In recent times, France has been grappling with a significant budget deficit, raising concerns about its economic health. The recent downgrade by Scope Ratings highlights potential risks to the nation’s financial stability. Understanding the intricacies of the **France budget deficit** is crucial to assess the broader implications for the economy.

France is currently facing a significant budget deficit, which has become a pressing issue for its economy. The recent downgrade by Scope Ratings has sparked discussions around the potential risks to France’s financial stability. It’s important to delve into the details of the France budget deficit and understand how it impacts the nation’s economy.

Current State of France’s Financial Position

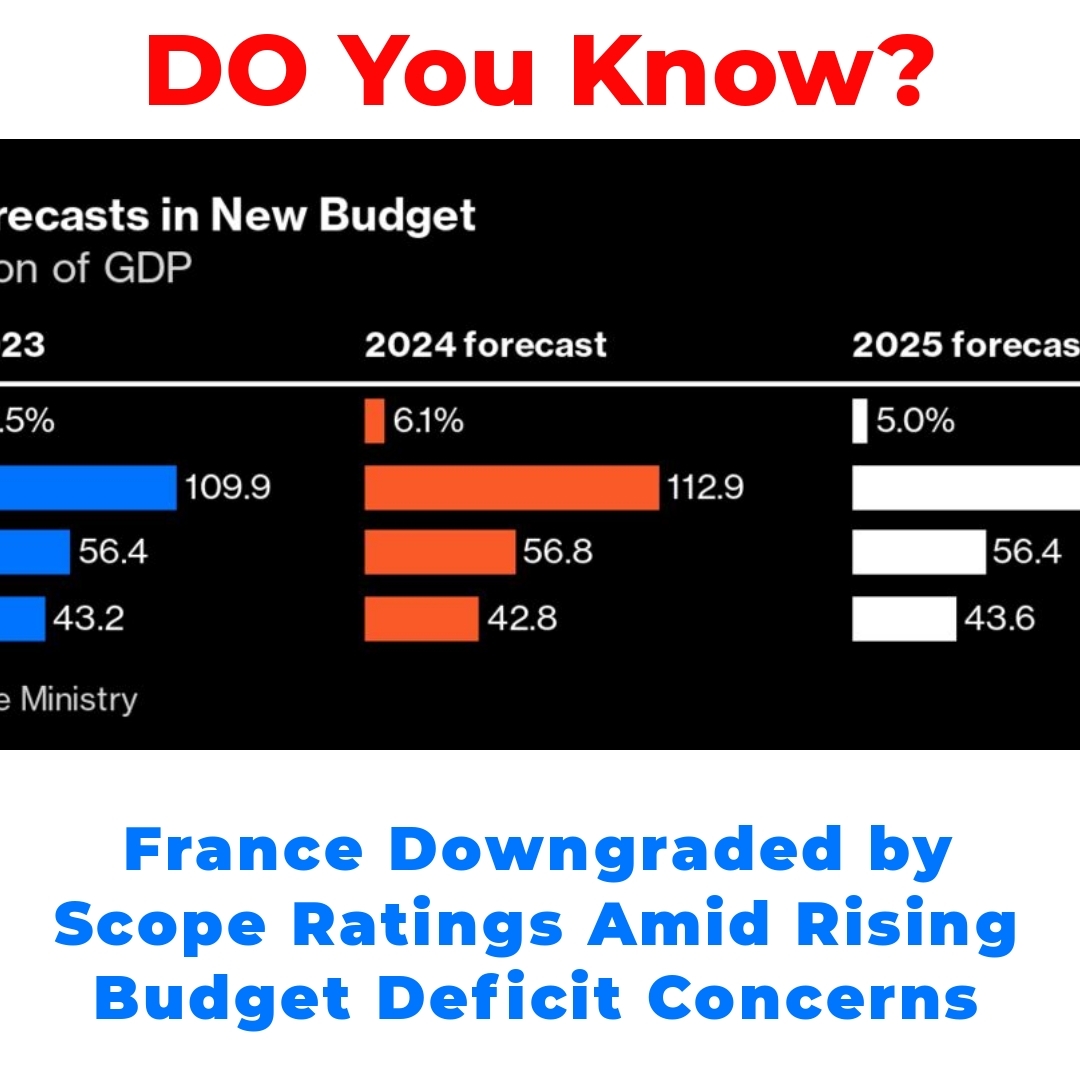

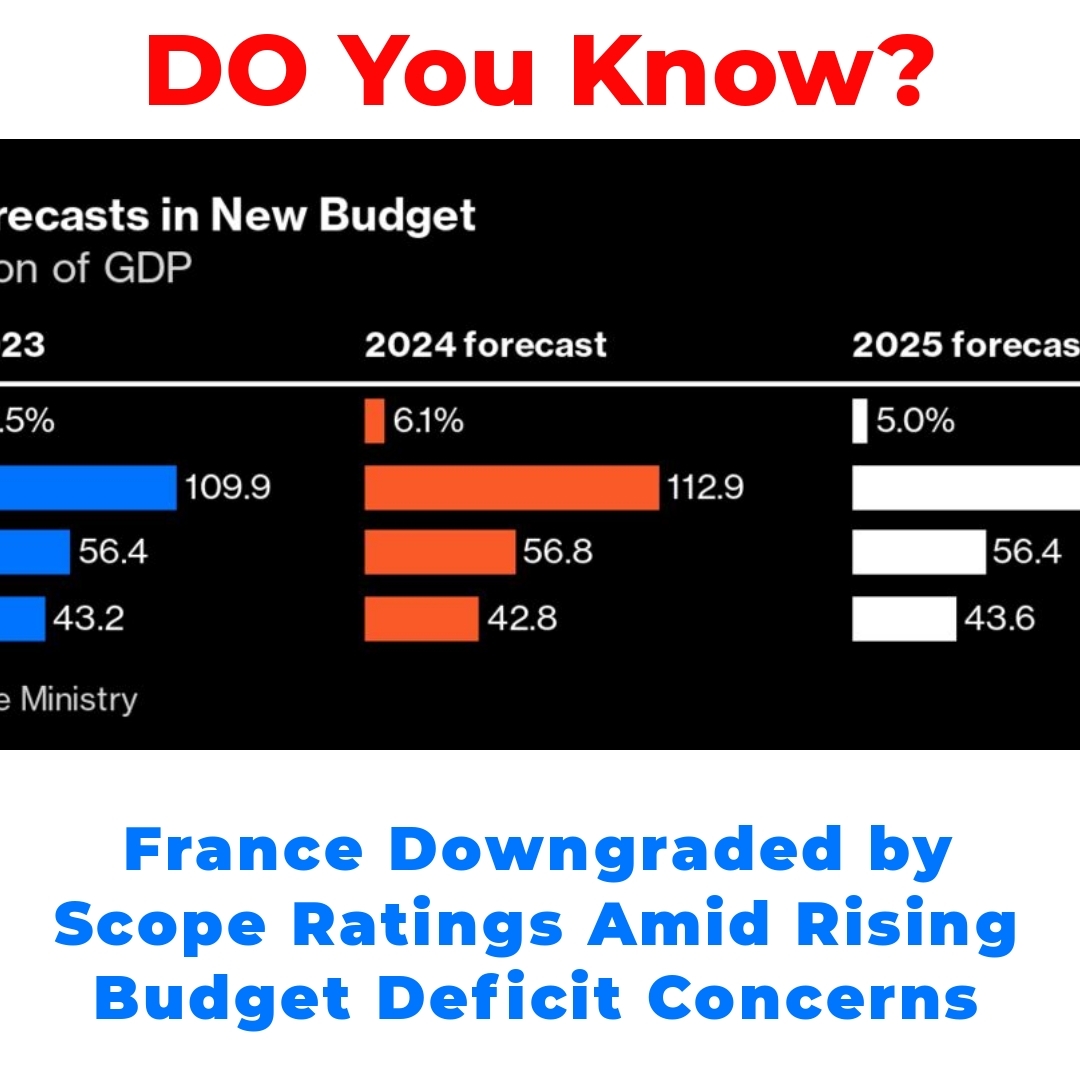

The budget deficit in France has been on a troubling trend, making it a concern for policymakers and economists alike. This deficit stands as a result of various economic pressures, including rising public debt. Over the past few years, numerous factors have contributed to an increased budget gap, leading to a situation where government spending often surpasses its revenue. This imbalance poses questions regarding France’s financial stability in the long run.

