Funding markets play a vital role in the financial ecosystem, providing the necessary liquidity for smooth operations. Recent concerns over elevated funding rates have emerged, raising questions about their impact on bank lending and overall cash flow. Insights from Bank of America shed light on these pressing issues.

Funding markets are crucial in ensuring smooth operations in our financial ecosystem. They help maintain the necessary liquidity that keeps the wheels of the economy turning. However, recent trends show elevated funding rates, leading to concerns about how this affects bank lending and the overall cash flow in the financial system. Bank of America has provided valuable insights regarding these issues, which are worth discussing.

Understanding Funding Markets

So, what exactly are funding markets? In simple terms, they are platforms where various entities can raise funds to meet their financial needs. This usually includes banks, corporations, and even governments. The importance of funding markets cannot be overstated; they help maintain cash flow and ensure liquidity, which is essential for daily transactions and long-term investments.

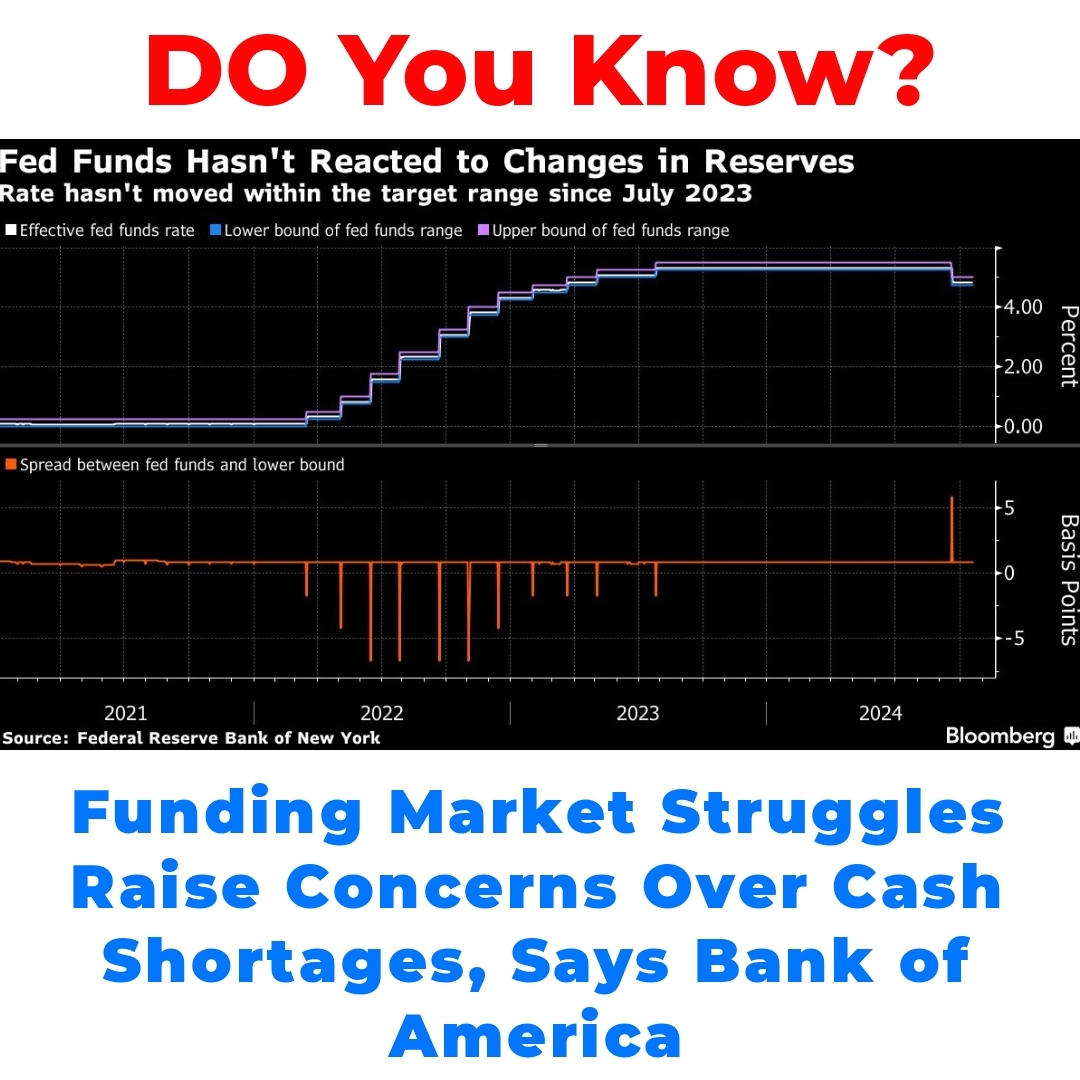

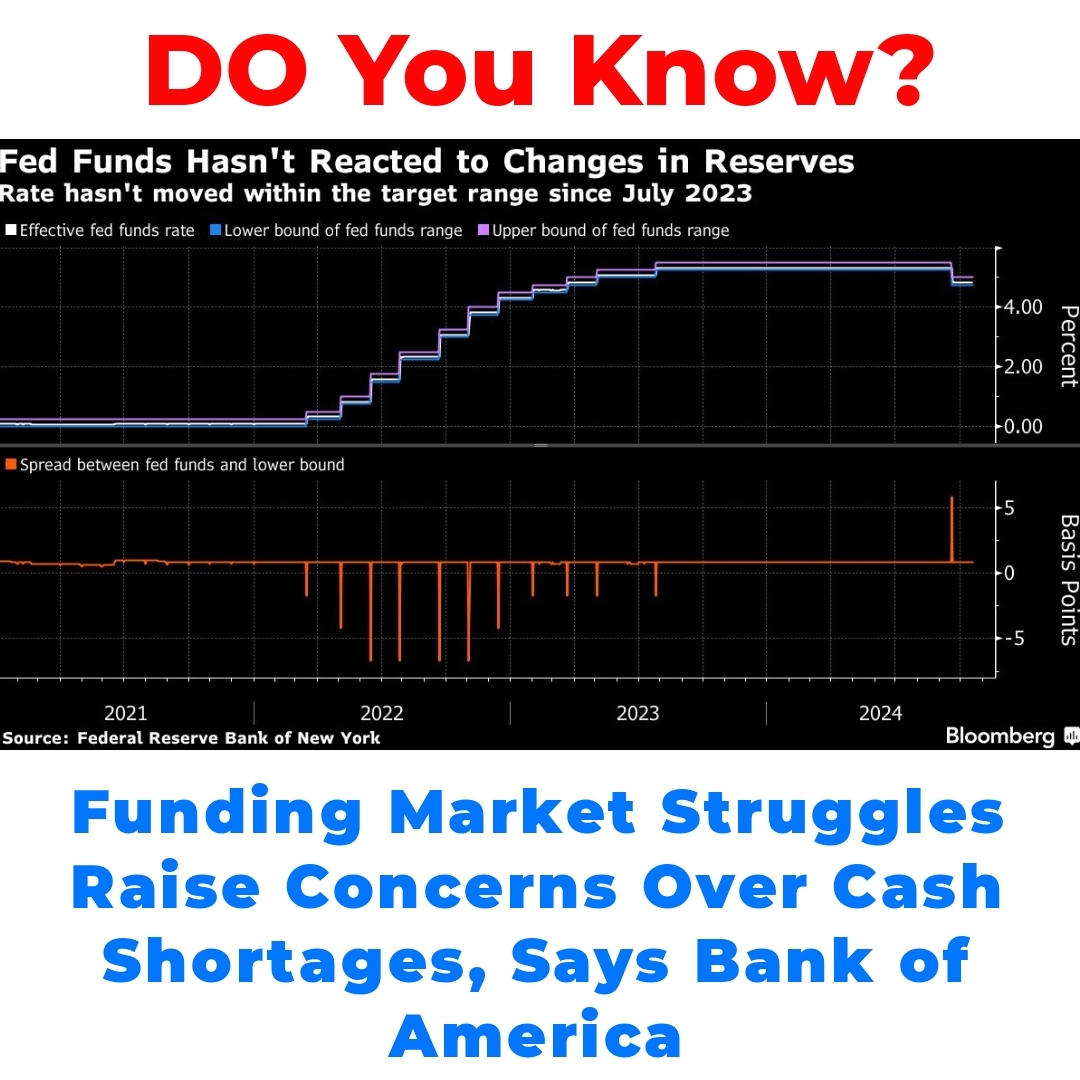

Right now, we are witnessing some concerning trends in funding rates. These rates have hit elevated levels recently, which has significant implications for various economic activities. When these rates rise, it typically indicates a tightening of cash flow in the market. As cash becomes more expensive to borrow, the overall economic activity may slow down, raising questions about long-term growth and stability.

