Australia’s interest rates are currently in the spotlight as the Reserve Bank of Australia (RBA) focuses on maintaining elevated rates amidst rising inflation concerns. This article delves into the implications of these interest rates for consumers and examines how inflation influences monetary policy decisions in the country.

The Current Interest Rate Climate

Right now, Australia is experiencing a significant increase in interest rates, reaching a 12-year high. This shift can be traced back to various economic factors, but the underlying theme is how these interest rates play a crucial role in our overall economy. High interest rates signal the RBA’s effort to combat inflation, impacting both consumers and businesses alike.

Background of Interest Rates in Australia

Historically, Australia has seen a variety of interest rate levels, depending on economic conditions. In recent times, the RBA has boosted rates to combat rising inflation. This adds a significant layer of complexity to our economic environment, as higher rates can slow down spending and borrowing, which are essential for economic growth.

What the RBA’s Decision Means for Consumers

The RBA’s decision to keep interest rates high comes with a variety of implications for everyday Australians. For many, this affects loans and mortgages, making repayments more expensive. On the flip side, for savers, it could mean better returns on savings accounts. However, public perception about these **interest rates** tends to be mixed, with some understanding the necessity while others feel stressed by the rising costs.

Inflation Trends and Their Impact on Monetary Policy

Understanding Inflation in Australia

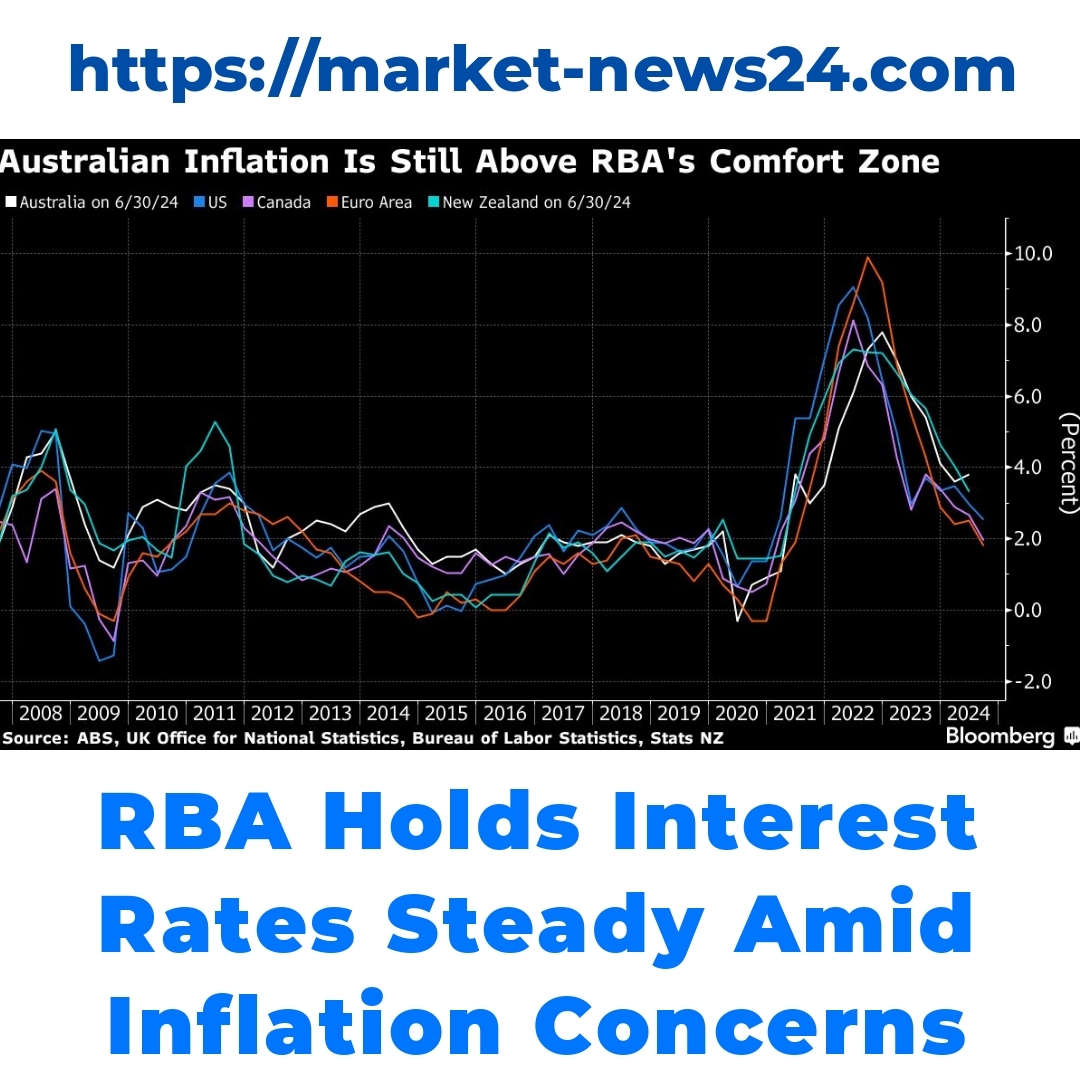

Inflation essentially means that prices for goods and services are rising, and the purchasing power of money is decreasing. Currently, Australia is facing notable inflationary pressures, with statistics indicating a climb in prices affecting many sectors of the economy. This context plays a significant role in the RBA’s decision-making process regarding **interest rates**.

The RBA’s Role in Managing Inflation

The RBA actively uses **interest rates** as a tool to control inflation. The board closely examines various economic indicators before making decisions. Recent minutes from board meetings reveal a cautious but determined approach to stabilizing the economy while attempting to keep inflation in check, reflecting the RBA’s commitment to its monetary policy goals.

RBA’s Monetary Policy and Interest Rate Decisions

Recent Decisions and Outlook for Monetary Policy

The RBA has set a target inflation rate to maintain economic stability. The decision to keep interest rates high reflects the RBA’s priority to control inflation effectively. As we look ahead, their monetary policy framework remains focused on fostering long-term economic health and stability.

Implications of Current Interest Rates on the Economy in Australia