With the recent Scope Ratings downgrade, there is a heightened awareness of the challenges France is grappling with regarding its finances. The downgrade indicates a loss of confidence from rating agencies concerning France’s fiscal health and signals potential worries for international investors. As public debt rises in relation to the deficit, the outlook for France’s financial stability hangs in the balance.

Political Challenges Affecting Fiscal Policy

One of the significant hurdles in managing the France budget deficit is the political landscape in the country. Political challenges in France have often hindered effective budget management, making it difficult for the government to implement necessary fiscal policies. The division among political groups, along with public opinions and pressures, often leads to indecisiveness in government spending strategies.

Political decisions have a direct impact on fiscal policies, and sometimes, the need for immediate political gains overshadows long-term economic benefits. This creates political impediments to budget management in France, leading to outdated fiscal policies that are ill-equipped to adapt to current economic conditions. As such, the government faces a tough battle on how to balance political obligations with the pressing need for sound economic policies.

Economic Outlook for France

The economic outlook in France is increasingly complicated by the rising budget deficit, and the implications of the Scope Ratings downgrade are significant. Investors and international stakeholders may start viewing France’s financial stability through a more critical lens, leading to potential consequences, such as decreased investments and higher borrowing costs.

As economic uncertainties grow, the government must navigate carefully to restore confidence. With the budget deficit rising, France’s financial health becomes intertwined with perceptions from the international community, which could ultimately affect its economic recovery and overall growth prospects.

Strategies for Containing the Budget Deficit

To address the issue of France’s ballooning budget deficit, effective budget management practices must be implemented. Policymakers need to explore various strategies to contain this deficit, including tightening government spending, improving tax collection, and fostering economic growth through investment in infrastructure and innovation.

Additionally, increasing transparency in budgetary processes could help in rebuilding trust among citizens and investors. Engaging in meaningful fiscal reforms and considering public opinions while crafting budgets are also vital strategies that can lead to more sustainable fiscal health in the long run. These strategies to contain France’s ballooning budget deficit will require concerted effort across multiple sectors, bringing together governance and socioeconomic understanding.

The Broader European Context

The financial troubles faced by France are not just an isolated issue; they resonate throughout the broader European context. Countries across Europe are grappling with similar challenges related to public debt and fiscal policies. France’s situation highlights the interconnectedness of European economies and how one nation’s financial struggles can impact collective economic stability.

As European nations face pressures due to fluctuating economies, understanding the dynamics between them becomes paramount. Collaborative approaches towards fiscal policy reform could potentially enhance resilience against economic shocks affecting public debt across Europe, ensuring that member states work in unison to achieve stability and growth.

Conclusion

Addressing the France budget deficit is crucial for long-term financial stability. The challenges posed by the Scope Ratings downgrade underscore the urgency for decisive action in fiscal policy reform. Developing effective strategies and solutions not only for the budget deficit but for broader economic management can pave the way for a healthier financial future for France.

Ensuring the country takes the right steps towards managing its fiscal affairs will not only aid in recovery but also enhance France’s standing in the global financial arena. Engaging in discussions and staying informed about these economic developments will be paramount as they hold implications for the nation’s path forward.

What is the current budget deficit in France?

The budget deficit in France has been increasing, causing concern for both policymakers and economists due to rising public debt.

What caused the recent downgrade by Scope Ratings?

The downgrade by Scope Ratings reflects a decrease in confidence regarding France’s fiscal health, indicating potential financial stability risks.

How does France’s budget deficit affect its economy?

The budget deficit leads to government spending that often exceeds revenue, raising questions about France’s long-term financial stability and economic growth.

What political challenges contribute to the budget deficit?

The political landscape in France creates challenges for effective budget management, leading to indecisiveness in implementing necessary fiscal policies.

How does the budget deficit impact investor perception?

Increased budget deficit may lead investors to view France’s financial stability more critically, possibly resulting in decreased investments and higher borrowing costs.

What strategies can be employed to contain the budget deficit?

- Tightening government spending

- Improving tax collection

- Investing in infrastructure and innovation

- Enhancing transparency in budgetary processes

How does France’s financial situation relate to the broader European context?

France’s budget deficit is indicative of larger issues faced by several European countries regarding public debt and fiscal policies, highlighting interconnected economic stability.

What steps are needed for long-term financial stability in France?

Decisive actions in fiscal policy reform and engaging the public in budget discussions are essential for addressing France’s budget deficit and improving its financial future.