In the world of cryptocurrency, Ethereum and Solana are two names that often spark heated debates. Right now, the social media buzz around these digital currencies is creating quite a stir. As chatter increases, one of these tokens might just experience a significant bull run. Curious about which one? Dive into our latest comparison and see how social trends could impact their Market value!

Win Up To 93% Of Your Trades With The World’s #1 Most Profitable Trading Indicators

- SOL and ETH saw social media buzz recently.

- The SOL and ETH prices have crossed into new price zones this week.

Social media platforms were buzzing with discussions about Ethereum [ETH] and Solana [SOL] recently, fueled by notable price movements as they entered new price zones.

There has been a significant change in their Total Value Locked (TVL) over the last month, adding to the excitement surrounding these assets.

Solana and Ethereum see positive social metrics

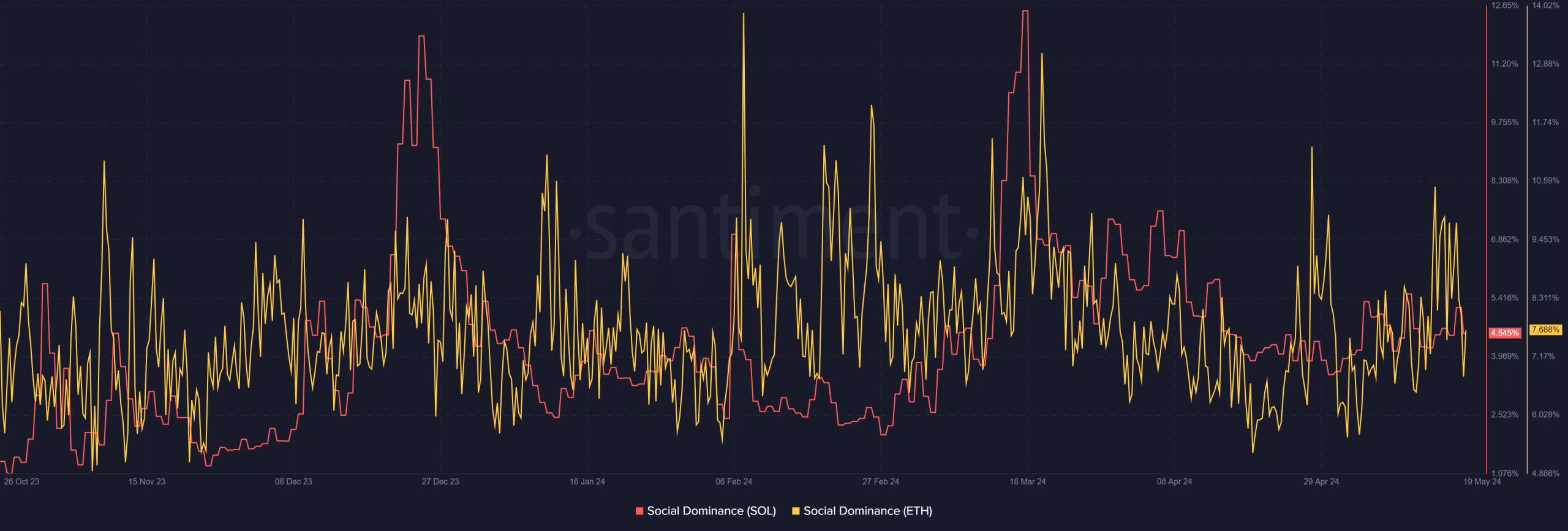

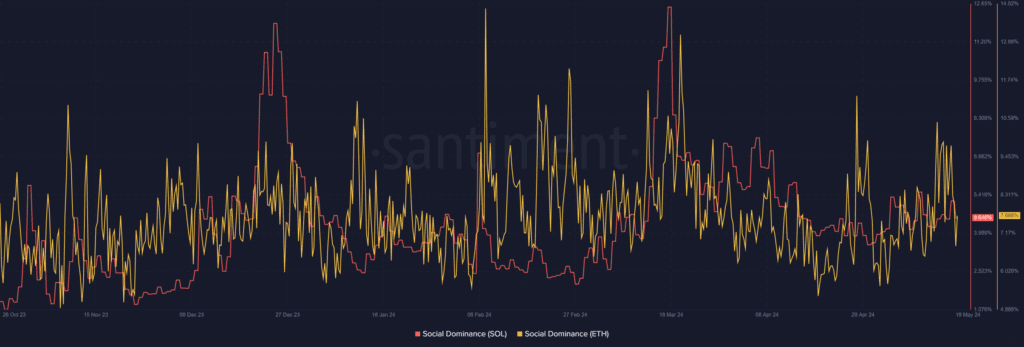

According to data from Lunar Crush, Solana and Ethereum recently experienced similar and intriguing social media trends. Ethereum had a social dominance of 9.35%, while Solana had 8.85%.

SOL garnered 42.4 million social interactions, whereas ETH recorded 45.18 million. Both assets also boasted positive sentiments, with an 85% positivity rate.

However, an analysis of social dominance on Santiment revealed a shift. Solana’s social dominance decreased to around 4.7%, while Ethereum’s declined to 7% at the time of this writing.

SOL and ETH enter new price zones

The analysis of Ethereum (ETH) and Solana (SOL) price trends explains the recent increase in social metrics.

