Indian bonds are increasingly capturing the attention of global investors, marked by their significant role in the evolving international investment landscape. With the advent of exchange-traded funds (ETFs), these financial instruments are becoming more accessible, paving the way for substantial capital flows into the Indian bond market driven by global index inclusion.

Understanding Indian bonds is crucial for any investor looking to diversify their portfolio. But what exactly are Indian bonds? In simple terms, Indian bonds are debt securities issued by the Indian government or corporations to raise funds. There are various types of Indian bonds, including government securities, corporate bonds, and municipal bonds. Over recent years, the Indian bond market has shown remarkable growth potential, fueled by increasing investor appetite and sound economic policies.

Investors from around the world are turning to Indian bonds for fixed-income investments. What makes them particularly appealing is India’s emerging market status, which often correlates with higher returns compared to more developed markets. The allure of Indian bonds is further enhanced by the country’s robust economic growth and favorable demographics.

The next big thing in bond investments is exchange-traded funds (ETFs), which provide a unique way to invest in Indian bonds. But how do ETFs work? Essentially, ETFs are investment funds that trade on stock exchanges, much like stocks. They pool money from multiple investors to purchase a diversified portfolio of assets, which can include Indian bonds. The primary advantage of using ETFs is their flexibility and lower fees compared to traditional mutual funds.

When it comes to investing in Indian bonds through ETFs, the process is fairly straightforward. Investors can buy shares of an ETF that focuses on Indian bonds right from their brokerage accounts. Some leading ETF providers, like ICICI Prudential and SBI Mutual Fund, have rolled out their own offerings, making it easier for both domestic and international investors to gain exposure to this lucrative market.

