The Federal Reserve Employment Report is a vital economic indicator that significantly influences Federal Reserve decision-making, especially leading up to key policy meetings. Understanding this report helps to grasp the current labor market conditions and their implications for future monetary policy adjustments.

The Significance of Employment Data

The Federal Reserve Employment Report provides a detailed overview of key employment statistics, including job growth and the unemployment rate. This employment data plays a crucial role in reflecting the current conditions of the labor market. When we examine these figures, we can get a clearer picture of how the economy is performing.

Understanding this data is vital for the Federal Reserve, as they monitor these indicators closely to inform their monetary policy decisions. For instance, if job growth is strong, it could lead the Federal Reserve to consider tightening policies to keep inflation in check. On the other hand, a rising unemployment rate might push them to take more action to stimulate the economy.

Analyzing the Labor Market Conditions

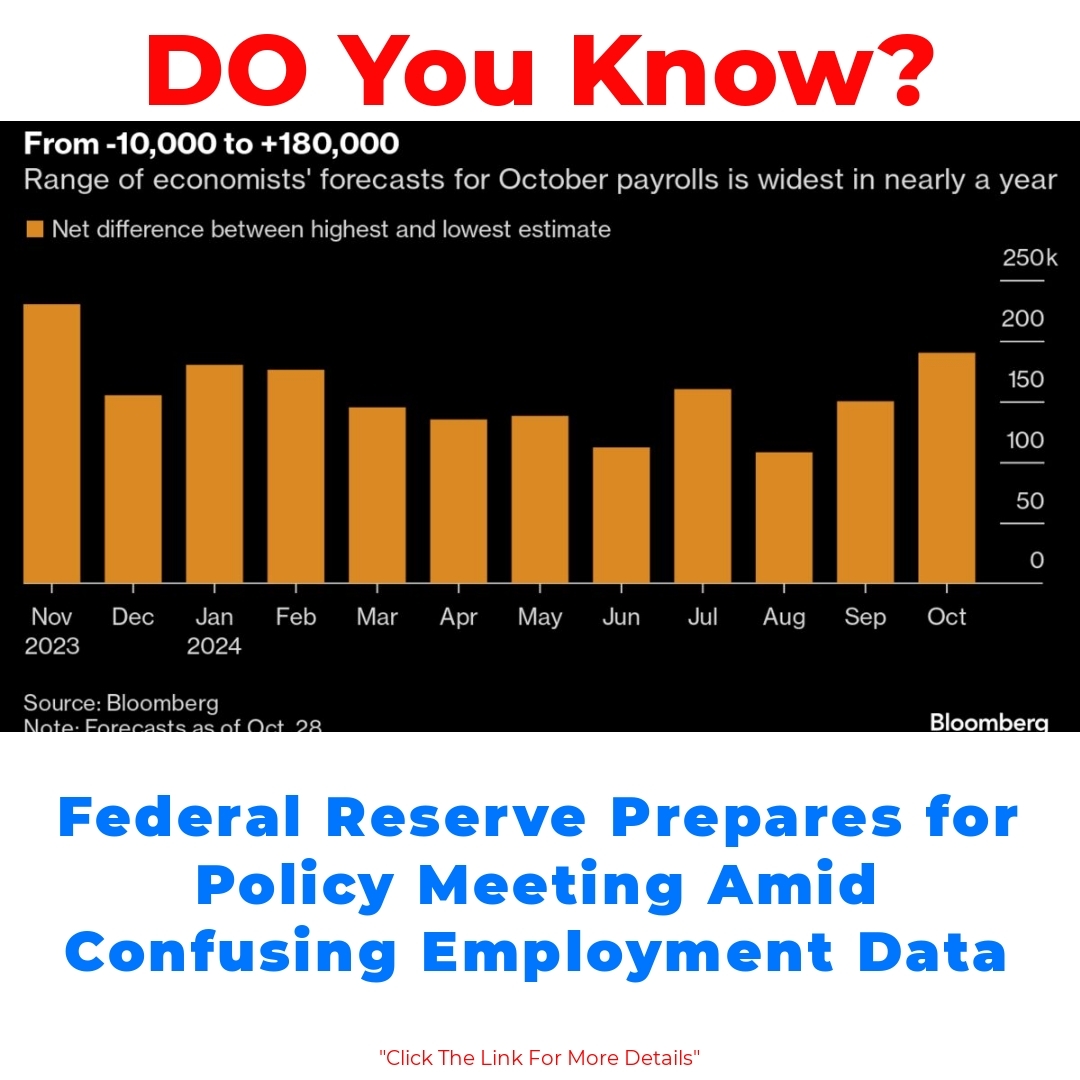

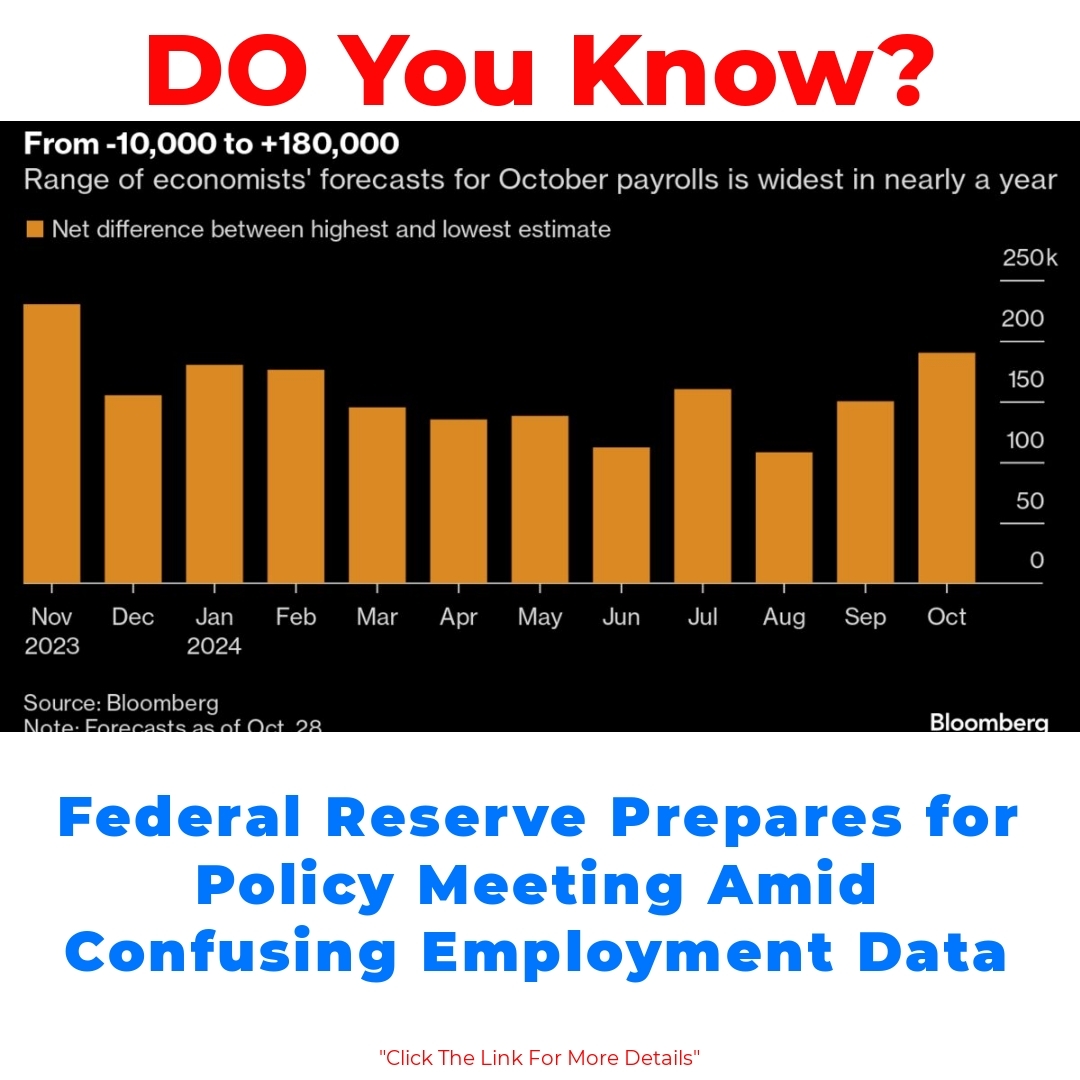

Let’s take a look at recent trends in job growth and the unemployment rate. Over the past few months, we’ve seen fluctuations in these numbers, which can significantly influence the Federal Reserve’s decision-making process. For example, consistent job growth can signal to policymakers that the economy is thriving, which could lead them to raise interest rates.

