The economic landscape in France is currently facing challenges, prompting Fitch Ratings to place the country on a negative outlook. This decision has raised concerns over fiscal responsibility and financial stability. Analyzing the implications of Fitch Ratings’ assessment of the France negative outlook reveals potential impacts on investor confidence and public finances.

The decision by Fitch Ratings to place France on a negative outlook has thrown a spotlight on the country’s economic challenges. This move raises significant concerns regarding fiscal responsibility and the overall financial stability of France. With the upcoming Fitch Ratings France budget 2025 being a focal point, it’s essential to dig deep into what this means for the nation’s economy.

Fitch Ratings France Budget 2025: An Overview

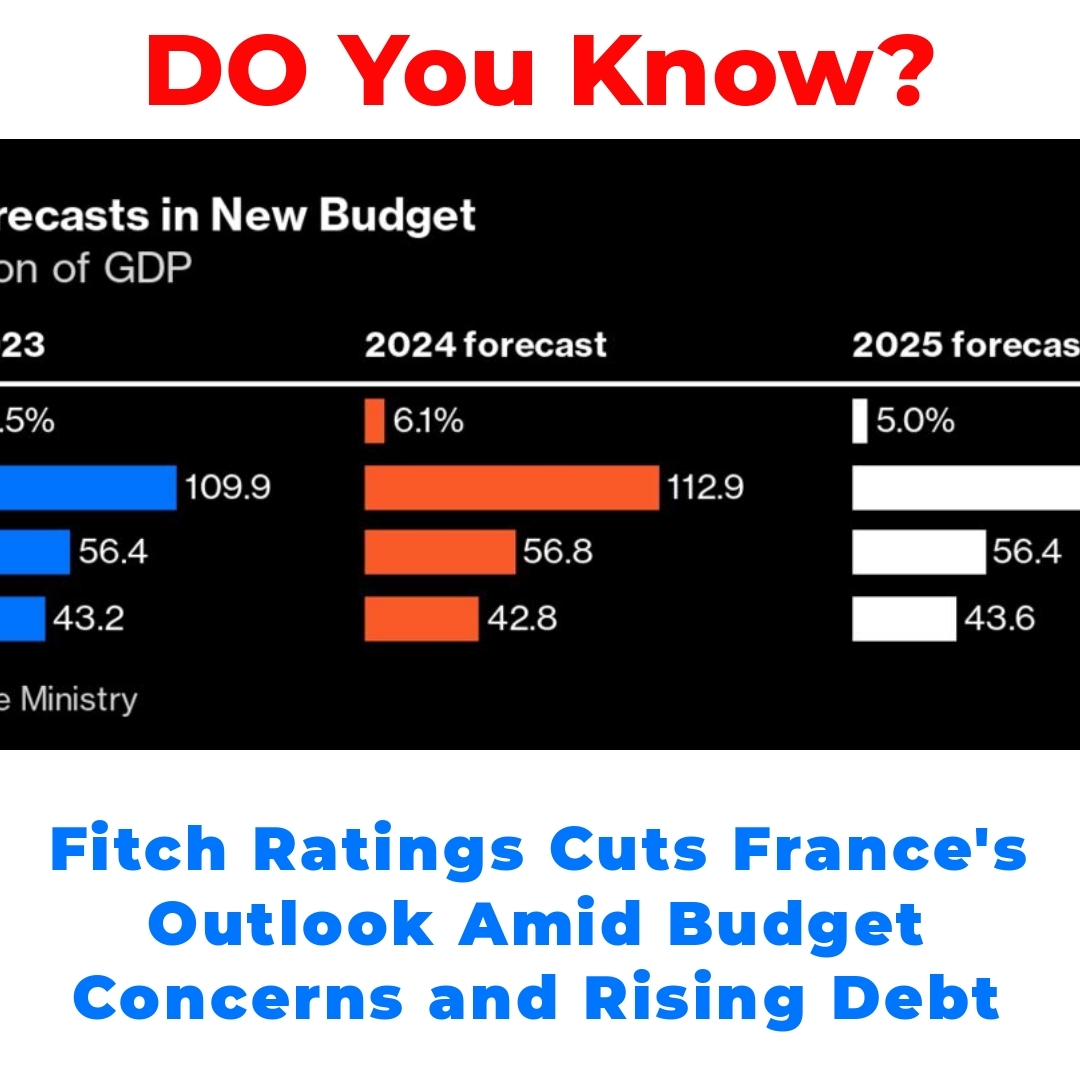

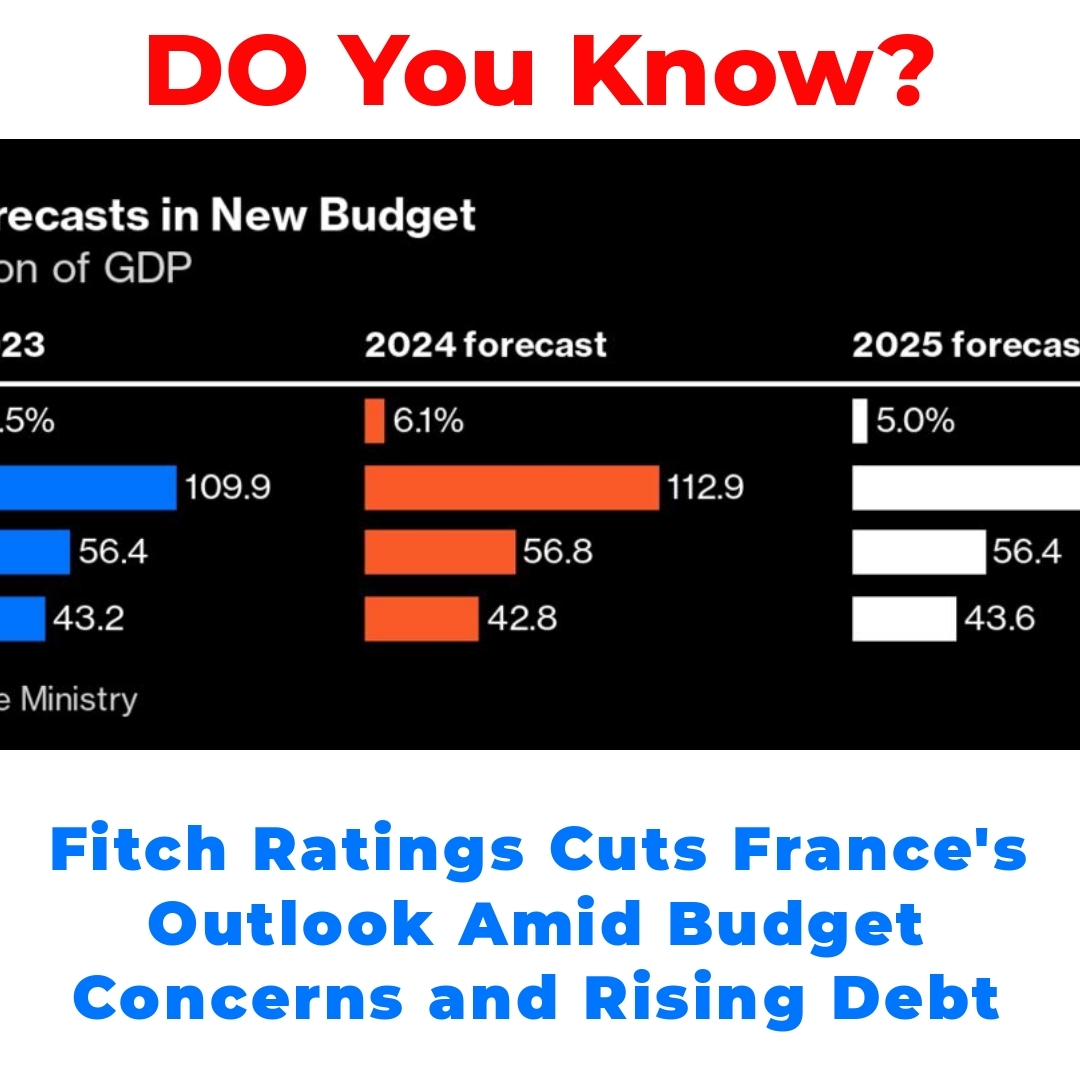

Recently, the French government rolled out its budget presentation for 2025, outlining key allocations aimed at stimulating growth and managing expenses. However, as reviewed by Fitch Ratings, there are pressing concerns regarding how realistic and sustainable these targets are. The **Fitch Ratings France budget 2025** highlights ambitious revenue projections, yet it comes with a warning about the potential risks involved if spending outgrows income-generating measures.

Public Finances Under Scrutiny

The scrutiny of public finances in France has intensified, with various analysts pointing out that the current fiscal situation is precarious. The role of Prime Minister Michel Barnier is crucial in steering the country toward fiscal recovery. His administration faces the challenge of balancing necessary government spending with the need for tighter fiscal control to ensure financial stability. Recent policy decisions have come under fire as being either too lenient or short-sighted in addressing the looming challenges ahead.

