Recent revival of inflation fears has stirred discussions in financial markets, making it crucial to grasp the link between inflation, bond yields, and risk assets. This article delves into the complexities of inflation’s impact, the resilience of risk assets amidst rising bond yields, and how US presidential politics shapes market sentiment.

Inflation, a term that’s been popping up in conversations lately, refers to the rise in prices of goods and services over time. It’s something that affects everyone, from the groceries we buy to the cost of gas. Recently, we’ve seen some concerning trends indicating that inflation might be on the rise again. As this unfolds, understanding its implications on the financial markets, particularly how it influences bond yields and risk assets, is more crucial than ever.

One of the key components we need to unpack is inflation itself and how it impacts the economy. Recent economic indicators have suggested a possible revival of inflation. When inflation rises, the purchasing power of money decreases and investors begin to adjust their strategies accordingly. Economic data, such as consumer price index numbers, are watched closely in this regard. As inflation expectations rise, it can lead to significant shifts in market dynamics, forcing investors to rethink their investment strategies.

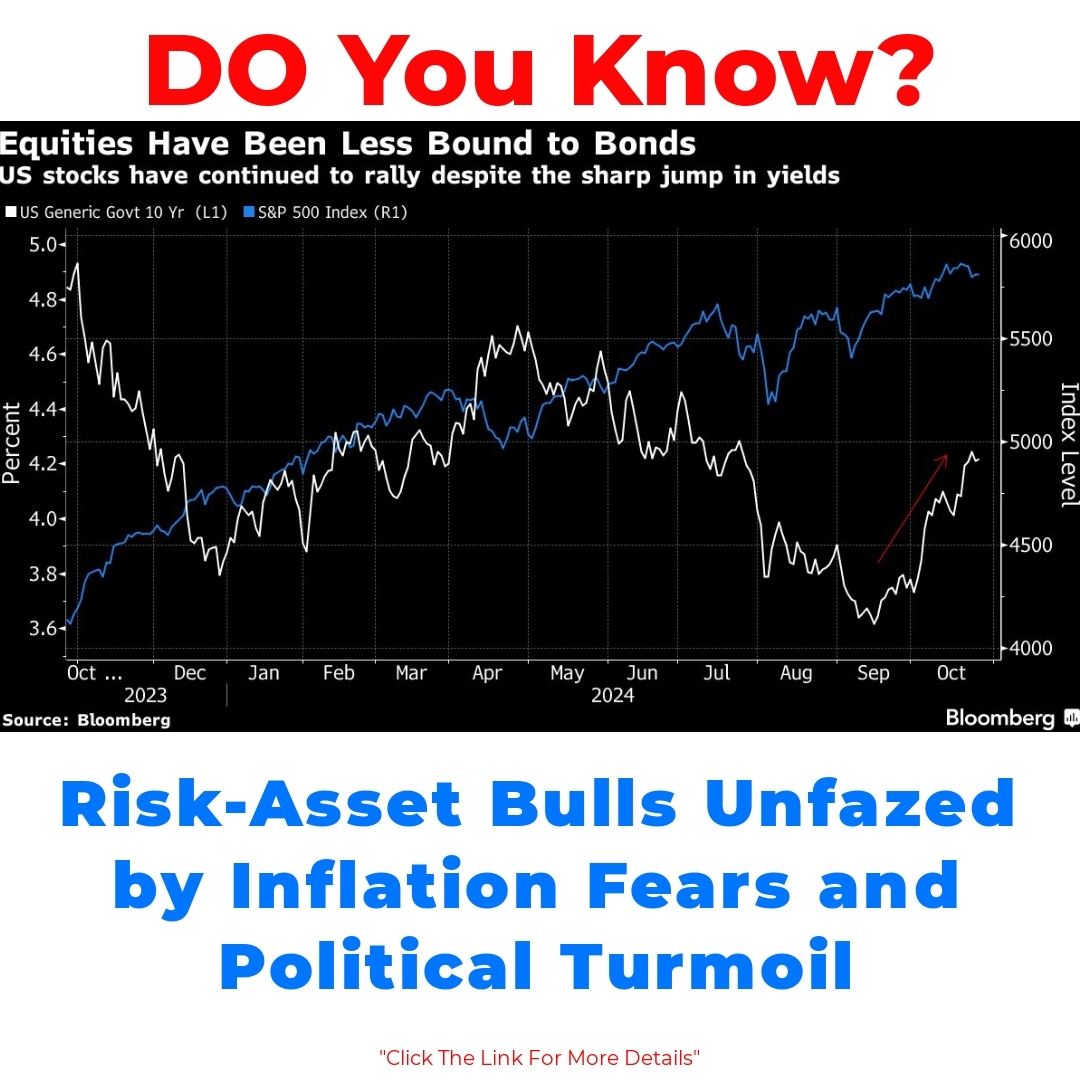

Now, let’s dive into bond yields and how they respond to fears of inflation. Bond yields represent the return an investor can expect from a bond and are crucial indicators of economic health. Usually, when inflation fears mount, bond yields tend to increase. Investors start to demand higher returns to compensate for the decreased purchasing power of future interest payments. This relationship between inflation and bond yields is vital in understanding the broader financial landscape. So, let’s consider how inflation impacts bond yields and risk assets collectively.

