Hedge funds are currently rethinking their strategies concerning Brent crude prices as they move away from bearish bets in light of rising geopolitical tensions. Understanding these changes is crucial in grasping the larger dynamics of the oil market, where war risks are increasingly influencing investment decisions and market volatility.

Currently, hedge funds are making significant shifts in their strategies concerning Brent crude prices. As geopolitical tensions rise, these funds are moving away from bearish bets. It’s essential to understand how these changes are shaping the broader dynamics of the oil market, especially since war risks are influencing investment decisions and market volatility in unprecedented ways.

Understanding Hedge Funds and Their Strategies

Hedge funds play a crucial role in the commodities trading market. These investment funds utilize various strategies to maximize returns, often participating in the buying and selling of Brent crude. When discussing hedge fund strategies, two primary approaches stand out: long positions, which anticipate price increases, and short positions, which expect price declines. Traditionally, hedge funds have also engaged heavily in crude oil trading, particularly in the Brent market, seeking to benefit from price fluctuations.

For instance, a hedge fund might take a long position in Brent crude if they predict rising demand due to geopolitical events or seasonal changes. On the other hand, a short position reflects a bearish outlook, suggesting that a hedge fund expects prices to fall based on supply dynamics or economic downturns. These hedge fund strategies are vital for understanding how these investors navigate the complex energy market.