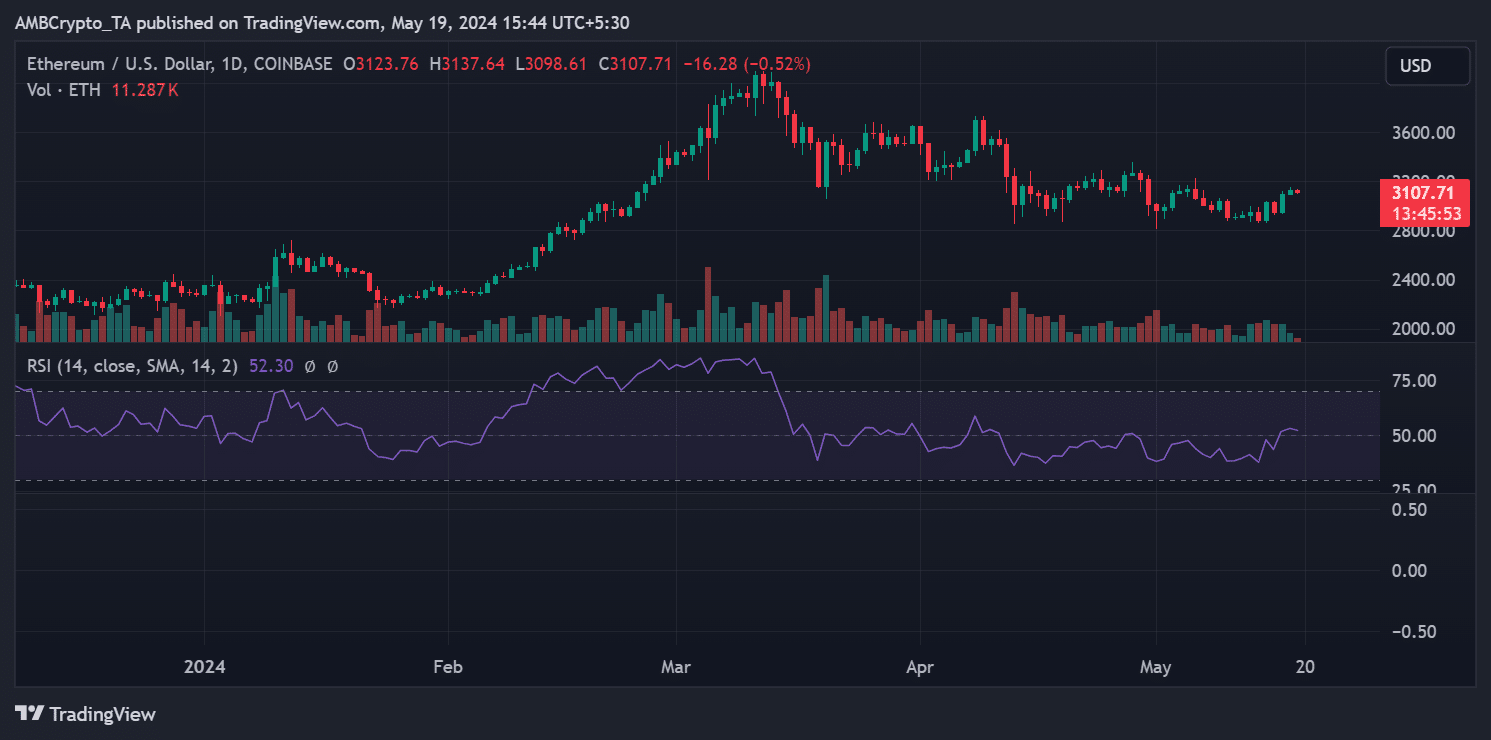

A daily time frame chart for Ethereum showed that it recently re-entered the $3,000 price range. On the 18th of May, ETH added less than 1%, pushing its price into the $3,100 zone for the first time in weeks.

At the time of this writing, ETH was trading at around $3,107, though it had declined by approximately 0.5%.

Despite the slight decrease, the Relative Strength Index (RSI) indicated that ETH remained in a weak bull trend.

