The growing national debt in France is becoming a pressing issue that requires urgent attention. Fiscal responsibility is crucial in tackling these debt challenges, and this article explores various strategies for France debt reduction through effective management of government assets. Understanding how to utilize these assets can significantly impact the nation’s financial future.

Understanding France’s Debt Situation

The current state of France’s national debt raises significant concerns for the economy and future fiscal policies. As of now, France has a staggering debt that exceeds €2.9 trillion. This high level of national debt can impact economic growth, stifle public investment, and limit the government’s ability to fund essential services. The implications are profound: if not managed properly, France could face increased borrowing costs and pressure from international creditors. It underscores the essential need for fiscal responsibility in managing this debt.

By prioritizing strategies to manage this national debt effectively, France can aim for a more stable economic future. The focus on fiscal responsibility will play a critical role in ensuring that financial burdens don’t get passed onto future generations. Understanding the debt situation is an important first step toward finding viable solutions to move forward.

The Role of Government Assets in Debt Reduction

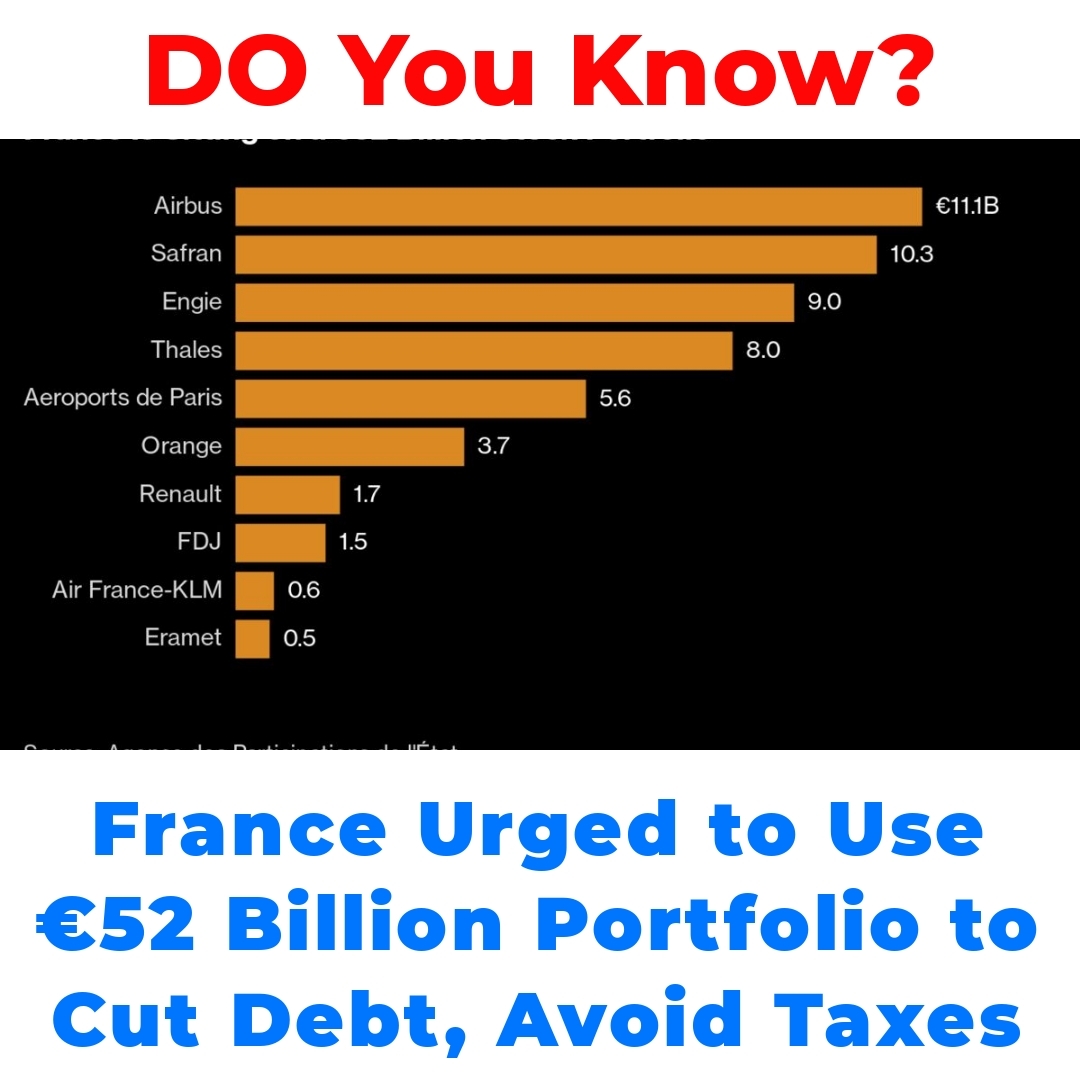

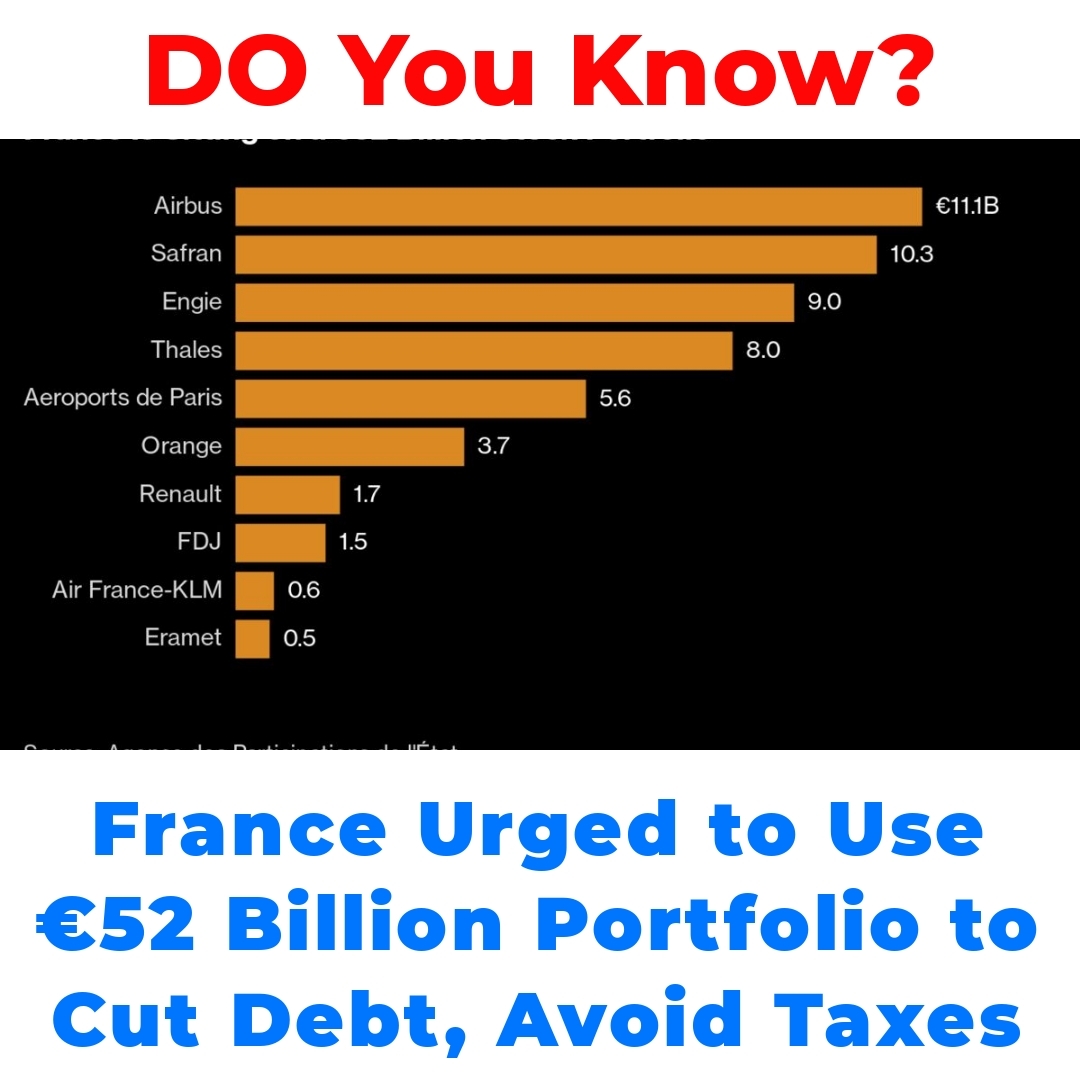

When we talk about government assets management, it’s all about how the government can use its resources to help alleviate its national debt. France, for instance, has a substantial €52 billion stock portfolio that can be a key player in this scenario. Proper management and strategic utilization of these assets can significantly ease the overall debt burden.

In essence, the role of government assets in minimizing France’s debt burden cannot be overstated. When the government makes thoughtful and responsible decisions about its assets, it can create budgetary flexibility that helps support various public services and potentially invest in key areas of economic growth.

Strategies for France to Leverage Its Stock Portfolio

