In recent years, the South Korean exchange has seen a notable shift in investor behavior, particularly regarding single-stock options. Historically challenged by low investor interest in these financial instruments, recent changes have sparked growing enthusiasm, making single-stock options an attractive avenue for traders on the South Korea stock market.

The South Korean exchange has been working hard to change the game when it comes to single-stock options. These financial instruments allow investors to buy or sell options on individual stocks, offering more flexibility and control. In this section, we’ll explore what single-stock options are and how they operate within the South Korea stock market.

Single-stock options are contracts that give investors the right, but not the obligation, to buy or sell a specific stock at a predetermined price, known as the strike price, before a certain expiration date. They can be an essential part of various trading strategies, as they allow for speculation on price movements or provide a way to hedge against potential losses in stock holdings. In the context of the South Korean exchange, these options have gained attention as a way to enhance trading opportunities for investors.

Historically, the journey of single-stock options in the South Korean exchange hasn’t been easy. Several factors have contributed to the lukewarm interest from investors over the years. For a long time, there was a lack of awareness and understanding of how single-stock options work, making it difficult for traders to see their value. Additionally, the exchange faced stiff competition from more established markets, which offered a wider variety of trading options.

Furthermore, the regulatory environment wasn’t always favorable for single-stock options trading, which led to uncertainties for potential investors. As a result, many traders preferred investing in traditional stocks or other more conventional options, leaving a gap in the market that could have been filled by single-stock options.

