Foreign portfolio investors (FPIs) injected over Rs 87,000 crore (over $10 billion) into Indian equities this quarter, marking the highest inflow since June 2023. Key factors driving this investment include improved growth prospects, increased global index weight, and a robust IPO Market, with 50 companies raising Rs 53,453 crore by August 2024. Despite a sluggish start to the year due to political uncertainty, FPIs showed strong demand for shares in the secondary Market. Optimism about political stability and potential US Federal Reserve rate cuts has further bolstered investor confidence in India’s markets. While valuations are elevated, experts remain hopeful that strong earnings will sustain this positive momentum.

Foreign portfolio investors (FPIs) have made a significant return to the Indian stock Market, injecting over Rs 87,000 crore (more than $10 billion) into domestic equities in the current quarter. This surge marks the largest inflow since the end of June 2023. Positive growth forecasts, increased representation in global indices, and a flurry of initial public offerings (IPOs) have contributed to this encouraging trend.

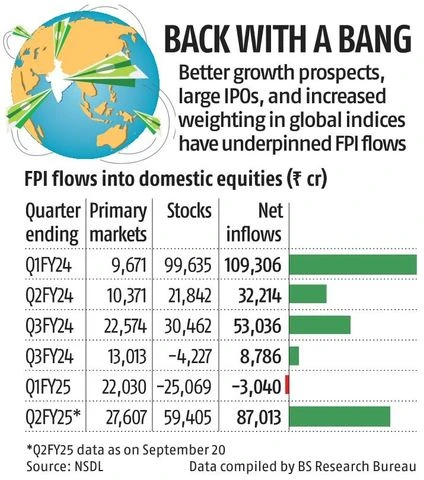

After notable declines in the first half of 2024, FPIs have shifted back to buying. In the March quarter, they were net buyers of Rs 8,786 crore, but they turned net sellers by Rs 3,040 crore in the June quarter. The initial uncertainty stemmed from India’s parliamentary elections, which led to concerns about the political landscape. While Prime Minister Narendra Modi’s party succeeded in forming a government again, they now rely on alliances, unlike in previous terms.

Despite these ups and downs, FPIs showed strong interest in the primary Market. During the first half of 2024, they invested Rs 13,013 crore in the March quarter and Rs 22,030 crore in the subsequent quarter, primarily through IPOs, follow-on public offerings, and qualified institutional placements.

India’s IPO Market has thrived this year, with 50 companies raising Rs 53,453 crore by August 2024, including anticipated large issues from firms like Hyundai Motors. The surge of 38 percent in the BSE IPO index reflects strong performances from newly listed companies. Interestingly, in the September quarter, FPIs began prioritizing purchases from the secondary Market over primary investments.

The outlook has turned positive for foreign investors, citing political stability and potential rate cuts by the US Federal Reserve as influential factors. With enhanced interest in India’s growth story, the current Market dynamics remain promising, despite the high valuations. The benchmark Nifty trades at a forward price-to-earnings ratio of 21.2, moderately above its decade average.

Analysts believe that strong performance in upcoming earnings reports will be crucial for maintaining favorable FPI flows. While initial reactions to potential US rate cuts may lead to increased risk appetite, consistent earnings will ultimately determine Market trajectories.

In summary, India’s financial landscape is vibrant, buoyed by foreign investments and a robust IPO Market, suggesting a positive outlook, provided earning reports align with expectations.

Tags: Foreign Portfolio Investors, Indian Stock Market, IPOs, Economic Growth, Investment Trends, Narendra Modi, US Federal Reserve, Financial News, Market Analysis.

-

What does FPI stand for?

FPI stands for Foreign Portfolio Investor. These are investors from other countries who invest in stocks and bonds of a different country. -

Why did FPIs invest over Rs 87,000 crore in India?

FPIs invested this amount in India because they see good growth potential in the Indian economy and want to take advantage of the growing Market. -

How does FPI investment affect the Indian stock Market?

When FPIs invest a lot of money, it generally boosts the stock Market. It can lead to higher stock prices and greater Market stability. -

Is this investment trend expected to continue?

Many experts believe that if the Indian economy continues to perform well, FPIs may keep investing heavily in the future. - What sectors are FPIs focusing on?

FPIs typically focus on promising sectors like technology, finance, and healthcare, where they see the potential for strong returns.

)