The Role of Bank Lending in the Financial System

Now let’s delve into bank lending, which is an essential aspect of the financial ecosystem. Bank lending refers to the process where banks provide loans to individuals and businesses. This flow of credit is vital; it fuels investments, keeps businesses running, and helps consumers make significant purchases like homes and cars.

However, when bank lending decreases, it can contribute to serious liquidity concerns. A reduction in bank lending means less money is circulating in the economy, which can lead to cash flow problems. Consequently, businesses may struggle to operate, and individuals may find it harder to secure loans for personal projects, which ultimately affects overall economic health.

Liquidity Concerns and Cash Flow Issues

The relationship between funding markets and cash availability is quite intricate. Elevated funding rates often lead to a scarcity of cash, impacting how easily individuals and businesses can access funds. This crunch can create a feedback loop where the higher the rates, the less lending occurs, leading to tighter financial conditions across the board.

Insights from Bank of America reflect these current liquidity concerns. They point out that if banks are hesitant to lend due to elevated funding rates, it can have far-reaching implications on both the economy and individual spending power. The liquidity crunch could stifle investment growth and economic expansion, leading to potential stagnation.

Analyzing the Relationship Between Funding Market Rates and Bank Lending

It’s essential to understand how elevated funding rates influence bank lending practices and credit availability. When funding rates rise, banks tend to tighten their lending standards, making it harder for businesses and individuals to access funds. This can lead to a decline in consumer spending and business investment, both vital components for a healthy economy.

If the current trends continue, the long-term implications on the financial system could be significant. A sustained period of elevated funding rates could lead to a more cautious lending environment, reducing overall credit availability. This, in turn, could have a domino effect, impacting everything from employment rates to consumer confidence.

Conclusion

In summary, the interplay between funding markets, bank lending, and the health of the financial system is crucial to understand. Elevated funding rates can lead to reduced lending, which creates liquidity concerns and affects overall cash flow in the market. As we navigate these trends, it becomes increasingly important to monitor them closely to mitigate potential risks that could harm our economy.

Call to Action

Staying informed about funding market trends and their implications is essential for both investors and consumers. Understanding how these rates impact the financial system and individual investments can help you make better financial choices. Keep an eye on these developments so you can be prepared for any shifts in the economic landscape.

What are funding markets?

Funding markets are platforms where banks, corporations, and governments can raise funds to meet their financial needs. They are vital for maintaining cash flow and ensuring liquidity in the economy.

Why are elevated funding rates a concern?

Elevated funding rates indicate tighter cash flow, making borrowing more expensive. This can lead to slower economic activity and raises questions about long-term growth and stability.

How does bank lending relate to the financial system?

Bank lending involves banks providing loans to individuals and businesses, which is crucial for investments, operation of businesses, and major purchases by consumers.

What happens when bank lending decreases?

A decrease in bank lending leads to less money circulating in the economy, creating liquidity issues that can affect business operations and individuals’ ability to get loans.

How do elevated funding rates impact cash flow?

When funding rates are high, access to cash diminishes for individuals and businesses. This can create a cycle where higher rates result in decreased lending, tightening financial conditions further.

How do elevated funding rates affect lending standards?

As funding rates increase, banks often tighten their lending standards. This makes it harder for consumers and businesses to access funds, potentially leading to lower spending and investment.

What are the long-term implications of sustained elevated funding rates?

A prolonged period of high funding rates could create a cautious lending environment, reducing credit availability. This could have broader effects on employment and consumer confidence.

Why is it important to monitor funding market trends?

Staying informed about funding markets and their implications is crucial for making better financial decisions and being prepared for economic shifts.