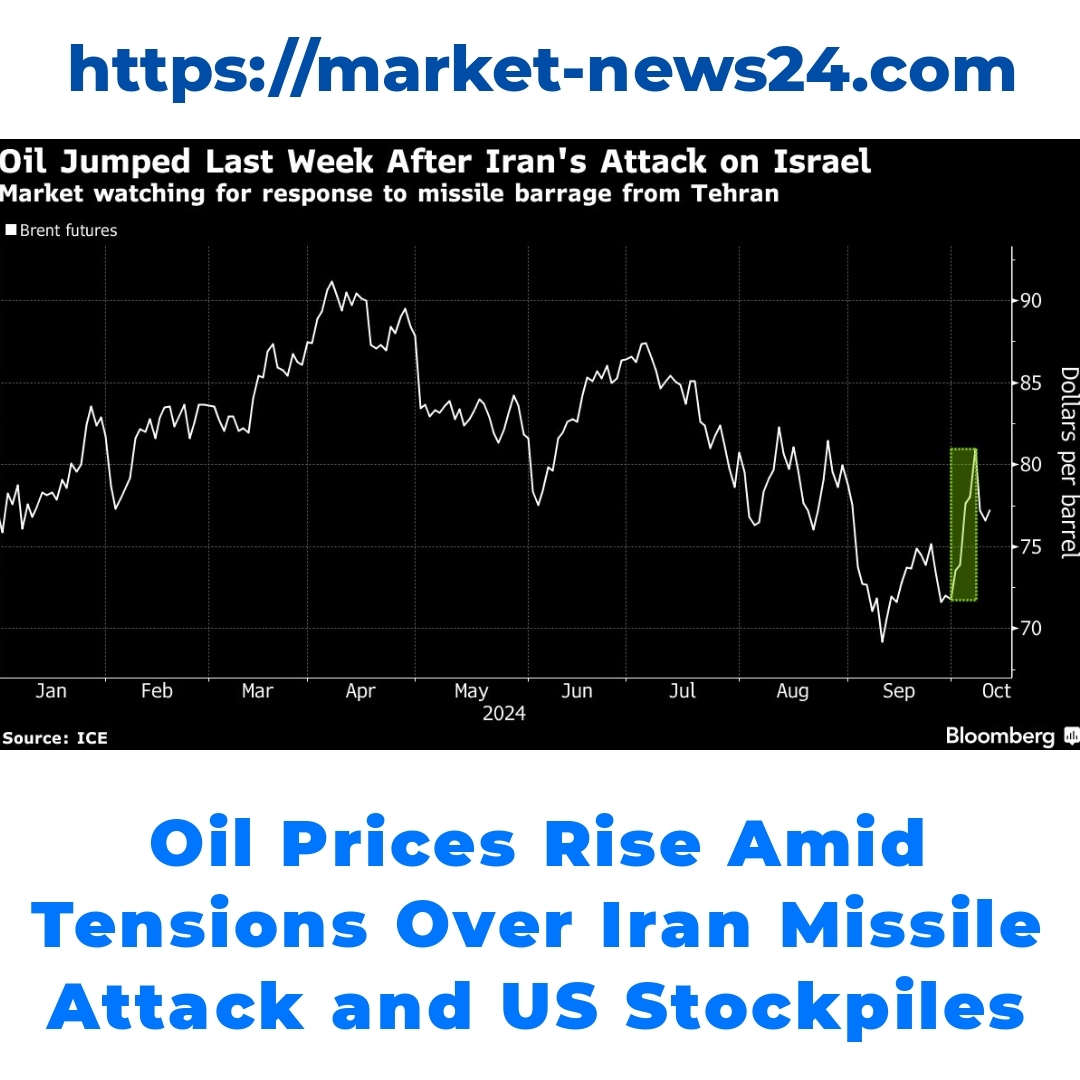

The oil market is witnessing significant fluctuations, with recent rises in oil prices following a temporary decline. Key factors influencing these movements include rising geopolitical tensions, highlighted by the recent Iran missile attack, and shifts in US crude stockpiles. Understanding these dynamics is crucial for grasping current trends in the oil prices landscape.