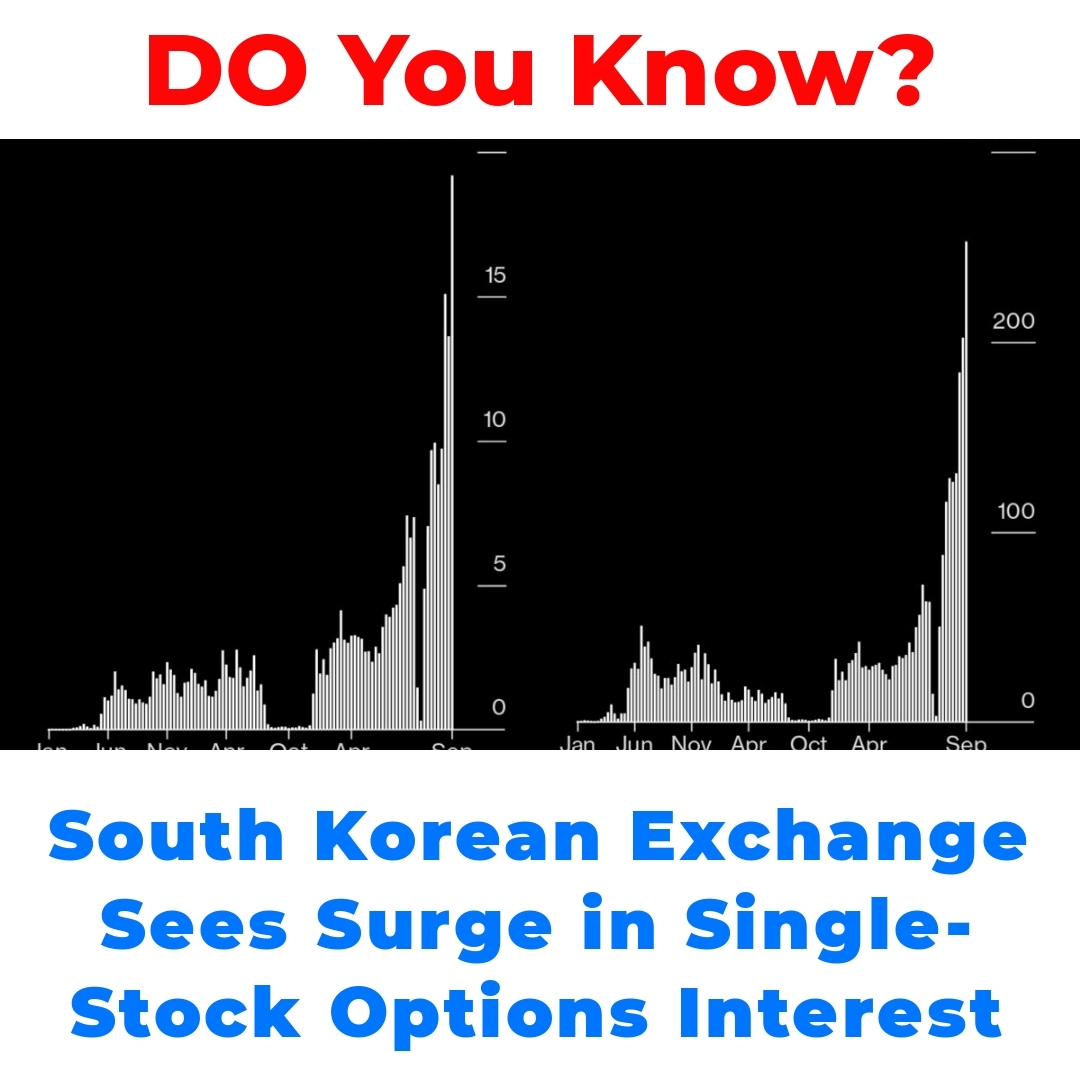

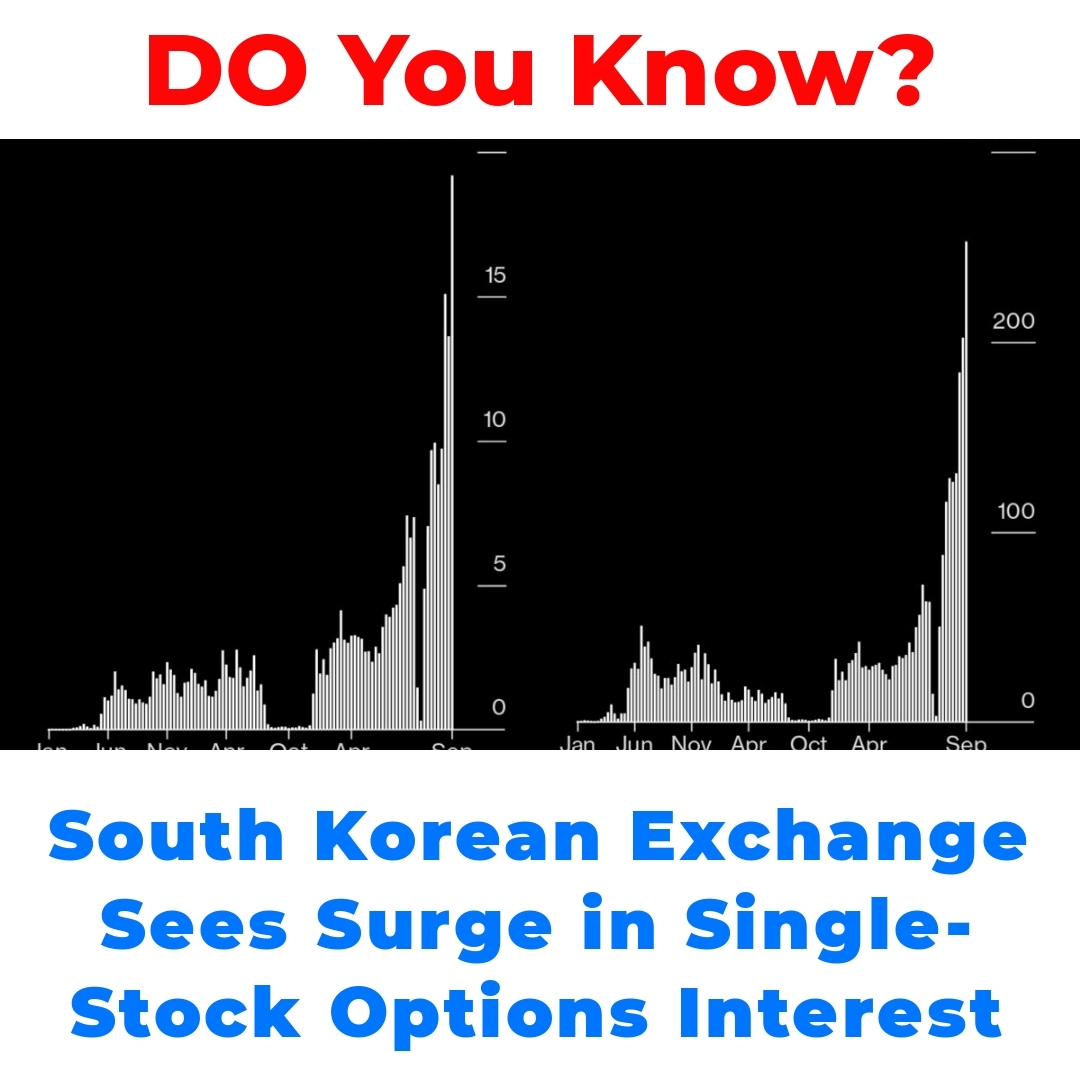

Luckily, times are changing. Recent trends in South Korea’s exchange market have shed light on single-stock options in a whole new way. With a renewed emphasis on education and awareness, more and more investors are starting to take notice. Reports indicate a significant uptick in trading volumes for single-stock options, which means that traders are getting more engaged with these products. In fact, statistics suggest that trading volume has skyrocketed over the past year, reflecting a growing appetite for this type of investment.