Current Market Trends: Bearish Bets and War Risks

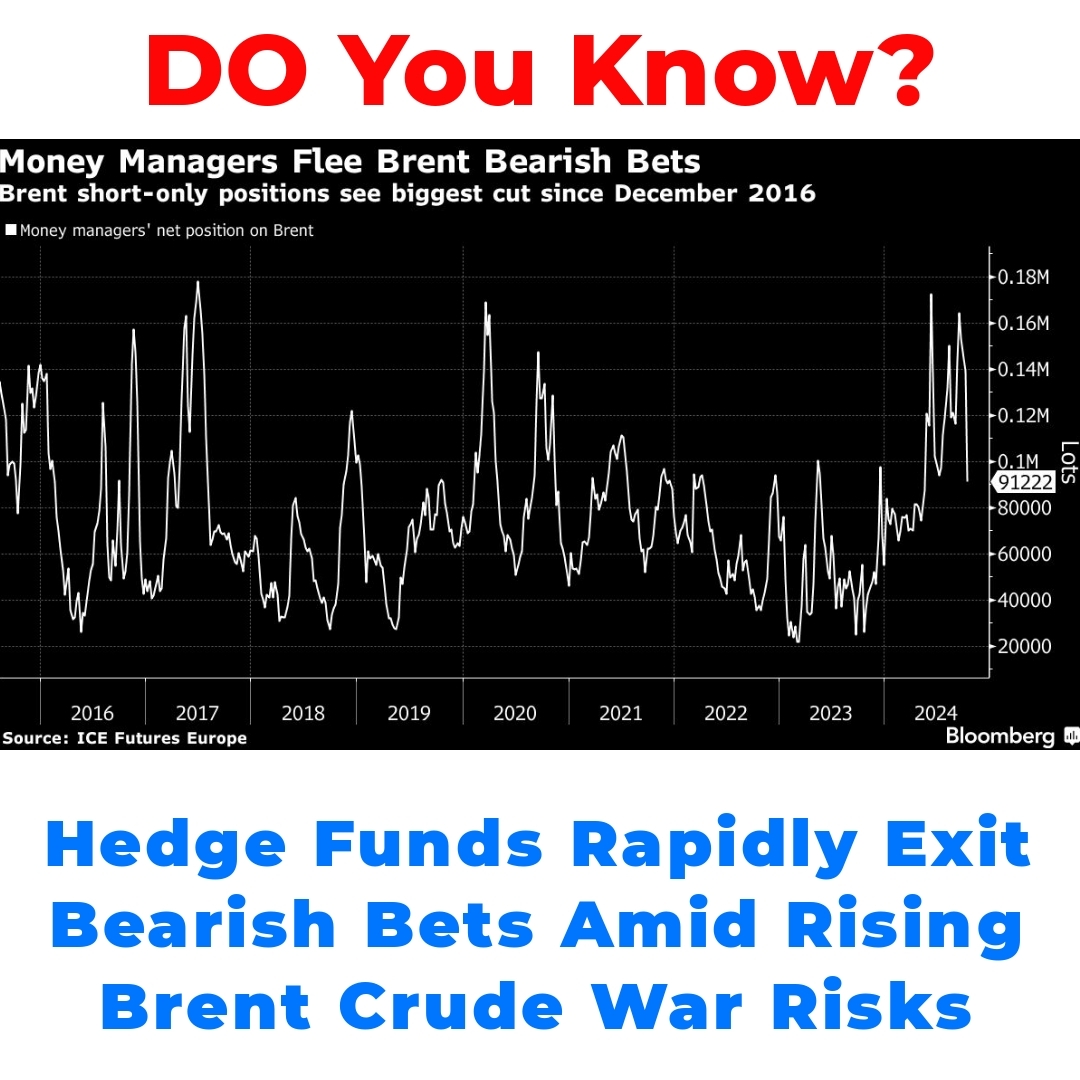

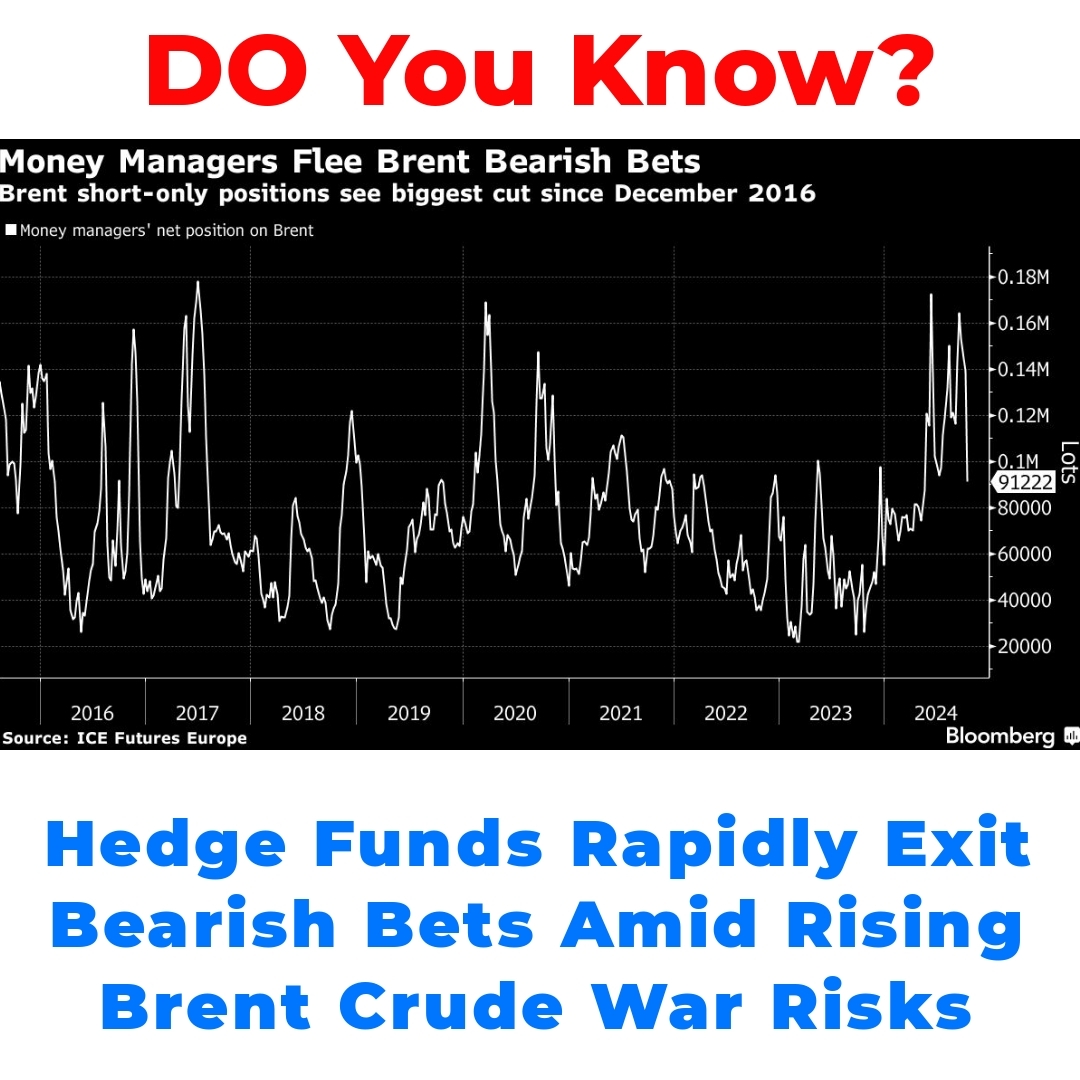

Recent data shows that hedge funds are rapidly reducing their bearish bets against Brent crude prices. Bearish bets involve wagering that prices will decrease, and the current market conditions are prompting many hedge funds to rethink this strategy. The decision to move away from such positions comes as geopolitical risks continue to rise.