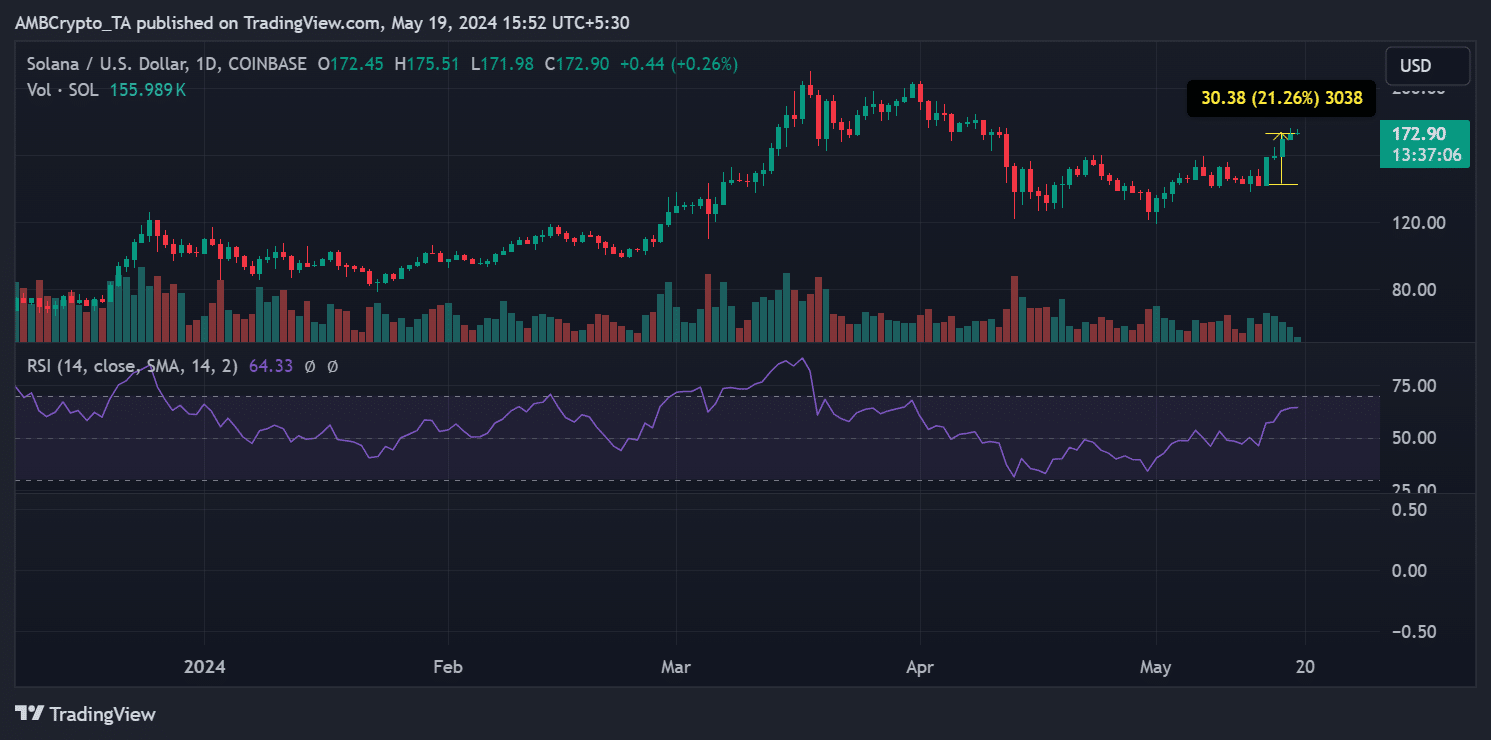

On the other hand, Solana has been experiencing consecutive uptrends over the past few days. The chart revealed that SOL’s price increased by about 20% from the 15th of May to press time.

At the time of this writing, SOL was trading at around $172 with a less than 1% increase. The RSI showed that SOL remained in a strong bull trend.

Solana sees more TVL growth than Ethereum

Analysis of the Total Value Locked (TVL) for Ethereum and Solana indicated that both have increased over the past seven days and one month. However, Solana has experienced a more significant rise.

Read Ethereum’s [ETH] Price Prediction

Win Up To 93% Of Your Trades With The World’s #1 Most Profitable Trading Indicators

What are Ethereum and Solana?

Ethereum is a popular blockchain platform known for its smart contracts and decentralized applications (dApps). Solana is a newer blockchain known for its high-speed transactions and low fees, aiming to scale better than other networks.

Why does social buzz affect Ethereum and Solana’s prices?

Social buzz can influence investor sentiment. When people talk positively about Ethereum or Solana on social media, more investors might buy the tokens, leading to a price increase, or bull run.

How do technological differences impact social buzz?

Ethereum is widely known for pioneering smart contracts, while Solana is praised for its speed and lower costs. These different strengths attract various communities and opinions, fueling social media discussions.

Can social buzz alone cause a bull run?

Social buzz can initiate a bull run, but other factors like Market trends, technological updates, and broader economic conditions also play crucial roles. Buzz mainly amplifies existing trends.

Is one more prone to bull runs due to social buzz?