Looking at historical trends, we see that during periods of inflation, bond yields often rise as investors adjust their expectations. For instance, in past economic cycles, central banks have typically responded to rising inflation by increasing interest rates, which in turn can lead to higher bond yields. This historical context gives us a window into an economic outlook that may provide insights into how current financial markets will perform amidst inflation fears.

Now, let’s turn our focus to risk assets. Risk assets include different types of investments, such as stocks, commodities, and real estate. Interestingly, despite the rising concerns about inflation and the corresponding increase in bond yields, these assets have shown a remarkable degree of resilience. This resilience can be attributed to various factors, including strong corporate earnings, ongoing consumer spending, and a favorable economic backdrop in some sectors. Understanding the effects of inflation fears on investment strategies in this context becomes essential for investors looking to navigate market uncertainties.

Market sentiment also plays a crucial role here. In times of economic fluctuations, how investors feel about the future can influence the performance of risk assets significantly. The interplay between inflation fears and current economic indicators can create a mixed bag for investors, leading to some sectors outperforming while others struggle. It’s essential for investors to be aware of these dynamics to make informed decisions amidst changing market conditions.

Now, let’s not forget the influence of US presidential politics on our economic landscape. Political events can have a direct impact on market performance, especially in the context of inflation and economic indicators. The current political landscape is marked by uncertainty, which can heavily shape market sentiment and reactions. Understanding bond yields amid US presidential politics is therefore crucial for investors who want to stay ahead of potential market movements.

Throughout history, we’ve seen how elections and policy changes can lead to immediate reactions in financial markets. For instance, news of a new policy direction might positively or negatively affect investor confidence, influencing both bond yields and risk asset performance. Case studies of past elections can provide valuable insights into how political events might correlate with inflation and broader economic factors.

So, what does all this mean for investors in today’s shifting economic landscape? A few strategies can help navigate these complexities arising from inflation, bond yields, and political dynamics. Staying informed about economic outlook trends and market sentiment can give investors an edge. Additionally, adjusting investment portfolios in response to interest rate changes and inflationary pressures can help mitigate risks and enhance returns.

Investors should also consider diversifying their portfolios to balance potential risks associated with rising inflation. By analyzing market reactions to inflation and political events in the US, investors can better position themselves for future opportunities that may arise even in turbulent times.

In conclusion, the interconnection of inflation, bond yields, risk assets, and US presidential politics creates a complex tapestry of financial dynamics that investors must navigate. By staying informed, understanding the economic indicators at play, and being adaptable, investors can confidently face these uncertainties in the current economic environment.

It’s essential to keep an eye on the market trends and the movements of key economic indicators. Being proactive in your investment strategy will position you to take advantage of market shifts while managing potential risks effectively.

“`html

Read more… Tech and Media Sectors to Drive $1.1 Trillion Global Growth

Read more… GLOBALT’s Thomas A. Martin Optimistic About Upcoming Tech Earnings Season

Read more… Biden Administration Urges Rapid AI Adoption for National Security

“`

FAQ

What is inflation?

Inflation is the rise in prices of goods and services over time, reducing the purchasing power of money. It affects everyday expenses, from groceries to gas prices.

How does inflation impact the economy?

When inflation rises, investors often adjust their strategies because the value of future money decreases. Economic indicators such as the consumer price index are crucial in understanding these trends.

What are bond yields?

Bond yields represent the return investors can expect from bonds. They are indicators of economic health and often rise when fears about inflation increase, as investors seek higher returns to offset reduced purchasing power.

How does rising inflation affect risk assets?

- Risk assets include stocks, commodities, and real estate.

- Some risk assets have shown resilience despite rising inflation due to strong corporate earnings and consumer spending.

- Understanding these dynamics is vital for making informed investment decisions.

What role does market sentiment play?

Investor feelings about the future can significantly influence the performance of risk assets. Mixed market conditions may lead to some sectors thriving while others decline.

Can US presidential politics affect inflation?

Yes, political events can directly impact market performance, especially during changing economic climates. Investor confidence can shift based on new policies or election outcomes.

How should investors respond to inflation and market changes?

- Stay updated on economic outlooks and market sentiment.

- Adjust investment portfolios in line with interest rates and inflation trends.

- Diversify investments to balance risks associated with inflation.

Why is it important to monitor economic indicators?

Keeping an eye on key economic indicators and market trends helps investors make proactive decisions and manage risks effectively in a shifting economic environment.