Technology analyst Daniel Ives is advising investors to “buy the dip” when it comes to Palantir stock. Despite recent fluctuations, Ives believes that the data analytics company still has strong potential for growth. Learn more about why he is bullish on Palantir in this exclusive report.

Win Up To 93% Of Your Trades With The World’s #1 Most Profitable Trading Indicators

Palantir, the big data analytics company listed on the NYSE under ticker symbol PLTR, experienced a significant stock climb of 225% over the past year. However, following its recent earnings release, the stock saw a 15% drop today. Despite reporting record profits of $106 million in Q1 and exceeding revenue expectations, the company fell short of investor expectations.

With a focus on AI-driven solutions for governments and corporations, Palantir raised its guidance for FY2024 but failed to meet Street estimates. Slower international sales, particularly in Europe, contributed to the stock decline.

Analyst Daniel Ives of Wedbush sees the current dip in stock price as a buying opportunity, emphasizing Palantir’s growth potential in AI. With a growing client base and improved sales cycles, Ives remains optimistic about the company’s future prospects.

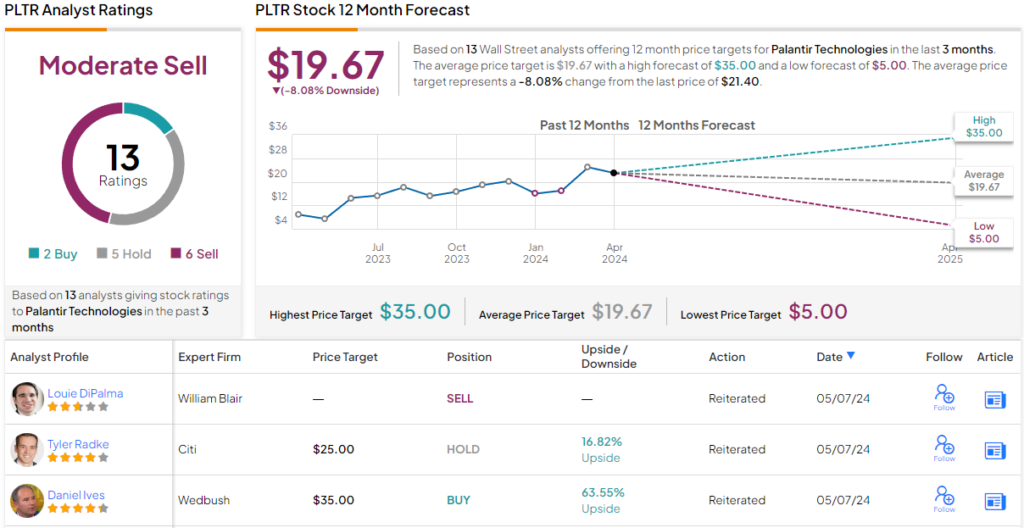

While Ives rates PLTR as an Outperform with a price target of $35, representing a 64% upside, other analysts have a more cautious outlook. With a Moderate Sell consensus rating and an average price target suggesting an 8% downside, opinions on the stock vary.

For investors seeking attractive valuations in the stock Market, TipRanks’ Best Stocks to Buy tool offers valuable insights. Remember to conduct thorough research before making any investment decisions.

Win Up To 93% Of Your Trades With The World’s #1 Most Profitable Trading Indicators

1. What does “buy the dip” mean?

Buying the dip refers to purchasing a stock when its price has dropped significantly, with the expectation that it will rise again in the future.

2. Who is Daniel Ives?

Daniel Ives is a well-known analyst in the stock Market, known for his insights and recommendations on various companies and stocks.

3. Why is Daniel Ives recommending buying Palantir stock?

Daniel Ives believes that Palantir stock is a good investment opportunity at its current price, and he recommends buying it while the price is low.

4. Should I trust Daniel Ives’ recommendation on Palantir stock?

It’s important to do your own research and consider multiple sources of information before making any investment decisions based on a single recommendation, even if it’s from a reputable analyst like Daniel Ives.

5. What should I consider before buying the dip in Palantir stock?

Before buying the dip in Palantir stock, consider the company’s financial health, Market position, competition, and long-term growth prospects to make an informed decision.

Win Up To 93% Of Your Trades With The World’s #1 Most Profitable Trading Indicators

Win Up To 93% Of Your Trades With The World’s #1 Most Profitable Trading Indicators