Recent fluctuations in the oil market have captured attention, particularly in light of escalating tensions in the Middle East. These geopolitical factors significantly affect oil prices, making it crucial to analyze current trends. As we approach 2025, understanding these dynamics will be vital for market participants and stakeholders alike.

The Current State of the Oil Market

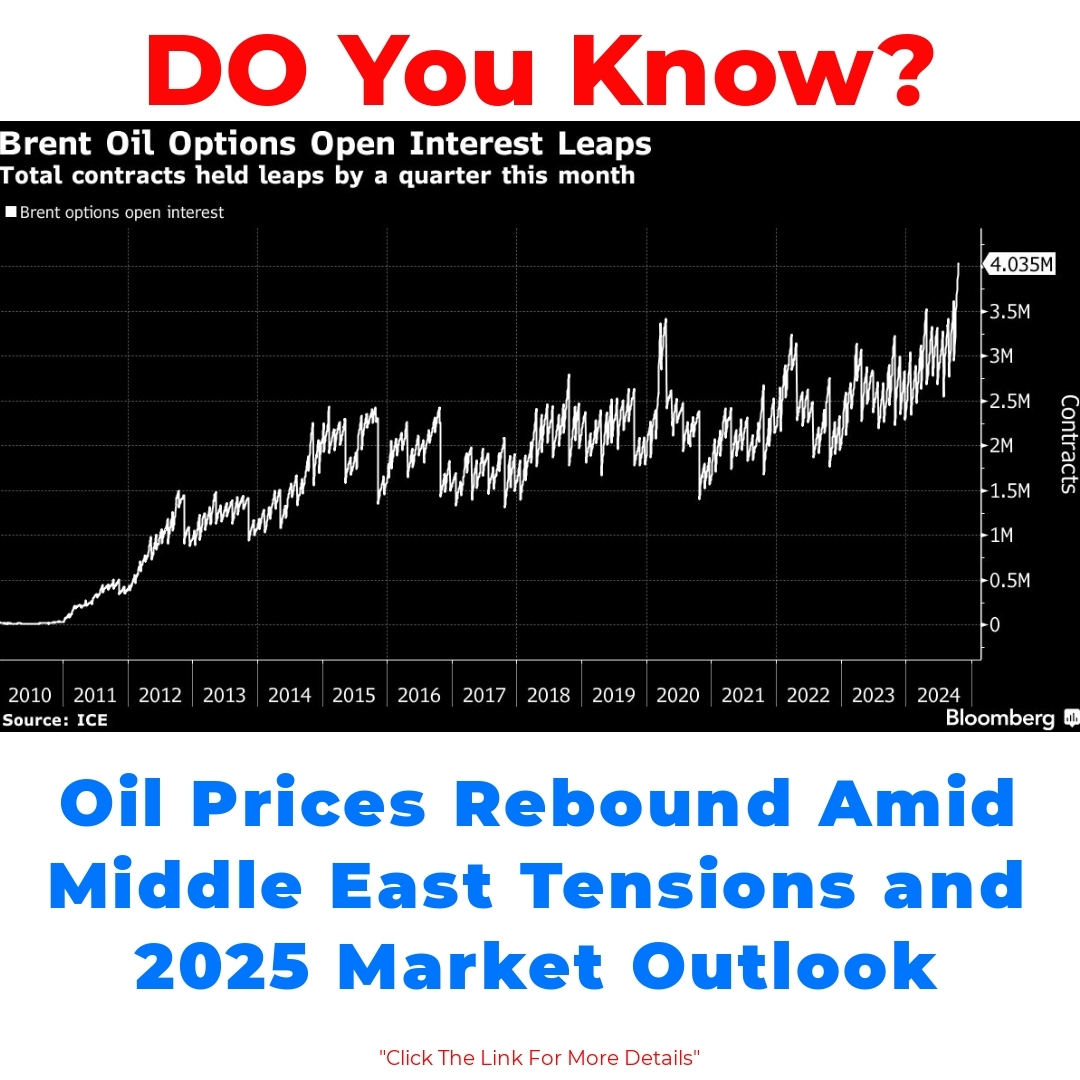

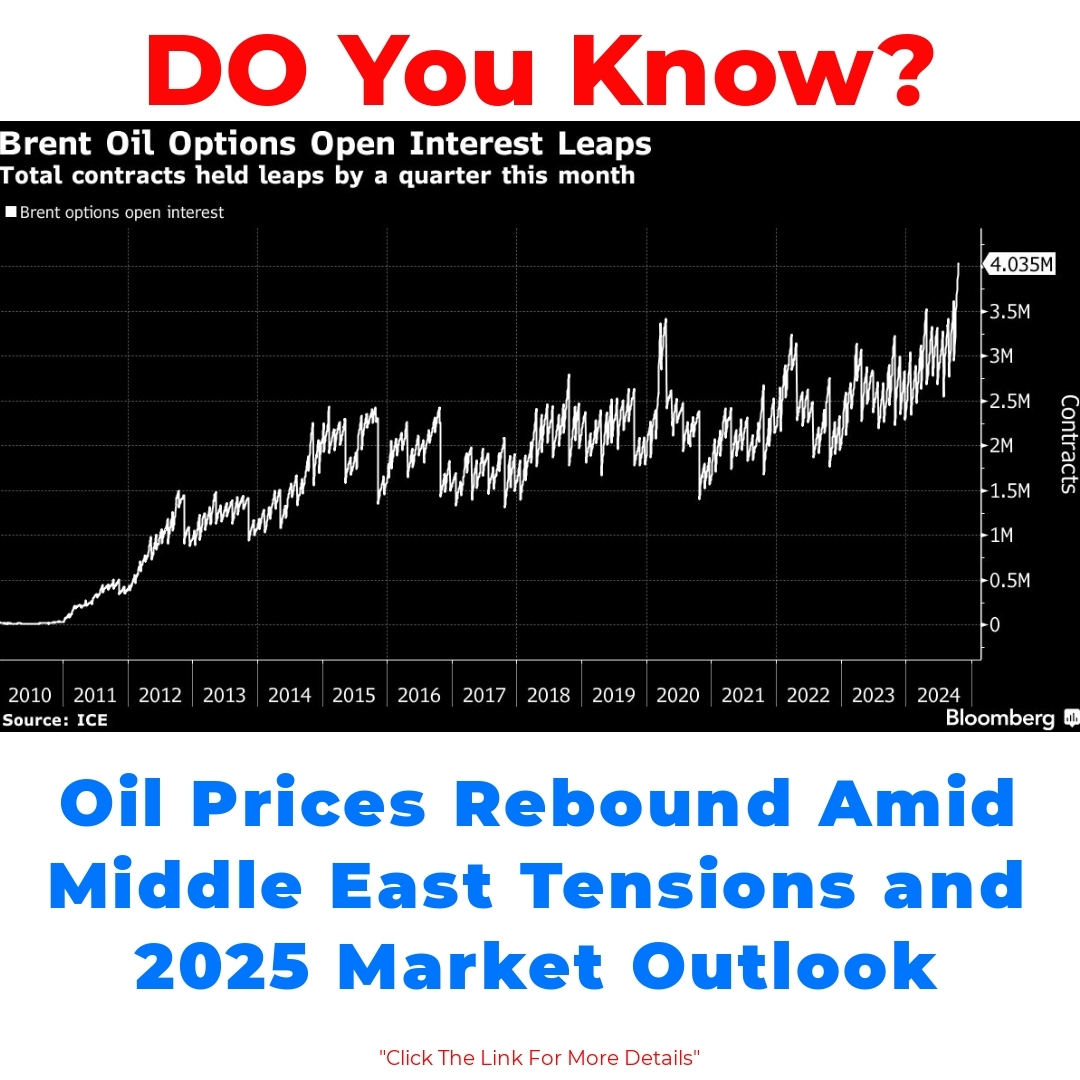

The oil market has recently seen a notable rebound in prices. This shift can be traced back to several key factors that are influencing market dynamics. Firstly, the global recovery from the pandemic has led to increasing demand for oil as industries ramp up production and travel resumes. Secondly, supply chain challenges and reduced output from major oil-producing countries have contributed to tightened supply.

Traders’ assessments are crucial during these times. Market sentiment has recently been optimistic, with many traders believing that the recovery will continue as economies strengthen. When we compare the current market conditions with historical data, it’s clear that we are entering a unique phase, one that might bear some similarities to past recoveries but also differs based on global and regional dynamics.