High **interest rates** can drastically impact business investments. Companies may hold back on expansion plans or projects due to increased borrowing costs, creating a ripple effect throughout the economy. There’s a palpable sense of uncertainty surrounding the future of monetary easing, as many are eager to know when rates might begin to decrease.

Economic Stability and Financial Implications

The Balance Between Interest Rates and Economic Health

Finding the right balance between **interest rates** and economic health is crucial. An increase in rates can help bring down inflation, but it can also slow economic growth if maintained for too long. It is vital for consumers and businesses alike to practice sustainable financial habits as they navigate these changing conditions.

Consumer Behavior and Economic Policy

High **interest rates** do tend to affect how consumers spend and save. With heightened borrowing costs, many people may choose to save more rather than spend, which can reset economic expectations. Insights from the latest discussions in the RBA’s board meetings highlight the need to adapt economic policies to align with these consumer behaviors and maintain stability.

Conclusion

In summary, understanding the significance of **interest rates** is critical in today’s economic framework in Australia. The RBA’s careful approach to managing these rates in light of inflation is vital for guiding economic stability. Staying informed about potential shifts in the RBA’s monetary policy can empower consumers to make better financial decisions as we navigate this complex landscape.

For further reading, checking reports and studies on **interest rates**, inflation trends, and RBA decisions can provide more in-depth insights into these critical economic factors.

What are the current interest rates in Australia?

The current interest rates in Australia have reached a 12-year high as the RBA takes measures to combat rising inflation.

How do high interest rates affect consumers?

High interest rates can lead to more expensive repayments on loans and mortgages for consumers. However, savers might benefit from better interest returns on savings accounts.

Why has the RBA kept interest rates high?

The RBA is focusing on controlling inflation, which is why they have opted to maintain high interest rates as a monetary policy tool.

How does inflation impact interest rate decisions?

Inflation denotes rising prices and decreasing purchasing power, prompting the RBA to adjust interest rates to manage economic stability effectively.

What are the effects of high interest rates on businesses?

High interest rates may restrict business investments as increased borrowing costs can lead companies to reconsider expansion plans.

What should consumers consider during this time?

Consumers should practice sustainable financial habits, potentially increasing savings and being mindful of spending due to higher borrowing costs.

How can I stay informed about changes in interest rates?

It’s advisable to check reports and studies on interest rates, inflation trends, and RBA decisions to keep abreast of the economic climate.