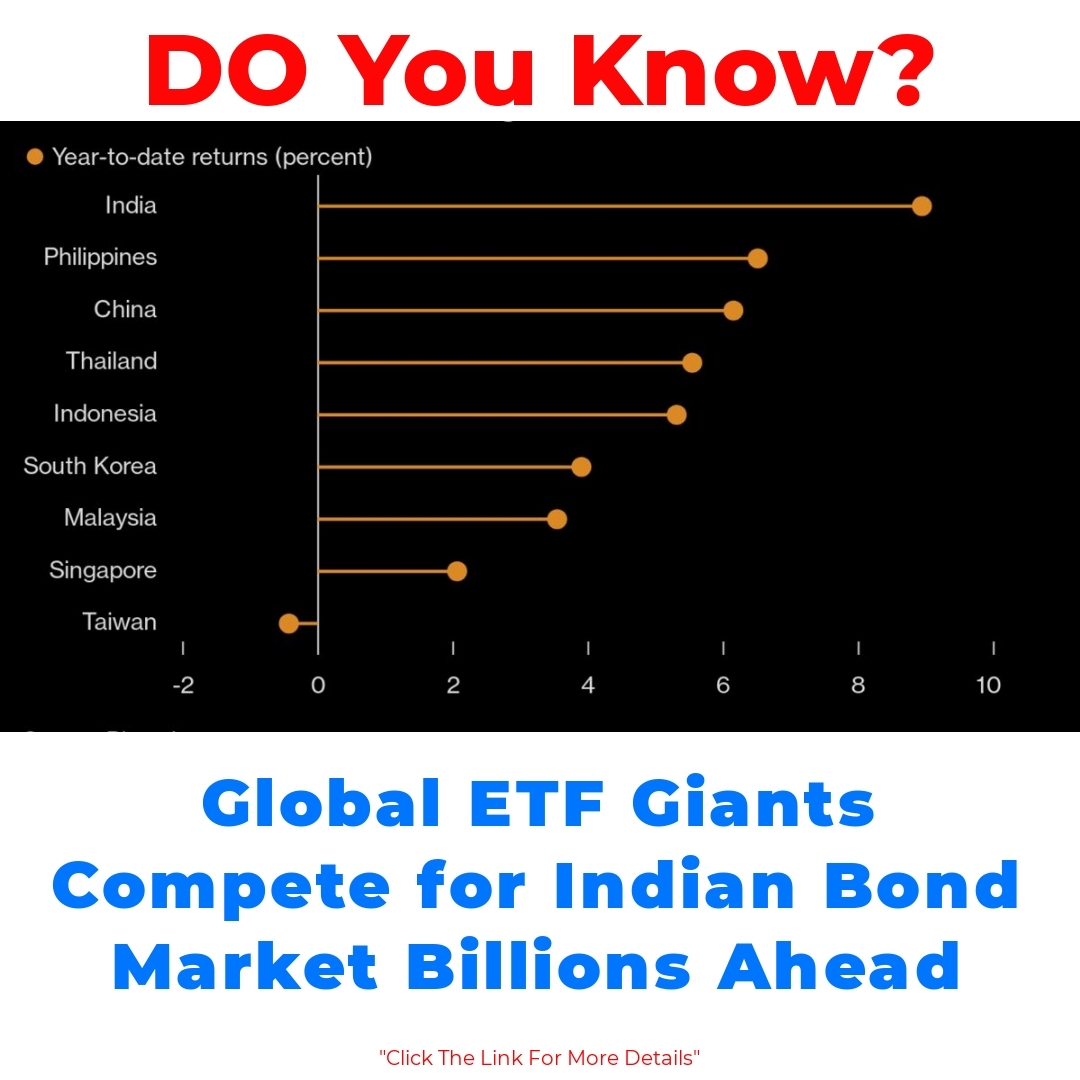

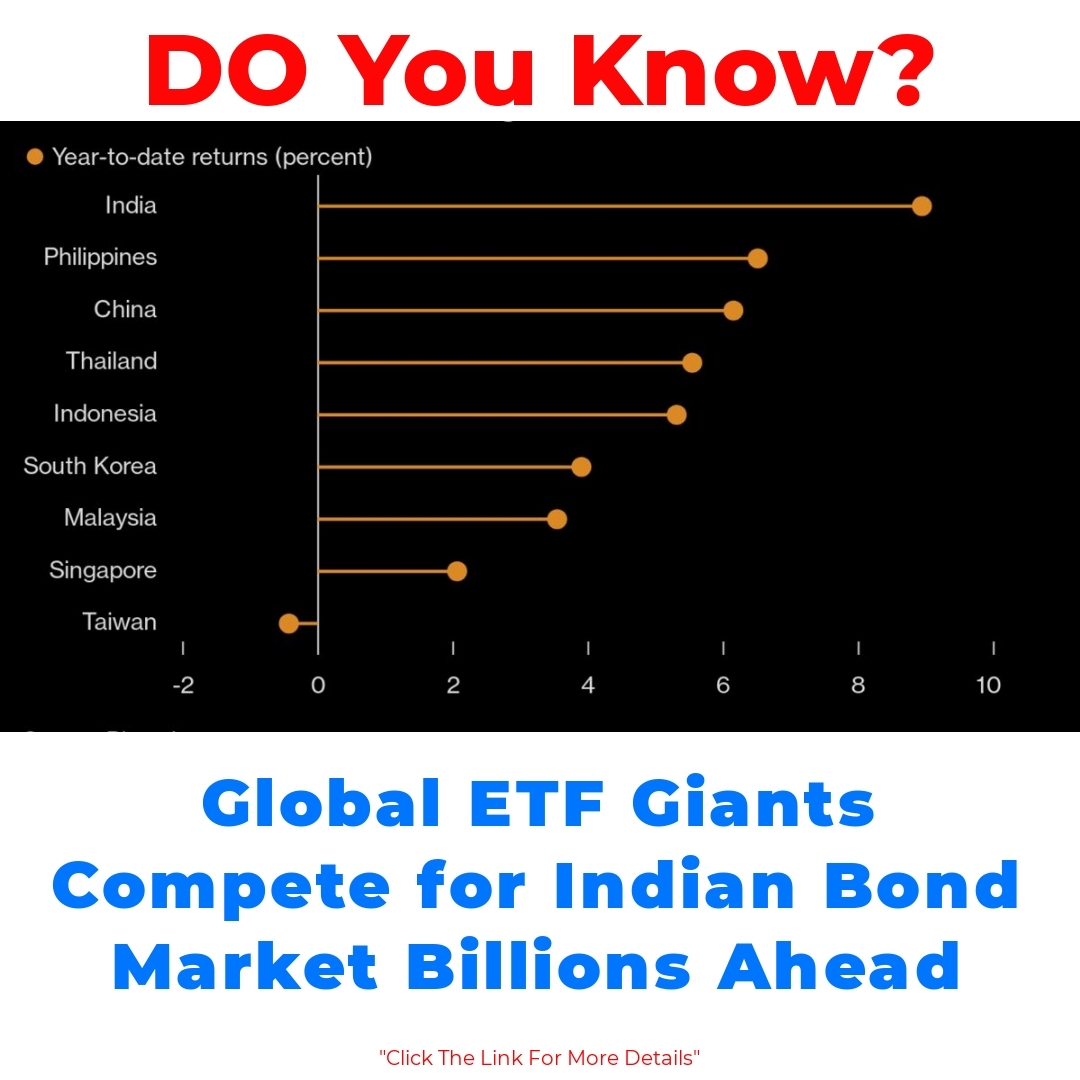

So, why are global indexes so important in this scenario? Global indexes are collections of various assets that serve as benchmarks for investor performance. The inclusion of Indian bonds in these global indexes means they become more visible to global fund managers and investors. This index inclusion is expected to drive considerable capital flows into Indian bonds, signaling to potential investors that they are a significant player in the bond market.

As Indian bonds get included in major global indexes, the anticipated surge in capital flows could benefit both bond investors and ETF providers. For investors, this can translate into more liquidity, diversified risk, and competitive yields. For ETF providers, it opens up new avenues for attracting investment, further enriching the Indian bond landscape.

Current trends in bond investments indicate that interest in Indian bonds is growing. This trend reflects the broader context of emerging markets, where investors are increasingly seeking out new opportunities. Factors driving these investment opportunities include India’s strong economic fundamentals and government initiatives aimed at improving infrastructure and financial stability.

Moreover, when comparing Indian bonds to other emerging market bonds, investors may find that Indian bonds often offer competitive returns with acceptable risk profiles. While every investment comes with its own risks, the dynamics of the Indian bond market create a compelling case for investors exploring fixed-income options. It’s essential to weigh these factors when deciding where to allocate your investment capital.

Another significant advantage of Indian bonds is their potential for diversification. In a global investment portfolio, Indian bonds can serve as a tool for risk mitigation, balancing other asset classes. This mix can enhance the overall performance of your portfolio, making it a strategic component for long-term growth.

Looking ahead, the future of Indian bonds seems promising. As global interest continues to rise, many experts predict that Indian bonds will increasingly become a staple in global capital flows. This growing interest necessitates that ETF providers adapt quickly to changing market dynamics, ensuring that they offer products that meet investor needs effectively.