The Implications of a Negative Outlook on France’s Economy

What does France’s negative outlook mean for the economy? For one, it could lead to decreased investor confidence, impacting how willing investors are to commit resources to French ventures. Additionally, there’s a potential ripple effect on credit ratings and borrowing costs. If the perception of risk increases, the government could face higher costs for financing its initiatives. This could, in turn, affect government spending and ultimately stifle future economic growth.

Fitch Ratings Critiques France’s 2025 Budget

Fitch Ratings has been vocal in its critique of France’s 2025 budget presentation. Key areas of concern include unrealistic spending levels and overly optimistic revenue projections that don’t take into account potential economic downturns. This critical view aligns well with the broader economic realities, suggesting that the government may need to reconsider its fiscal strategies to avoid deeper financial pitfalls.

France Government Response to Public Finance Deterioration

In response to the mounting criticisms regarding public finance deterioration, the French government is not sitting idly. They’ve introduced several measures aimed at improving fiscal policy and stabilizing public finances. These strategies include potential tax reforms and tightened spending caps that could help restore confidence among investors and credit agencies alike. The ongoing reforms are pivotal in defining how effectively the government can address the concerns outlined by Fitch Ratings.

Conclusion

In summary, the current **France negative outlook** is a wake-up call for policymakers to take actionable steps in fiscal management. From the critiques of the Fitch Ratings France budget 2025 to the broader implications for public finances, it is clear that vigilance and strategic planning are needed for the country’s economic future. As these developments unfold, it is vital for individuals and businesses to stay informed and proactive regarding fiscal policies that may impact them in the coming years.

References

Additional references to support the information discussed will be provided to ensure credibility and depth in understanding the economic landscape in France.

FAQ

What does Fitch Ratings’ negative outlook on France mean?

The negative outlook suggests that there are serious concerns about France’s economic stability and fiscal responsibility. It may lead to lower investor confidence, higher borrowing costs, and increased risks for the government to finance its initiatives.

Why was France’s budget for 2025 criticized by Fitch Ratings?

Fitch Ratings critiques France’s 2025 budget for having unrealistic spending levels and overly optimistic revenue projections. They believe these targets do not adequately account for potential economic downturns.

How might this negative outlook affect investors?

- Decreased investor confidence in French projects.

- Potentially higher costs for the government to borrow money.

- Influence on credit ratings, which can affect future investments.

What steps is the French government taking in response to these concerns?

The French government is implementing various measures aimed at improving fiscal policy. These include:

- Potential tax reforms.

- Tighter spending caps to maintain fiscal control.

What are the implications for the average citizen or business?

Individuals and businesses may face changing financial landscapes due to potential tax reforms and government spending adjustments. Staying informed about fiscal policies is crucial.

Where can I find reliable information about France’s economic situation?

Check reputable financial news websites, government reports, and economic analyses for updated and credible information regarding France’s economic landscape.