On the other hand, if the unemployment rate rises unexpectedly, the Federal Reserve may interpret this as a sign of economic weakness, prompting them to consider lowering rates or implementing other stimulative measures. Graphical data and statistics can effectively highlight these changes over time, helping economists and analysts understand the labor market’s trajectory.

Impacts of Employment Report on Federal Reserve Policy

The impacts of the Employment Report on Federal Reserve policy cannot be understated. Historically, previous employment reports have directly influenced significant economic policy decisions. For instance, if the report shows unexpectedly high job growth, the Fed may feel confident in adjusting interest rates and tightening monetary policy.

Expectations for future policy adjustments often hinge on the trends found within these employment data. If the labor market appears strong and stable, we can expect a more hawkish tone from the Federal Reserve. Conversely, any signs of weakness could lead them to adopt a more dovish stance.

How Employment Data Influences Federal Reserve Decisions

So, how exactly does employment data influence Federal Reserve decisions? An in-depth analysis reveals that these reports can lead to significant policy changes. For example, in previous instances, when employment reports indicated robust job growth, the Federal Reserve raised interest rates to prevent the economy from overheating.

Additionally, market reactions often follow closely after employment report releases. Investors look at these reports for clues about future Fed actions. A positive report may boost market confidence, while a negative one could raise concerns about economic stability. Understanding these dynamics can help investors anticipate moves in the financial markets.

Preparing for the Upcoming Federal Reserve Policy Meeting

As we approach the upcoming Federal Reserve policy meeting, it’s essential to know how to read and interpret the employment report. Watch for key figures such as overall job creation and the unemployment rate. Evaluating these numbers can provide insights into what direction the Federal Reserve may take during the meeting.

During the policy meeting, pay attention to any statements regarding employment data, as these can signal potential adjustments to monetary policy. Understanding these nuances can allow you to gauge the potential outcomes based on varying employment data scenarios. Being well-informed can serve as an advantage as economic conditions evolve.

Conclusion

In summary, the Federal Reserve Employment Report is an essential tool for understanding labor market conditions and their implications for monetary policy. By grasping the significance of this report, we can better anticipate Federal Reserve actions and the broader economic landscape.

Being aware of these economic indicators can provide valuable context as we move toward upcoming policy decisions. Keeping a close eye on these factors will not only enhance our understanding of economic trends but also prepare us for changes that may arise in response to employment data.

Call to Action

Stay informed about employment data and the actions of the Federal Reserve. Understanding these developments will empower you to make better financial and investment decisions. For further reading on employment statistics and their economic impact, check out credible financial news sources and economic analysis websites. Knowledge is key, so keep learning!

What is the Federal Reserve Employment Report?

The Federal Reserve Employment Report provides important details about job growth, the unemployment rate, and other key employment statistics that reflect the current state of the labor market.

Why is employment data important?

Employment data is crucial for understanding economic conditions. It helps the Federal Reserve make informed decisions about monetary policy, such as raising or lowering interest rates based on job growth or unemployment trends.

How do job growth and unemployment rates affect Federal Reserve decisions?

Strong job growth may lead the Federal Reserve to tighten policies to prevent inflation, while a rising unemployment rate may prompt them to take actions to stimulate the economy.

What trends should I look for in employment data?

Key figures to monitor include:

- Overall job creation

- Unemployment rate

- Wage growth

How do employment reports influence the financial markets?

After the release of employment reports, market reactions can vary. A positive report may boost market confidence, while a negative one could create concerns about economic stability, influencing investor behavior.

What should I watch for leading up to a Federal Reserve policy meeting?

Pay attention to changes in employment figures and Federal Reserve statements regarding these figures. Understanding these aspects can give you insights into potential future monetary policy adjustments.

How can I stay informed about employment data?

Keep an eye on credible financial news sources and economic analysis websites to stay updated on employment statistics and the Federal Reserve’s actions.