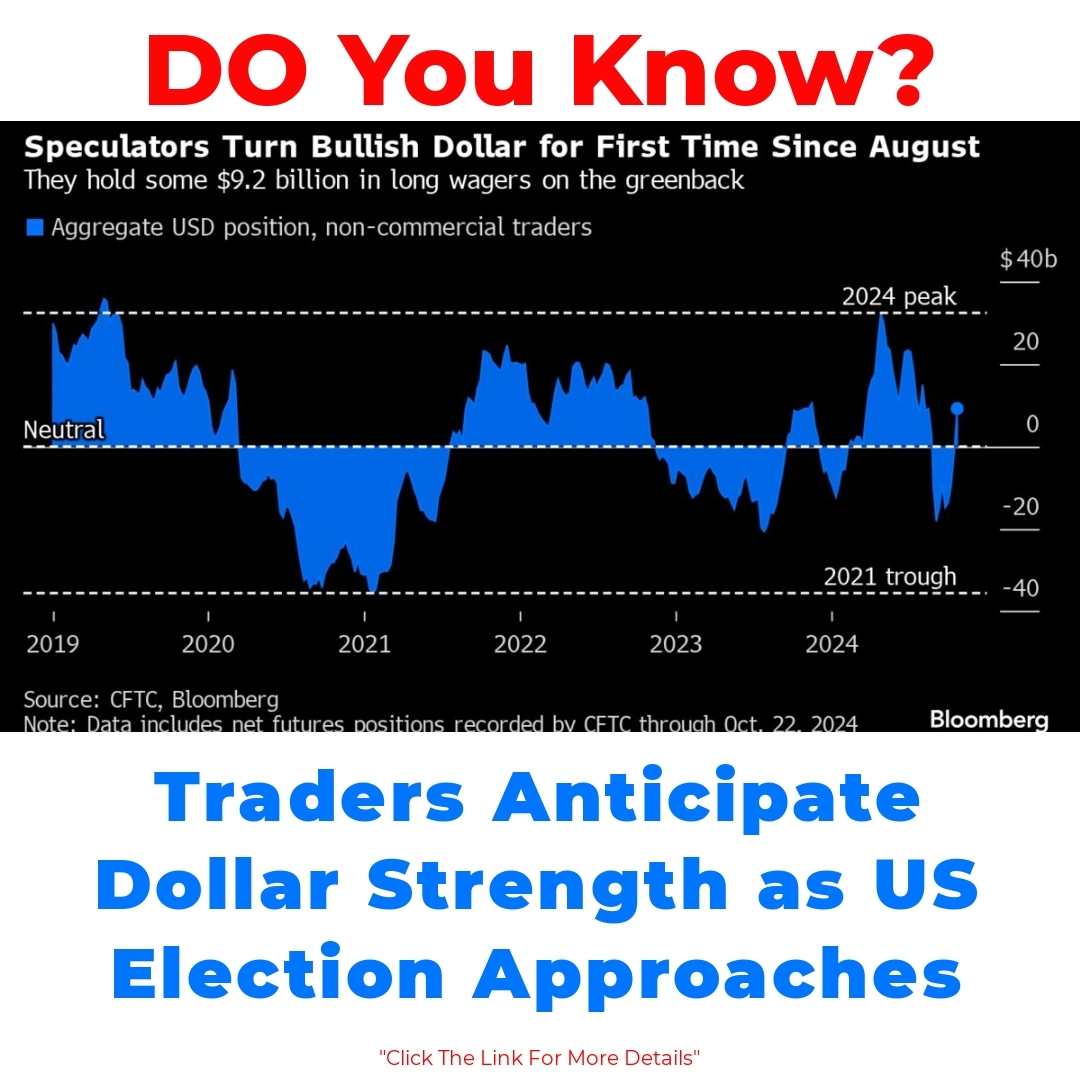

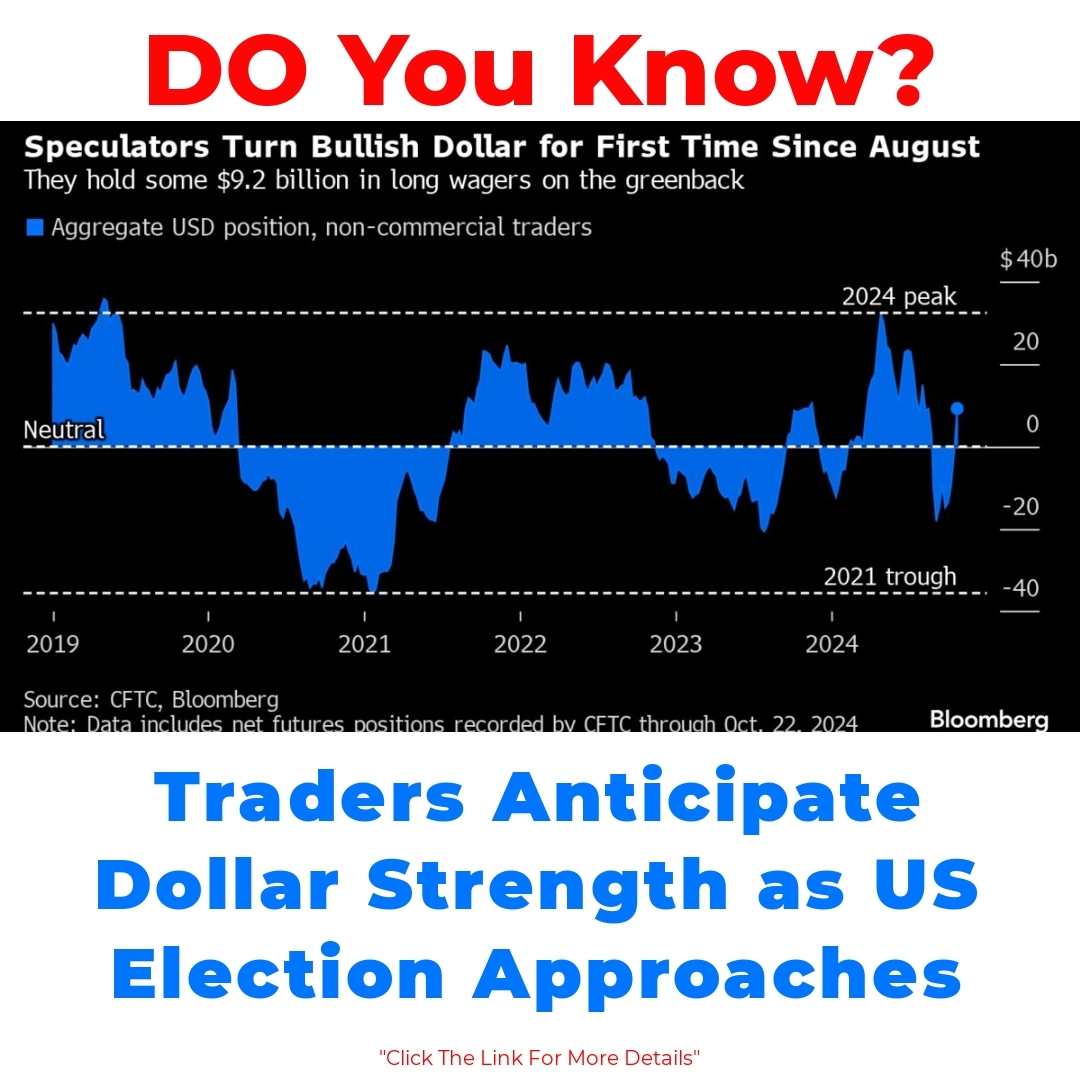

Speculative currency traders are increasingly focusing on the possibility of a stronger greenback as the US election looms on the horizon. This shift reflects their anticipation of currency movements influenced by economic indicators and market sentiment, underscoring the strategic decisions traders must make in the foreign exchange market surrounding this pivotal event.

Speculative currency traders are making moves in anticipation of a stronger greenback as we approach the US election. These traders play a crucial role in the foreign exchange market by engaging in buy and sell activities driven largely by market sentiment and their assessment of economic conditions. With the election on the horizon, it’s no surprise they’re betting on the dollar gaining strength, reflecting their expectations of how various factors will play out in the coming weeks.

Understanding the Role of Speculative Currency Traders

So, who are these speculative currency traders? Essentially, they are investors who buy and sell currencies based on their predictions of future movements. Their motivations can vary—some may be looking for short-term profits, while others may be hedging against potential risks. The forex market is highly influenced by collective market sentiment, which means that the strategies these traders employ can significantly impact currency movements. For instance, if many traders believe that the dollar is going to strengthen, their actions can create a self-fulfilling prophecy, pushing the dollar even higher.

