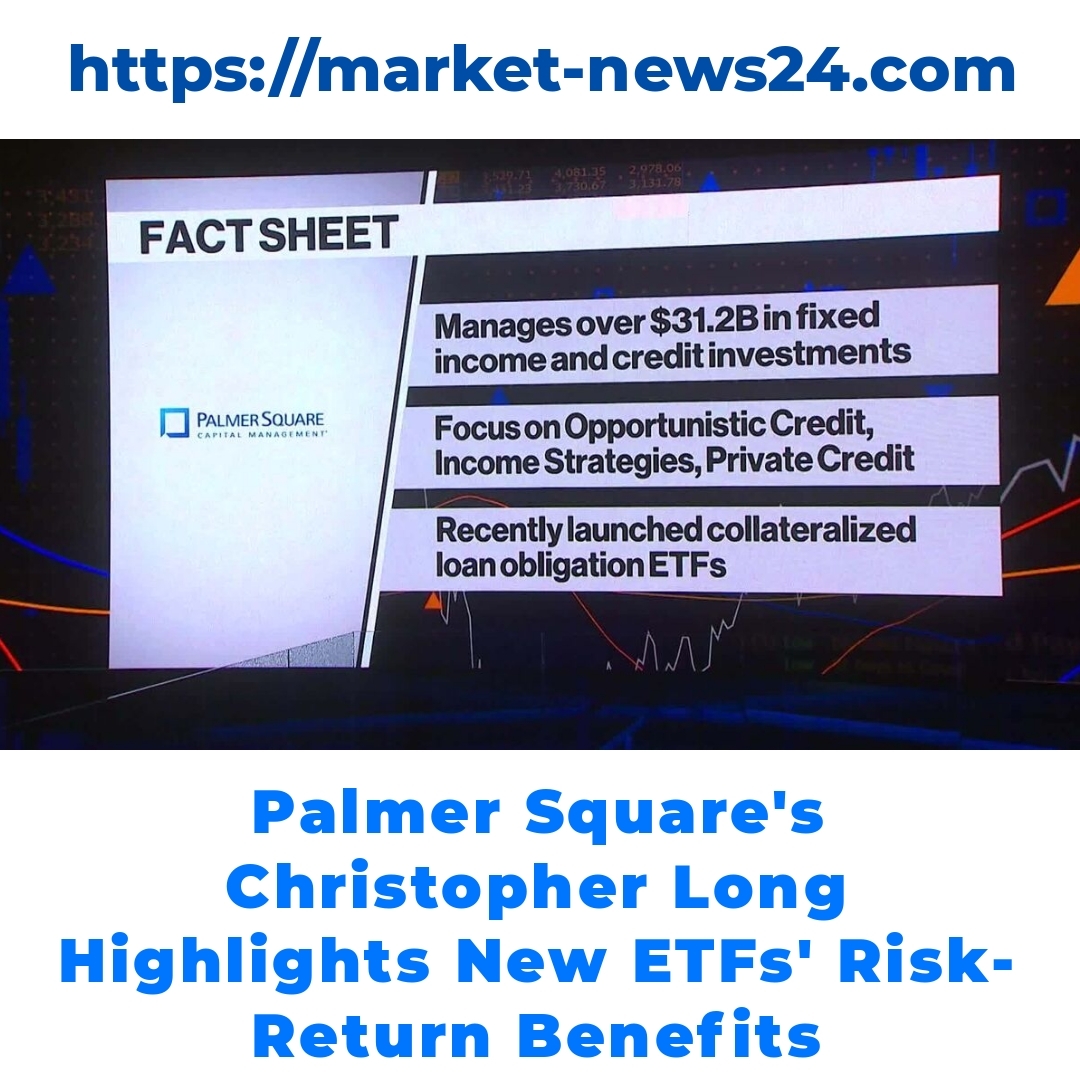

ETFs, or Exchange-Traded Funds, have become increasingly popular in today’s financial markets, offering unique benefits as a risk-return product. Christopher Long, Founder and CEO of Palmer Square Capital Management, shares valuable insights on their advantages during a discussion with Vonnie Quinn on Bloomberg Markets. This article delves into the significance of ETFs in strategic investment planning.