Recent Fluctuations in Oil Prices

The recent increase in oil prices comes after a noticeable two-day decline. Markets are reacting to various factors, but the spotlight is on geopolitical events that are driving prices up. For instance, reports suggest that oil prices have risen significantly, peaking at approximately $75 a barrel. Such fluctuations can really affect not just traders but consumers too. Understanding these changes is key for anyone interested in the oil market.

The Impact of the Iran Missile Attack on Crude Oil Trading

One of the major catalysts for the current rise in oil prices is the recent Iran missile attack. This incident sent shockwaves through the crude oil trading community, causing concerns over supply disruptions. When geopolitical tensions rise, traders often react by adjusting their positions in the oil markets. This can lead to as much as a 3% increase in oil prices in just a few hours! The Iran missile attack is a prime example of how geopolitical events can directly influence market stability and trader sentiment.

US Crude Stockpiles and Their Market Significance

Another crucial factor in the oil market right now is the data on US crude stockpiles, which have seen an increase. Recent reports have shown that stockpiles have grown considerably, reaching levels that may signal a surplus in supply. This can have a significant impact on oil prices, potentially stabilizing them despite geopolitical tensions. Understanding the impact of US crude stockpiles on prices is essential; they can counterbalance sudden disruptions caused by international events, like the recent missile attack from Iran.

Potential Israeli Response and Geopolitical Tensions

As tensions remain high, the anticipated Israeli response to the Iran missile attack could further complicate the oil market landscape. There’s uncertainty about how Israel may react, and any retaliatory action could exacerbate geopolitical tensions in oil markets. This situation could lead to increased volatility in oil prices. Traders are on edge as they wait to see how the situation unfolds, understanding that even the slightest shift can have major implications for crude oil trends globally.

Links Between Geopolitical Events and Oil Prices

Let’s take a step back and look at how ongoing Middle Eastern conflicts can influence oil prices on a broader scale. The connection between geopolitical events and oil prices is well-established. Every time there’s a missile attack or escalation in conflict, markets react. This brings us to the phrase: “how missile attacks affect oil prices.” It’s evident that such incidents lead to fears of supply disruptions, thus driving oil prices higher.

Conclusion

In summary, the fluctuations in oil prices we are witnessing today are deeply intertwined with significant geopolitical events, such as the Iran missile attack, as well as shifts in US crude stockpiles. Understanding these connections allows market participants and consumers to better anticipate changes in the oil landscape. By staying informed about the ongoing geopolitical tensions and their potential impacts, we can navigate the complexities of the oil market more effectively.

Frequently Asked Questions

What are the main reasons for the recent increase in oil prices?

The recent spike in oil prices is primarily driven by geopolitical events, particularly the Iran missile attack, which raised concerns about supply disruptions. Additionally, there’s a notable impact from US crude stockpile data.

How does a missile attack affect oil prices?

Missile attacks create uncertainty in the oil market, leading traders to fear potential supply disruptions. This often results in a rapid price increase, sometimes up to 3% within a few hours.

What is the significance of US crude stockpiles in the current market?

Increased US crude stockpiles suggest a potential surplus in supply. This can stabilize oil prices amid geopolitical tensions, providing a counterbalance to disruptions caused by international incidents.

What could happen if Israel retaliates against Iran?

An Israeli response to the recent missile attack could escalate tensions further, potentially increasing volatility in oil prices. Traders remain cautious as the situation evolves, knowing that any changes can significantly impact the market.

Why is it important to understand the links between geopolitical events and oil prices?

Understanding these links is crucial for anticipating market changes. Geopolitical events, such as missile attacks, can lead to price fluctuations and affect both traders and consumers in the long run.