When examining how these bearish bets relate to market predictions, it’s clear that they mirror investor sentiment regarding oil supply and demand. With escalating war risks, these funds are recognizing the potential for increased market volatility, which can disrupt traditional forecasting models. This recognition highlights how external factors, especially geopolitical tensions, can impact the oil market significantly.

The Impact of War Risks on Oil Prices

As war risks intensify, they are reshaping predictions for Brent crude prices. The impact of war risks on oil prices can be profound, affecting not only immediate supply concerns but also longer-term geopolitical stability. Historical events, such as conflicts in the Middle East, showcase how oil prices can soar in response to fears of supply disruptions.

By looking back, it’s evident that similar events have led to drastic price shifts in the oil market. For example, during the Gulf War in the early 1990s, Brent crude prices skyrocketed due to fears surrounding oil supply. Understanding these historical precedents provides context for current trends as investors gauge the possible outcomes of rising geopolitical tensions.

Hedge Funds and Their Perspective on Brent Crude Trading

Hedge funds are currently adjusting their approach to trading Brent crude amidst these geopolitical uncertainties. Many are focusing on how hedge funds are trading Brent crude, seeking to capitalize on pricing volatility rather than adhering strictly to bearish or bullish predictions.

Investment strategies have become increasingly nuanced, with funds looking for opportunities that may arise from short-term price fluctuations. Timing is crucial in this volatile market, so hedge funds are analyzing numerous indicators, such as inventory levels and geopolitical developments, to inform their trading approaches.

Investing in Brent Crude: Strategies Amidst Geopolitical Tensions

For those looking to invest in Brent crude oil, it’s essential to consider strategies for investing in Brent crude amid geopolitical tensions. These strategies may include diversifying investments, hedging against price volatility, and staying informed about global events that impact supply and demand.

- Stay updated on geopolitical developments affecting oil-producing regions.

- Consider using options and futures to hedge against potential price swings.

- Diversify by investing in related commodity sectors to mitigate risks.

When making decisions, investors should weigh factors like global economic trends, technological advancements, and shifts in energy policy—all of which can significantly impact Brent crude prices.

Brent Crude Price Predictions in a Volatile Market

Looking ahead, the forecasted price trends for Brent crude are increasingly uncertain due to the dynamics of a volatile market. Brent crude price predictions are likely to experience fluctuations driven by ongoing geopolitical risks and changing supply scenarios.

Market participants must prepare for potential price volatility as unexpected events can easily alter forecasted trends. By keeping a close eye on global developments and being proactive in their strategies, investors can navigate the complexities of the current oil market.

Conclusion

In summary, hedge funds are currently reevaluating their positions in the Brent crude market, moving away from bearish bets amid rising war risks. Recognizing the relationship between hedge funds and Brent crude prices is vital in understanding the broader oil market’s dynamics. As geopolitical tensions continue to evolve, the strategies that hedge funds adopt will be crucial for predicting future market behavior and price movements.

Ultimately, keeping abreast of these trends will help investors make more informed decisions in this complex and often unpredictable environment.

Hedge funds Brent crude prices

FAQ

What are hedge funds doing with Brent crude prices currently?

Hedge funds are shifting their strategies and moving away from bearish bets on Brent crude prices due to rising geopolitical tensions. This change is influencing their investment decisions and the overall oil market dynamics.

What does it mean to have a long or short position in Brent crude?

A long position means a hedge fund expects Brent crude prices to rise, while a short position indicates they believe prices will fall. Historically, hedge funds have utilized these positions to profit from fluctuations in the crude oil market.

Why are hedge funds reducing their bearish bets on Brent crude?

Hedge funds are reducing bearish bets because the current geopolitical risks have created a more volatile market. They are reconsidering their strategies as they recognize the potential for price increases due to these external factors.

How do war risks impact Brent crude prices?

War risks can lead to significant fluctuations in Brent crude prices. Historical events, like the Gulf War, show that fears of supply disruptions can cause prices to soar. Current geopolitical tensions are prompting similar concerns among investors.

What strategies can investors use when investing in Brent crude?

- Stay updated on geopolitical events affecting oil production.

- Utilize options and futures to protect against price fluctuations.

- Diversify investments across related commodities to reduce risk.

What should investors consider for Brent crude price predictions?

Investors should be aware that price predictions for Brent crude are becoming less certain due to ongoing geopolitical risks. They need to prepare for potential volatility and stay informed on global developments that could impact supply and demand.