Factors Driving Expectations for a Stronger Greenback

Several key economic indicators are currently driving traders’ expectations for a stronger dollar. These include the unemployment rate, inflation figures, and GDP growth. As these indicators show signs of improvement or stability, traders take it as a signal that the dollar might get stronger. Additionally, the prevailing trading trends indicate that there’s a notable shift towards positions favoring the dollar, suggesting that many are confident in its potential. Geopolitical events, particularly the upcoming US election, also play a role; uncertainties can lead to speculation as traders try to gauge how election outcomes might influence the forex market.

The Impact of the US Election on Currency Trading

Looking at historical trends, we often see heightened activity in forex trading leading up to US elections. Traders adjust their strategies based on the candidates’ policies, which can affect economic stability and growth. For instance, if a candidate is viewed as pro-business, traders might anticipate a stronger dollar due to expected economic boosts. Conversely, if significant uncertainties arise, that could cause traders to hedge their bets and possibly move away from the dollar. The election outcomes could very well dictate the future strength of the currency, making it a focal point for speculation.

Currency Trading Trends and Strategies

Right now, speculative currency traders are gravitating towards strategies that bet on a stronger dollar. Some common tactics include going long on dollar pairs, utilizing options to protect themselves from various risks, and leveraging technical analysis to identify potential entry and exit points. For example, many traders have been watching key levels of resistance and support in the dollar’s movements against other currencies. This anticipation is backed by both fundamental and technical indicators, which can help traders capitalize on the expected strengthening of the dollar.

Analyzing Economic Indicators and Their Relevance

When it comes to forex speculation, economic indicators are everything. Key indicators like the Consumer Price Index (CPI), unemployment claims, and Federal Reserve announcements can give insight into how the economy is performing. Speculative currency traders closely monitor these numbers, as they can forecast potential changes in dollar strength. The relationship between economic performance and the strength of the greenback is critical, especially in the context of an upcoming election, where policies may shift based on which candidate takes office.

Conclusion

In summary, speculative currency traders are eyeing a stronger greenback as the US election nears, driven by a host of economic indicators and market sentiment. The outcome of the election will undoubtedly have significant implications for currency trading strategies moving forward. As the political landscape changes, staying informed about market developments will be key for traders seeking to navigate the turbulent waters of the foreign exchange market.

Call to Action

What do you think? How will the US election impact currency trading? We’d love to hear your thoughts! Also, don’t forget to subscribe to our updates for the latest trends and analyses in the foreign exchange market.

“`html

Read more…

- Risk-Asset Bulls Unfazed by Inflation Fears and Political Turmoil

- Tech and Media Sectors to Drive $1.1 Trillion Global Growth

- GLOBALT’s Thomas A. Martin Optimistic About Upcoming Tech Earnings Season

- Biden Administration Urges Rapid AI Adoption for National Security

- TSMC’s Arizona Plant Surpasses Yields, Boosts US Chip Manufacturing Goals

“`

FAQ

What are speculative currency traders?

Speculative currency traders are investors who buy and sell currencies based on their predictions of future market movements. They aim for short-term profits or hedge against risks.

How does the US election affect currency trading?

US elections lead to increased forex trading activity. Traders adjust their strategies based on candidates’ policies that might impact economic stability. A pro-business candidate may indicate a stronger dollar.

What economic indicators do traders monitor?

Traders closely watch indicators like:

- Unemployment rate

- Inflation figures

- GDP growth

- Consumer Price Index (CPI)

- Federal Reserve announcements

What strategies are traders using right now?

Current strategies among traders include:

- Going long on dollar pairs

- Utilizing options to reduce risks

- Leveraging technical analysis for entry and exit points

Why is market sentiment important?

Market sentiment can create a self-fulfilling prophecy. If many traders believe the dollar will strengthen, their buying actions can push the dollar’s value higher.

How do geopolitical events play a role in currency trading?

Geopolitical events, especially elections, can create uncertainty. Traders speculate on the potential impact of election outcomes on the forex market, influencing their trading decisions.

What should traders keep in mind leading up to the election?

Traders should stay informed about:

- Political developments

- Economic indicators

- Market trends

Understanding these factors can help them navigate the volatility in the forex market.