Dear Jerome Powell, Chairman of the Federal Reserve, the spotlight is on gold and silver as investors and analysts question whether everything is under control in the economy. With uncertainty surrounding inflation, interest rates, and the impact of global events, the precious metals Market is garnering increased attention. Stay tuned to MishTalk for the latest updates and insights on these crucial economic indicators.

Win Up To 93% Of Your Trades With The World’s #1 Most Profitable Trading Indicators

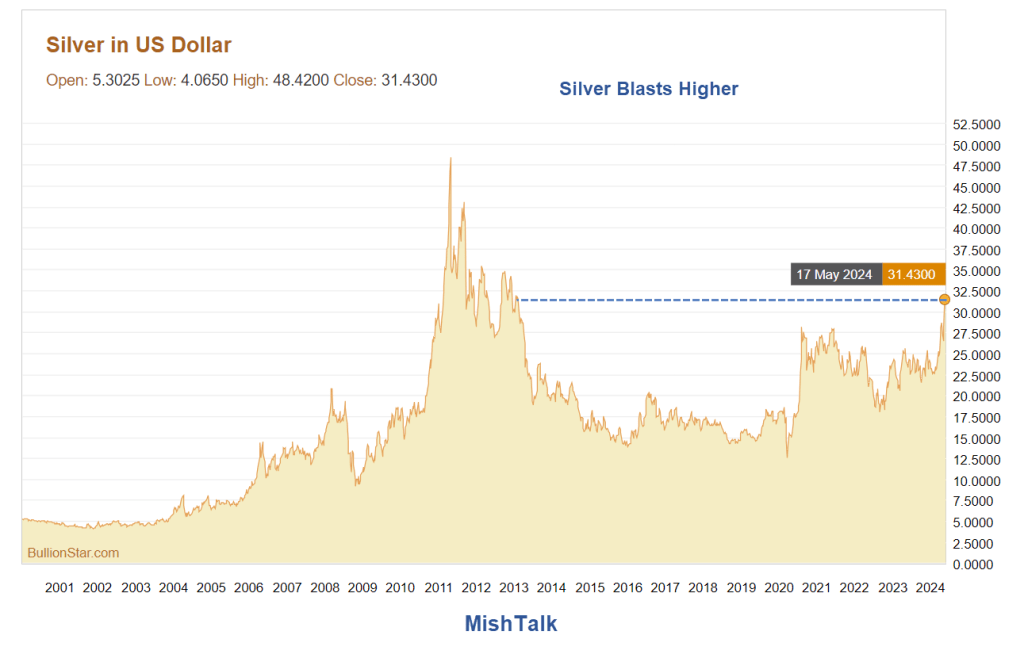

The US stock markets are soaring, with record highs across the board. Gold prices are also hitting all-time highs, while silver hasn’t seen prices this high since 2013. It seems like everyone is winning in this Market, with no room for losses.

Silver bulls, copper bulls, gold bulls, S&P 500 bulls, Nasdaq bulls, Dow bulls, and US housing bulls are all celebrating this Market rally. The excitement is palpable, with headlines buzzing about the surge in silver prices.

Gold is also experiencing a strong upward trend, with its highest move in a year coinciding with a rise in the US dollar. Contrary to popular belief, gold and the dollar don’t always move in opposite directions. Sometimes, they can both rise together, signaling a complex relationship between the two assets.

While gold is often touted as an inflation hedge, historical data shows that it doesn’t always perform well in times of inflation. Instead, gold shines as a hedge against credit stress, stagflation, and a lack of faith in central banks.

The current Market situation is sending a clear message – things are not completely under control. Gold and other assets like Bitcoin are being sought after as safe havens in uncertain times. As investors navigate these turbulent waters, it’s essential to stay informed and make smart financial decisions.

For those looking to buy gold, reputable dealers like Bullion Star offer a range of options, including grams of gold and silver as well as ounces. Their affiliate program provides a convenient way to access precious metals investments without added costs.

In a world where faith in central banks is wavering, gold and other alternative assets offer a sense of security and stability. As the Market continues to evolve, it’s crucial to stay vigilant and adapt to changing conditions.

Win Up To 93% Of Your Trades With The World’s #1 Most Profitable Trading Indicators

1. Is Jerome Powell in control of the economy?

Yes, he is the Chairman of the Federal Reserve and plays a significant role in shaping the country’s economic policies.

2. How does gold and silver relate to Jerome Powell’s actions?

Gold and silver prices often react to changes in economic policies and interest rates set by the Federal Reserve, which is led by Jerome Powell.

3. Should I invest in gold and silver now?

It’s always a good idea to diversify your investment portfolio, and gold and silver can be a good hedge against economic uncertainty and inflation.

4. What factors can impact the prices of gold and silver?

Factors such as geopolitical tensions, inflation rates, and the strength of the US dollar can all influence the prices of gold and silver.

5. What should I do if I’m concerned about the economy?

It’s always a good idea to stay informed, diversify your investments, and consider consulting with a financial advisor to make informed decisions.

Win Up To 93% Of Your Trades With The World’s #1 Most Profitable Trading Indicators

Win Up To 93% Of Your Trades With The World’s #1 Most Profitable Trading Indicators