Now, let’s explore some specific strategies for how France can use its government assets, particularly its €52 billion stock portfolio, for effective debt reduction.

– **Divestment of underperforming assets**: By identifying and selling off assets that yield lower returns, the government can generate immediate revenue.

– **Reinvestment of yields**: The returns from the stock portfolio can be redirected towards public services and infrastructure projects that foster economic growth and job creation.

– **Partnerships with the private sector**: Collaborating with private entities can optimize asset management and lead to innovative solutions for maximizing value from these government holdings.

Utilizing these strategies for France to leverage its stock portfolio can pave the way for more sustainable fiscal practices. By focusing on how to effectively manage these assets, France can take significant steps toward financial resilience.

Balancing Tax Increases with Asset Utilization

The ongoing debate around whether to increase taxes or utilize government assets is intense. Many argue that raising taxes puts a burden on the taxpayers, especially those with lower incomes. On the other hand, underutilized government assets present a golden opportunity for budgetary measures that can benefit the economy without imposing further taxation.

Finding a balance between tax increases and asset utilization in France’s fiscal policy is key to maintaining public support while managing national debt. If France can demonstrate effective government assets management, it could ultimately lead to a more equitable approach to fiscal responsibility.

The Importance of Economic Reform in Asset Management

Linking the focus on fiscal responsibility with broader economic reform efforts is crucial. Comprehensive reforms can improve government assets management, increase transparency, and ensure accountability in how assets are used. This can ultimately lead to economic growth and increased revenue.

By proposing reforms that prioritize efficient asset management practices, France can potentially unlock new revenue streams. Effective management of government assets can also bring about improved trust in fiscal policies and encourage public engagement in economic discussions.

