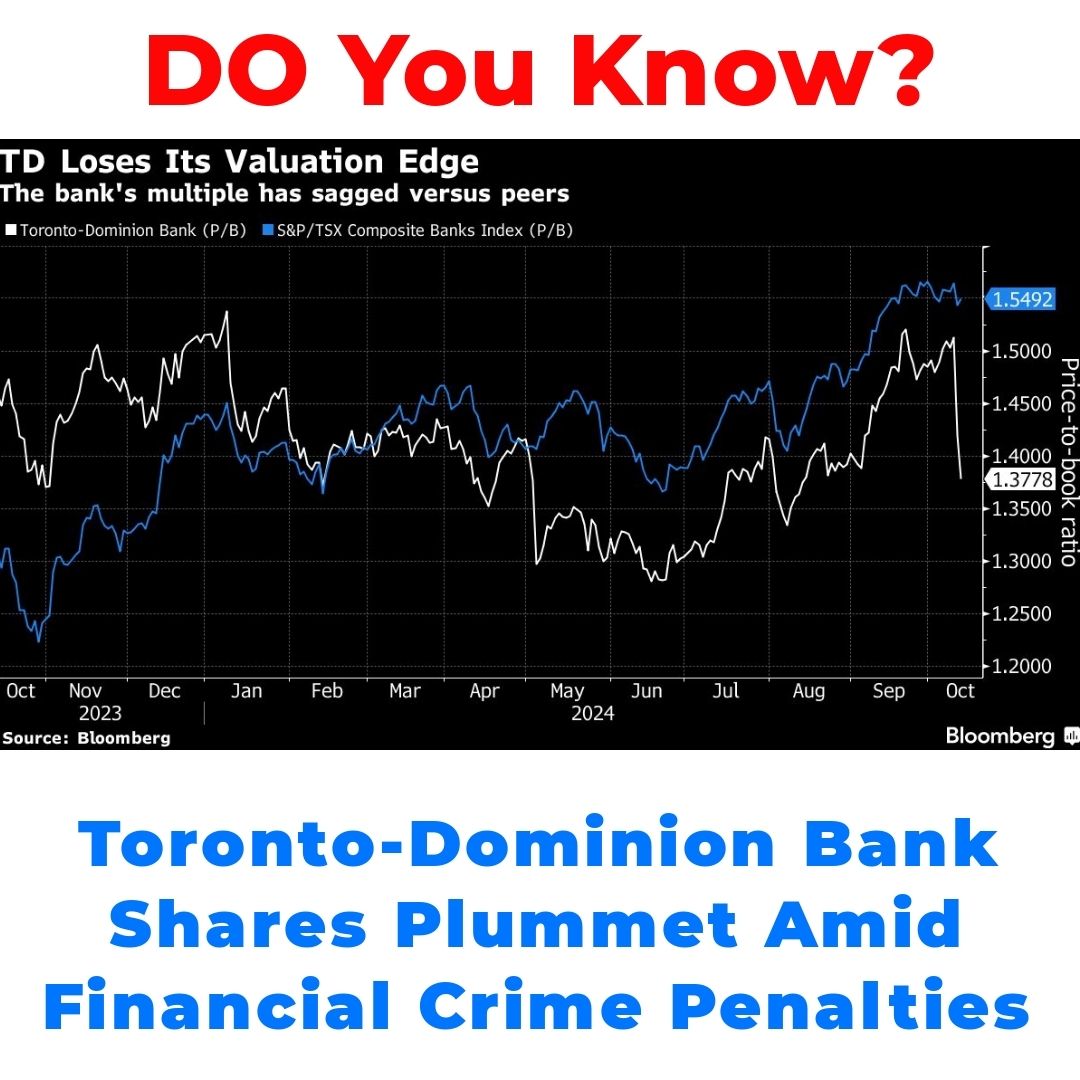

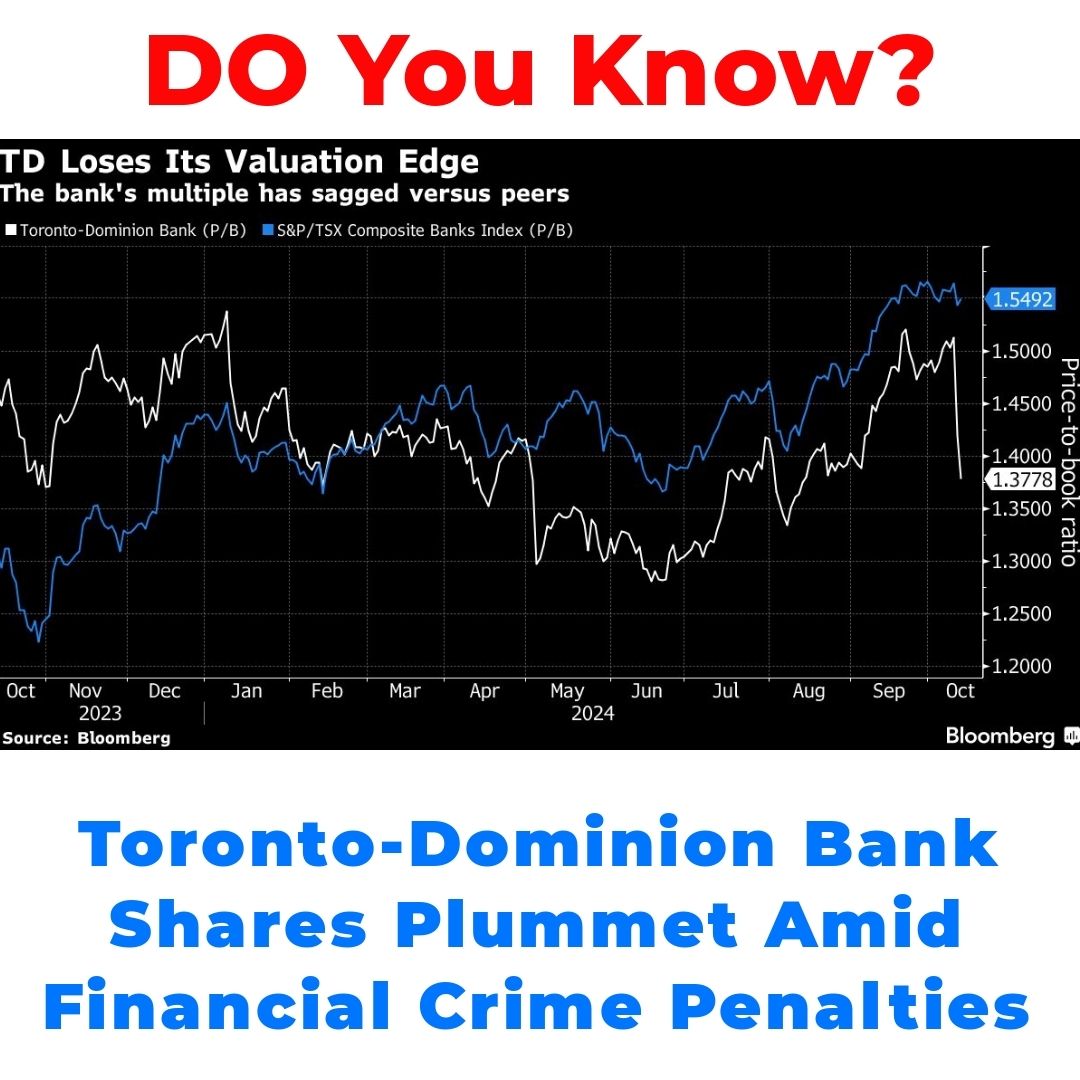

Recent Performance: A Closer Look

The data indicates a clear trend in TD Bank stock decline, with nearly 10% loss reported in a short span. This decline is not just a number; it’s indicative of the market’s skepticism about the bank’s current risk management strategies and future prospects. The recent decline in TD Bank share prices has added to the anxiety among many investors, prompting a reevaluation of their portfolios.

Consequences of Regulatory Violations at TD Bank

The financial penalties imposed on TD Bank are expected to have immediate effects on its finances. However, the long-term implications could be even more concerning. Any bank regulatory penalties can impact a financial institution’s ability to operate smoothly in the future.

Financial Penalties: Immediate Effects

TD Bank financial penalties are not just a one-off issue; they strain the bank’s resources. These financial repercussions can hinder growth and limit the bank’s future opportunities. Additionally, the immediate effects on the bottom line can be profound, influencing operational strategies and shareholder returns.

Long-Term Implications

Moving beyond immediate impacts, the long-term consequences of regulatory violations at TD Bank are equally significant. The ongoing scrutiny could lead to lasting reputational damage, affecting customer trust and investor relations. This situation underscores the need for robust compliance frameworks within financial institutions to ensure they can weather compliance storms in the future.

Conclusion

In summary, the recent decline in Toronto-Dominion Bank shares can be directly linked to the bank’s financial penalties regarding compliance issues. As investors reflect on these developments, it’s essential to connect the dots between financial penalties and stock performance. For those considering their next steps, keeping a close eye on Toronto-Dominion Bank shares in light of these challenges will be crucial moving forward.