Moreover, stock trading strategies have evolved to incorporate single-stock options, allowing investors to tailor their approaches based on individual stock performance. This shift in strategy has played a crucial role in igniting investor interest and encouraging a more dynamic trading environment within the South Korean exchange.

So, how are South Korean exchanges attracting investors to single-stock options? One of the key elements is effective marketing. The exchanges have ramped up their promotional efforts, including educational seminars and webinars that demystify single-stock options for potential investors. By addressing misconceptions and highlighting the benefits, they’re opening doors for those who might have previously hesitated.

Additionally, the introduction of new financial instruments and collaborations has enhanced the appeal of single-stock options. For instance, partnerships with financial education platforms offer resources that help traders develop their skills and knowledge. Successful marketing campaigns have seen a measurable increase in participation, showing that when investors are informed, they tend to engage more in the process.

Now, let’s take a moment to discuss the benefits of single-stock options trading in South Korea. For starters, single-stock options provide the opportunity for higher returns on investment compared to traditional stock trading. By allowing for speculative trading, investors can maximize their profits if they predict stock movements accurately. Furthermore, these options offer the chance to hedge existing positions, which can significantly reduce risk.

When comparing single-stock options to other types of trading options available in the South Korean market, they stand out for their flexibility. Unlike broader market options, single-stock options allow investors to focus on specific companies, tailoring their investments to their market theories. This refined approach can result in more targeted and potentially lucrative trading strategies.

Looking ahead, the future for single-stock options in the South Korean exchange appears promising. With current trends showing a growing acceptance among investors, it’s likely we’ll see continued development in this arena. Changes in investor habits, especially as younger and more tech-savvy traders enter the market, will further fuel interest in single-stock options.

However, some barriers to growth may still exist, like regulatory challenges and market volatility. It’s essential for the South Korean exchange to address these issues while continuing to foster an environment that encourages participation and innovation in trading options.

In conclusion, the rise of single-stock options in the South Korean exchange is more than just a trend; it’s a shift that could reshape how investors approach trading. With their ability to offer flexibility and strategic advantages, these financial instruments will likely become an indispensable tool for traders seeking to diversify their portfolios. The ongoing evolution of trading strategies showcases the importance of these options, making them an essential part of the South Korea stock market landscape.

So, if you’re interested in exploring single-stock options, now is the perfect time to delve into this exciting market. Stay informed about the latest trends, and consider discussing your thoughts with fellow traders. The more we share knowledge, the better prepared we’ll be to navigate this evolving financial landscape.

Frequently Asked Questions (FAQ)

What are single-stock options?

Single-stock options are contracts that allow investors the right, but not the obligation, to buy or sell a specific stock at a predetermined price (strike price) before a set expiration date. They offer flexibility in trading strategies and help in speculating on price movements or hedging against losses.

Why has interest in single-stock options been low historically?

Interest has been low due to:

- Lack of awareness and understanding of how they work.

- Competition from more established markets with more trading options.

- Unfavorable regulatory environment leading to uncertainties for investors.

How is interest in single-stock options changing in South Korea?

Recent trends show a significant increase in trading volumes for single-stock options, driven by:

- Heightened education and awareness among investors.

- Evolution of trading strategies incorporating single-stock options.

- Effective marketing efforts, including seminars and promotions.

What are the benefits of trading single-stock options?

The benefits include:

- Potential for higher returns on investment compared to traditional stock trading.

- Ability to hedge existing stock positions, which reduces risk.

- Flexibility to focus on specific companies, enabling tailored investment strategies.

What does the future hold for single-stock options in South Korea?

The future seems promising with:

- Growing acceptance among investors and increased participation.

- Emergence of younger, tech-savvy traders entering the market.

- Continued development and innovation, despite some regulatory challenges.

How can I get started with single-stock options?

If you’re interested in single-stock options:

- Stay informed about the latest trends in the market.

- Consider discussing strategies and insights with fellow traders.