Conclusion

In summary, effective government assets management is essential for facilitating France debt reduction. The strategic use of its stock portfolio and the careful balancing of fiscal policies can have a significant impact on the national debt situation.

As France moves forward, it becomes increasingly clear that a combination of innovative strategies and responsible fiscal practices will be necessary. Emphasizing the importance of managing government assets while keeping an eye on economic reform will be vital for successful France debt reduction in the years ahead.

FAQ

What is the current state of France’s national debt?

France’s national debt exceeds €2.9 trillion, which raises concerns about economic growth, public investment, and the government’s ability to fund essential services.

How can government assets help reduce France’s debt?

The French government has a €52 billion stock portfolio that can be strategically managed to alleviate national debt. Proper management of these assets can create budgetary flexibility and support public services.

What strategies can France use to leverage its stock portfolio?

- Divestment of underperforming assets to generate immediate revenue.

- Reinvesting returns from the stock portfolio into public services and infrastructure projects.

- Forming partnerships with private entities for optimized asset management.

Is it better to increase taxes or utilize government assets?

The debate is ongoing. While tax increases may burden taxpayers, utilizing underperforming government assets can provide a budgetary solution without imposing new taxes.

Why is economic reform important for asset management?

Linking fiscal responsibility with economic reform can enhance asset management, increase transparency, and ensure accountability, all of which can lead to economic growth and additional revenue streams.

What is the key to balancing fiscal policy in France?

Finding a balance between tax increases and effective asset utilization is essential for maintaining public support while managing the national debt.