The resurgence of meme-stock frenzy is signaling a bullish US stock Market. Amateur investors are driving up the prices of popular stocks, reminiscent of the GameStop saga earlier this year. This trend points to potential Market frothiness as retail traders continue to shake up traditional investing strategies. Stay tuned for more updates on this evolving Market phenomenon.

Win Up To 93% Of Your Trades With The World’s #1 Most Profitable Trading Indicators

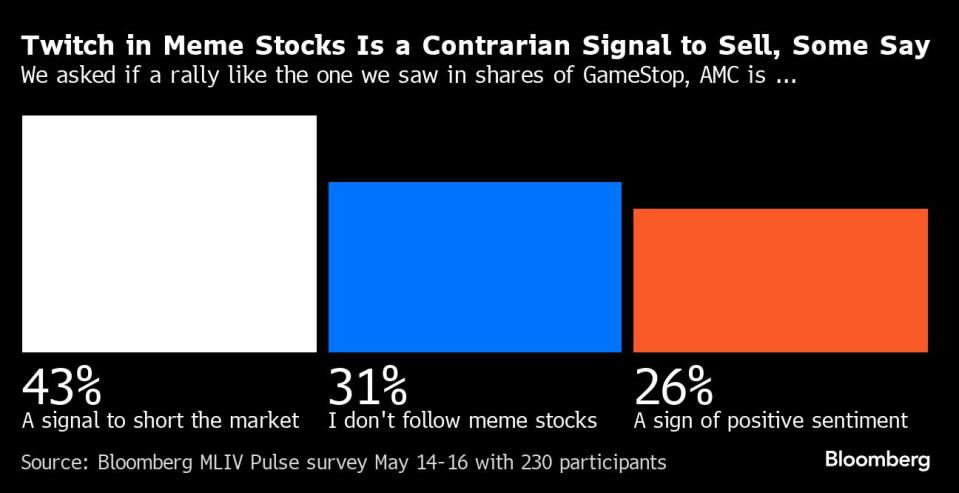

This week’s surge in meme stocks like GameStop and AMC is causing concern among investors, signaling that the US equity markets may be overheating. According to the latest Bloomberg Markets Live Pulse survey, more than 40% of respondents see the recent trading frenzy in these stocks as a sign of excessive Market excitement and a potential trigger to sell off.

The rapid rise and subsequent fall in share prices of GameStop and AMC, reminiscent of the meme-stock craze of 2021, have raised red flags for many investors. While some view this behavior as a contrarian warning for the stock Market, others see it as a positive indicator for future share prices. However, the majority of respondents believe that these meme stocks pose no significant threat to the overall equity Market.

The resurgence of meme stocks, although not as extreme as in 2021, has caught the attention of bored investors looking for excitement in the Market. Despite this short-lived phenomenon, the strong US economy, driven by robust consumer spending and manageable inflation, continues to support growth and optimism in the stock Market.

Federal Reserve policymakers have indicated their intention to maintain higher borrowing costs to curb inflation, reflecting the overall economic strength of the country. This resilience in the economy provides little incentive for policymakers to rush into interest rate cuts.

While valuations remain high, investors remain cautious, with leveraged long exchange-traded funds showing less enthusiasm compared to the previous meme-stock mania. Unlike last year, where retail investors fueled the frenzy, sophisticated traders are behind the recent surge in meme stocks. This shift in Market dynamics suggests a more calculated approach to trading, with a focus on risk management strategies.

As the Market navigates through these fluctuations, investors like Thomas Thornton are taking precautions by shorting certain stocks, such as the SPDR S&P Retail ETF (XRT), to protect their portfolios. Despite the uncertainty surrounding meme stocks, Market participants remain vigilant, prepared for any unexpected turns in the Market.

The Bloomberg Markets Live Pulse survey, conducted among Bloomberg readers, provides insights into investor sentiment and Market trends. This ongoing survey serves as a valuable tool for gauging Market sentiment and forecasting potential Market shifts.

Win Up To 93% Of Your Trades With The World’s #1 Most Profitable Trading Indicators

1. What is a meme-stock frenzy?

A meme-stock frenzy refers to a situation where retail investors drive up the prices of certain stocks through social media platforms like Reddit or Twitter.

2. Why is the revival of meme-stocks pointing to a frothy US stock Market?

The resurgence of meme-stocks indicates that retail investors are heavily influencing stock prices, which can create a volatile and overinflated Market.

3. Are meme-stocks a safe investment?

Meme-stocks are generally considered risky investments as their prices are driven more by hype and speculation than traditional Market fundamentals.

4. Should I participate in the meme-stock frenzy?

It is important to exercise caution when investing in meme-stocks, as the Market can be highly unpredictable and subject to swift changes in value.

5. How can I protect myself from the risks associated with meme-stocks?

To mitigate risks, consider diversifying your investment portfolio, conducting thorough research before buying meme-stocks, and being prepared for potential losses.

Win Up To 93% Of Your Trades With The World’s #1 Most Profitable Trading Indicators

Win Up To 93% Of Your Trades With The World’s #1 Most Profitable Trading Indicators