FAQ on Toronto-Dominion Bank Developments

What are the recent developments involving Toronto-Dominion Bank?

Toronto-Dominion Bank recently agreed to pay financial penalties related to compliance issues in its US branches, which has impacted investor confidence and caused a nearly 10% drop in its stock prices.

What caused the decline in TD Bank shares?

The decline in TD Bank shares can be attributed to the bank’s regulatory compliance challenges and the financial penalties imposed, which raised concerns about its operational integrity and risk management strategies.

How have investors reacted to the compliance issues at TD Bank?

Investors have expressed unease and skepticism regarding the bank’s ability to address the regulatory challenges, leading to a re-evaluation of their investment positions and contributing to the decline in stock prices.

What are the immediate financial implications of the penalties on TD Bank?

The immediate financial implications include strained resources, hindrance in growth opportunities, and negative impacts on the bank’s bottom line, which may affect operational strategies and shareholder returns.

Are there long-term consequences of these regulatory violations?

Yes, the long-term consequences may include reputational damage, ongoing scrutiny from regulators, and a potential loss of customer trust, highlighting the need for stronger compliance frameworks within the bank.

What should investors keep an eye on moving forward?

Investors should closely monitor TD Bank’s stock performance and the bank’s responses to compliance challenges, as these factors will be critical in assessing the bank’s future stability and growth potential.