Understanding Middle East Tensions and Their Impact

Middle East tensions have always had significant geopolitical implications, particularly for the oil market. These tensions include conflicts, trade disputes, and political instability, all of which can disrupt oil supply chains. Understanding how Middle East tensions affect oil prices is essential for anyone involved in oil trading or investment.

When tensions escalate in this region, it often leads to fears of supply disruptions. This, in turn, can push oil prices up as traders react to potential risks. An example of this can be seen in recent events where political instability has raised concerns about oil production, thereby impacting oil supply and demand dynamics globally. As we move toward 2025, these geopolitical factors will continue to play a pivotal role in shaping market behavior.

Market Outlook Heading into 2025

As we look ahead to 2025, experts are closely monitoring anticipated trends in the oil market. Many analysts suggest that we could see a steady increase in oil prices as demand continues to recover and geopolitical issues persist. When discussing the oil forecast for 2025, it’s important to consider economic indicators such as global GDP growth and energy consumption patterns.

Statistical data indicates a possible rise in prices due to both demand recovery and supply constraints. Coupled with expert opinions, this projection paints a picture of a market that might be more volatile due to ongoing geopolitical tensions, particularly in oil-producing regions. Navigating these trends will be crucial for traders and investors alike.

The Role of Geopolitical Risks

Geopolitical risks significantly influence the oil market dynamics. Changes in political landscapes can severely affect oil supply and prices. As conflicts arise or relationships between major oil-producing nations shift, traders and market analysts must remain vigilant to adapt to these changes.

Assessing the impact of geopolitical risks on oil supply is vital. For instance, if a major oil-producing country faces sanctions or internal unrest, global oil supply can fluctuate dramatically. This volatility often leads to pronounced shifts in oil prices, making it essential for participants in the oil market to stay informed and adaptive in the face of uncertainty.

Insights from Traders: What They Are Saying About the Oil Market

Recent insights from market analysts and traders reveal a mixed yet cautiously optimistic sentiment regarding the oil market. Many traders believe that while the risks are high, the potential for growth is equally significant. Insights into what traders are saying about the oil market can provide an understanding of market sentiment.

Traders emphasize the importance of being prepared for fluctuations in oil prices due to both market recovery and ongoing geopolitical tensions. Their feedback suggests a focus on strategic investments and risk management as key methods for navigating the complexities ahead.

Conclusion

In summary, the intricate relationship between the oil market and Middle East tensions cannot be overstated. As we approach 2025, it’s crucial for all market participants to stay updated on how these geopolitical factors will impact oil prices. The current environment presents both challenges and opportunities, and a keen understanding will be essential for making informed decisions moving forward.

Staying adaptable to market changes is key, and being aware of ongoing developments in the oil landscape will benefit stakeholders significantly.

Call to Action

If you want to keep up with the latest oil market trends and insights, consider subscribing for updates. Engaging in discussions on social media platforms about market predictions can also provide valuable perspectives. By staying connected, you can enhance your understanding and readiness for whatever the future holds in the oil market.

FAQ

What are the main factors driving the recent rebound in oil prices?

The recent increase in oil prices is primarily influenced by:

- The global recovery from the pandemic, leading to higher demand.

- Supply chain challenges and reduced output from major oil-producing nations.

How do Middle East tensions affect oil prices?

Middle East tensions can disrupt supply chains, causing fears of supply interruptions. When such tensions arise, prices often increase as traders react to the potential risk of shortages.

What should we expect from the oil market heading into 2025?

Experts predict a steady rise in oil prices due to:

- Recovering demand.

- Ongoing geopolitical tensions that could maintain market volatility.

What role do geopolitical risks play in the oil market?

Geopolitical risks can lead to significant fluctuations in oil supply and prices. For example, sanctions or unrest in oil-producing countries can dramatically affect global oil availability, resulting in price volatility.

What are traders currently saying about the oil market?

Traders express a cautious optimism, acknowledging high risks but also notable growth potential. They highlight the importance of strategic investments and robust risk management to navigate the current market complexities.

How can market participants stay informed about these trends?

Staying updated involves:

- Following the latest news and developments in the oil market.

- Engaging in discussions on social media for diverse perspectives.