Both Ethereum and Solana are impacted by social buzz, but it might be more noticeable with Solana due to its smaller Market cap compared to Ethereum. Smaller Market cap means social buzz can have a more significant impact.

Win Up To 93% Of Your Trades With The World’s #1 Most Profitable Trading Indicators

Win Up To 93% Of Your Trades With The World’s #1 Most Profitable Trading Indicators

-

Recap of NYC Insecure Agents Hackathon: Insights from the OWASP Gen AI Security Project for Enhanced Cybersecurity Practices

Creating AI agents is becoming easier with new no-code tools, but this raises concerns about security. These agents, built on language models, can manage tasks like calling other tools or communicating with each other. The OWASP Gen AI Security Project has developed guidelines to address the unique risks posed by AI agents. Recently, they hosted…

-

Recap of the OWASP Gen AI Security Project at NYC Insecure Agents Hackathon: Highlights and Key Takeaways

Building AI agents has become easier, thanks to no-code tools and frameworks. However, this ease comes with risks. These powerful agents, which rely on large language models (LLMs), can pose unique security threats. The OWASP Gen AI Security Project has created the Agentic Security Initiative to address these risks, releasing a guide that outlines specific…

-

Unlocking the Future: Key Insights from Microsoft’s Work Trend Index on Leading the AI Revolution

In today’s rapidly changing work landscape, Microsoft’s Work Trend Index reveals a crucial shift in organizational strategies. A significant 82% of business leaders plan to incorporate AI agents to boost workforce efficiency within the next 12-18 months. By evaluating which teams can benefit most from AI support, companies can enhance productivity and morale. AI can…