In conclusion, the significance of Indian bonds cannot be overstated. They present unique investment opportunities, particularly through the lens of exchange-traded funds (ETFs). With their potential for high returns, diversification benefits, and the excitement of upcoming capital flows driven by global index inclusion, Indian bonds are becoming an essential part of the global investment landscape. Investors are encouraged to explore the many advantages of including Indian bonds in their portfolios through ETFs, as they position themselves for future growth in an evolving market.

What are Indian bonds?

Indian bonds are debt securities issued by the Indian government or corporations to raise funds. They include:

- Government securities

- Corporate bonds

- Municipal bonds

Why invest in Indian bonds?

Investors find Indian bonds attractive because:

- They often offer higher returns compared to developed markets.

- India’s strong economic growth and favorable demographics boost their appeal.

How do exchange-traded funds (ETFs) work in relation to Indian bonds?

ETFs are investment funds that trade on stock exchanges, similar to stocks. They:

- Pool money from multiple investors to buy a diversified portfolio of assets, including Indian bonds.

- Offer advantages like flexibility and lower fees compared to traditional mutual funds.

How can I invest in Indian bonds through ETFs?

Investing in Indian bonds via ETFs is simple:

- Purchase shares of an ETF that focuses on Indian bonds through your brokerage account.

- Prominent ETF providers like ICICI Prudential and SBI Mutual Fund offer various options.

What role do global indexes play in Indian bond investments?

Global indexes are benchmarks for investor performance. Including Indian bonds in these indexes:

- Makes them more visible to global fund managers.

- Is expected to drive significant capital flows into Indian bonds.

What are the benefits of increased capital flows into Indian bonds?

Increased capital flows can lead to:

- More liquidity.

- Diversified risk.

- Competitive yields for investors.

How do Indian bonds compare to other emerging market bonds?

Indian bonds often provide:

- Competitive returns.

- Acceptable risk profiles.

What are the diversification benefits of Indian bonds?

Including Indian bonds in a global investment portfolio can help:

- Mitigate risk.

- Balance other asset classes.

- Enhance overall portfolio performance.

What does the future look like for Indian bonds?

Experts predict that as global interest grows, Indian bonds will:

- Become a key component of global capital flows.

- Require ETF providers to adapt to meet investor demands.