ETFs, or Exchange-Traded Funds, are financial products that blend many attractive features of traditional investments while providing unique advantages that have made them increasingly popular among investors. Unlike mutual funds, ETFs trade on stock exchanges, allowing investors to buy and sell throughout the day just like individual stocks. This flexibility, along with their diverse offerings, has made ETFs a go-to choice for many seeking to optimize their portfolios.

Christopher Long, the Founder and CEO of Palmer Square Capital Management, emphasizes the importance of understanding the structure and benefits of ETFs. In a recent discussion with Vonnie Quinn on Bloomberg Markets, he highlighted how ETFs function not only as individual securities but also as efficient risk-return products. By pooling various assets, ETFs provide investors with a way to gain exposure to different markets and sectors with ease.

One of the key points Christopher Long made during his interview is that ETFs have distinct advantages over traditional investment options. For instance, his insights underline how ETFs can deliver superior risk-adjusted returns. This is largely due to their ability to offer diversification, as a single ETF may contain dozens or even hundreds of different stocks or assets, thus reducing the need to select each investment individually.

When we look at the benefits of ETFs as a risk-return product, diversification emerges as a standout feature. By investing in an ETF, investors can spread their assets over multiple securities, which helps to mitigate risk. This means that if one security underperforms, the impact on the entire investment is lessened. Additionally, many ETFs come with lower expense ratios compared to mutual funds, which can enhance overall returns over time.

Palmer Square Capital Management has a distinct approach to investing in ETFs. They utilize these funds not just for diversification but as critical components of their portfolio management strategy. By strategically allocating assets within ETFs, the firm aims to align its portfolios with investor goals while maintaining a focus on risk management. This approach speaks to the strategic use of ETFs as they’re designed to handle market fluctuations effectively.

One of the vital roles of diversification in investing cannot be overstated. Modern investors increasingly seek to balance their portfolios to manage risk while pursuing returns. Different types of ETFs—like those focusing on specific sectors, regions, or asset classes—can be combined to create a well-rounded investment strategy. For example, an investor might choose to hold a mix of equity, bond, and commodity ETFs to balance out their exposure to market volatility.

There are various investment strategies that utilize ETFs to optimize performance in financial markets. Investors can opt for passive management strategies, where they hold ETFs that track an index, or active management strategies that involve frequent trading to capitalize on market movements. Each approach can lead to different outcomes, but the integration of ETFs provides a flexible tool for navigating various market conditions.

In conclusion, the advantages of ETFs as a risk-return product are significant. Insights from Christopher Long reinforce the idea that these funds are not only strategically beneficial for diversification but can also enhance overall portfolio performance. As ETFs continue to gain prominence in investment strategies, it’s essential for investors to consider how they can fit into their specific financial goals. The growing relevance of ETFs in today’s market underscores the importance of incorporating them into a well-rounded asset management approach.

What are ETFs?

ETFs, or Exchange-Traded Funds, are financial products that offer a blend of features from traditional investments while providing unique benefits. They trade on stock exchanges, allowing investors to buy and sell throughout the day, similar to individual stocks.

What are the main advantages of investing in ETFs?

- Flexibility to trade like individual stocks.

- Diversification by holding numerous assets within a single ETF.

- Lower expense ratios compared to mutual funds.

- Potential for superior risk-adjusted returns.

How do ETFs provide diversification?

By pooling various assets, ETFs allow investors to spread their investments across multiple securities, which helps reduce risk. If one security performs poorly, it doesn’t significantly impact the entire investment.

What investment strategies can be used with ETFs?

- Passive management strategies, where ETFs track an index.

- Active management strategies, involving frequent trading to take advantage of market movements.

How does Palmer Square Capital Management use ETFs?

Palmer Square Capital Management integrates ETFs into their portfolio management strategy, focusing on risk management while aligning portfolios with investor goals.

Can different types of ETFs be combined in a portfolio?

Yes, different types of ETFs, such as those focused on specific sectors, regions, or asset classes, can be combined to create a well-rounded investment strategy.

Why are ETFs gaining popularity among investors?

ETFs are becoming increasingly popular due to their flexibility, cost-effectiveness, and potential to enhance overall portfolio performance. They are a key component in modern investment strategies, allowing investors to manage risk while pursuing returns.